In light of the horrific events in France over the weekend, most anticipated a run on risk assets this morning, but in terms of major currencies the response appears moderate. France is the second largest economy in the Eurozone therefore a key determinate for overall Euro demand and while we’re seeing the Euro eyeing near 7-month lows against the dollar, weakness (in part) may also be attributed to if more stimulus is on the cards, and how much.

Still, perhaps EURJPY is a better reflection of risk aversion at play and we note the pair opening at fresh 200 day low this morning. Last week we’re watching the EURJPY in the context of a potential breakout – clearly the latest events have seen the pair well and truly break the support of 131.50 – previously thought to be solid.

EURJPY – Descending Triangle Pattern broken on the open

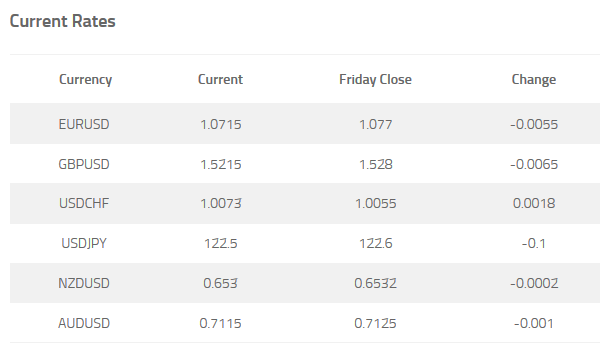

The US dollar has started the week in good form against its major counterparts which is also indicative of heightened risk concerns.

While markets look forward to the usual round of economic signposts this week, at the back of everyone’s mind is the events of Paris. Clearly such an event and the subsequent conjecture surrounding retaliation has the ability to destabilise financial markets – at least in the short term. French President, Francois Holland was quick to react deploying armed forces. The thought of a long and protracted war is not generally conducive to stable market behaviour.

Euro related economic news for the week includes Consumer Prices on Monday, ZEW series data on Tuesday, ECB Minutes on Thursday and Consumer confidence data to wrap up the week. Clearly, the data’s being accessed on the basis of further stimulus being released by the European Central Bank. Any economic data point which suggests further weakness will increase the likelihood of more stimulus – a Euro negative.

While Europe ponders more monetary easing, across the Atlantic it’s quite the opposite. The U.S and its Central Bank are of course on the path to ‘normalising’ interest rates with a slew of data this week expected to increase the chances that Yellen and Co increase rates in December. Economic releases of note include, Consumer Prices, Manufacturing and Industrial production with Wednesdays FOMC minutes no doubt the highlight of the week.

Locally, Aussie traders will be looking for further signs of policy divergence with its US counterpart with the release of the RBA November meeting minutes. Last week’s jobs data seemed to promote a little more enthusiasm surround the Australian economy, so perhaps we can expect it to moderate any negative vibes from the minutes, which was before the jobs data was released.

Risk Warning: Trading Forex and Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. The FSG and PDS for these products is available from GO Markets Pty Ltd and should be considered before deciding to enter into any Derivative transactions. AFSL 254963. ABN 85 081 864 039.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish. 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus.