Quick Recap

Alexis Tsipras and his finance minister Yanis Varoufakis want their cake and eat it too.

That’s the message that resonated out of Athens overnight with news that the Greek government was seeking a new deal with creditors even as Tsipras and Varoufakis were lobbying their fellow citizens to vote no in the weekend’s referendum. Here’s how I summed it up at Business Insider this morning:

That (Greece seeking a deal) buoyed traders on Europe’s stock exchanges. But German finance minister Wolfgang Schaeuble once again said no deal is possible until after the referendum. Comments early this morning (AEST) from Varoufakis suggest the walkout and referendum may be an attempt at a circuit breaking stunt. Varoufakis said that the government objective is to have a deal with creditors on Monday and that the banking situation “will return to normal soon after a deal is reached” because the ECB will “raise the ELA again and liquidity will be restored”. He’s trying to support the “no” vote by suggesting, as the PM did overnight, that it will actually strengthen the Greek’s hand at the negotiating table. These guys are like quicksilver.

Quicksilver indeed. These guys must be driving their creditors crazy.

But the big news really overnight in the lead up to tonight’s non-farm payrolls is that the US economy still looks strong and the ADP employment data suggests a big number tonight from non-farms. Here’s how my colleague from Bi US Akin Oyedele summed it up:

US economic data was plenty. Private payrolls grew by 237,000 in June (218,000 expected) the highest since December 2014, according to ADP. The May print was revised upwards to 203,000 from 201,000. Mark Zandi, chief economist of Moody’s Analytics, said in the release, “The US job machine remains in high gear. The current robust pace of job growth is double that needed to absorb the growth in the working age population.”

We know that yesterday James Bullard said that July was a live FOMC meeting and while that is likely a statement of fact rather than intent if we get another big payrolls report tonight. Greece might just fade into the background completely for a few days while traders grapple with the what, when and how much of this looming Fed tightening cycle. Worth noting for the moment is the 200 day moving average in the S&P 500 is holding in.

Forex traders have already voted and the Euro, and everything else are lower this morning after the gap was filled in the Euro following Monday’s trade. At 1.1055 even a moderately strong non-farms tonight could push Euro down toward the lows.

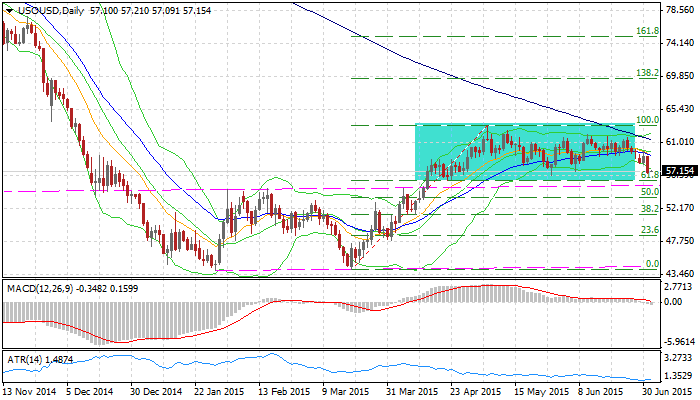

Elsewhere, as discussed earlier this week, the technicals for oil were pointing lower and we saw a huge drop last night to below $57. That’s given us the $2 I was looking for earlier this week. The catalyst was the first increase in stocks for two months.

Gold can’t take a trick, stocks were all higher on either Greece or the data and the ASX had a quiet futures session but the outlook for today is mixed.

In Asia yesterday Shanghai was pole-axed after lunch on, I think, the World Bank report that highlighted the fragility of the financial system and the need for reform.

On the day

On the data front today we get trade in Australia and tonight we get EU PPI but the highlight is the release of US non-farm payrolls a day before the 4th of July holiday when markets in the US will be closed.

Here’s the overnight scoreboard (7.02am AEST):

- Dow Jones up 0.79% to 17,757/li>

- Nasdaq up 0.53% to 5,013

- S&P 500 up 0.69% to 2,077

- London (FTSE 100) up 1.34% to 6,608

- Frankfurt (DAX) up 2.15% to 11,180

- Tokyo (Nikkei) up 0.46% to 20,329

- Shanghai (composite) down 5.23% to 4,053

- Hong Kong (Hang Seng) up 1.09% to 26,250

- ASX Futures overnight (SPI September) -1 point to 5,475

- US 10 Year Bonds +6 points to 2.42%

- German 10 Year Bonds +4 to 0.81%

- Australian 10 Year Bonds +8 points to 3.10%

- AUDUSD: 0.7642

- EURUSD: 1.1049

- USDJPY: 123.16

- GBPUSD: 1.5612

- USDCAD: 1.2586

- Crude: $56.85

- Gold: $1,168

- Dalian Iron Ore (September): 414

CHART OF THE DAY: US Oil, Darvas Box

We are now approaching the bottom of the box where support should be found. We’ll see how the price action goes, I’m cutting position by 50%, and respect the base unless or until it breaks. That’s where the other 50% will come off, below $56. But if the base breaks then oil could slip sharply lower. It has to break first.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.