Introduction

After a buoyant period, the US Dollar begins the last week of May on the back-foot, with traders assessing the possibility of a benchmark interest rate rise in the states come June. The US Dollar index touched the 92.0 level at the start of the month but has risen in staggered fashion to touch ah high of 95.50 last Thursday. Turnover has remained at lower levels compared to usual, as has been the case recently. Comments were made by various G7 representatives over the weekend. Notably Taro Aso, Japanese finance minister, mentioned that any gains in Yen over the last few weeks have been disorderly. John Williams of the San Francisco Federal Reserve, pointed out that the US presidential election would not be an obstruction to any potential monetary policy moves in North America.

Asian Session

The Nikkei 225 and Topix indices moved lower, in contrast to other shares in Asia. JPY gains were seen as the main driver of weight on corporates in Japan. Notable support and resistance is seen in USD/JPY at 110.37 and 111.05 respectively.

Taiwanese stocks had a particularly strong session, driven by production companies like with Apple Inc. The Taiex index rose by over 2.5% and TWD has had a fairly strong session, rising by 0.14% versus the greenback.

The day ahead in Europe and NY

EUR/GBP trades currently at .7737 after political news affected both currencies over the weekend. The UK treasury issues its full analysis regarding a potential Brexit today. Excerpts already released over the weekend to the press indicate that leaving Europe could provoke an ‘economic shock’ across the kingdom which could even lead to a recession. Political headlines in Europe focused on the far-right Freedom Party that is potentially about to gain power in Austria.

Flash PMIs are published in Europe today, both within individual nations and across the Eurozone as a whole. The German and continent-wide figures are released at 08:30 BST and 09:00 BST respectively. The Eurozone figures are expected to rise a touch, both in the services and manufacturing sectors.

EUR/RUB trades right now at 75.47, ahead of the release of unemployment data at 14:00 BST. The previous print stood at 6.0%. USD/Rub trades at 67.18 ahead of PMI data in the states and speeches from Federal Reserve members Bullard, Williams and Harker.

Spot

| Last | % since US Close | High | Low | |

| EURUSD | 1.1113 | 0.00% | 1.1125 | 1.1107 |

| USDJPY | 109.52 | 0.58% | 110.24 | 109.42 |

| GBPUSD | 1.4489 | -0.09% | 1.4534 | 1.4483 |

| AUDUSD | 0.7224 | 0.02% | 0.7260 | 0.7217 |

| NZDUSD | 0.6789 | 0.37% | 0.6807 | 0.6755 |

| USDCHF | 0.9890 | 0.13% | 0.9919 | 0.9883 |

| EURGBP | 0.7737 | -0.16% | 0.7754 | 0.7722 |

| EURCHF | 1.1111 | 0.02% | 1.1125 | 1.1107 |

| USDCAD | 1.3131 | -0.16% | 1.3136 | 1.3099 |

| USDCNH | 6.5596 | 0.08% | 6.5670 | 6.5562 |

FXO

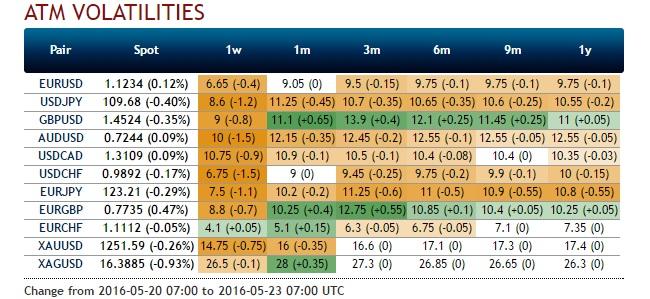

USD/JPY one month volatilities are now largely the same as they were at the close of trading on Friday. That 11.1% vol. is still historically high with Yen an increasing focus across global currency markets. The high volatility so far this year for the one month USD/JPY straddle is 16.25%, on February 12th.

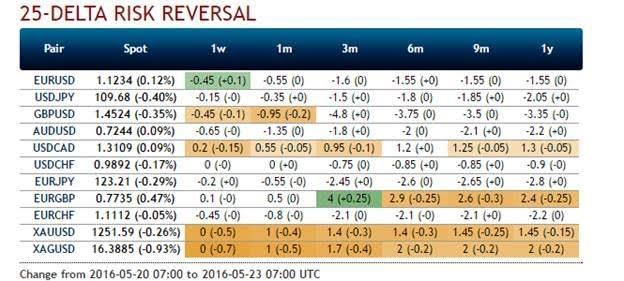

USD/JPY bias within the currency options retail space at Saxo Bank A/S shows an 85% leaning towards downside strikes. The biggest swing in sentiment can be seen within the USD/CHF space where an increase in long call and/or short positions by 6% brings this downside bias to 78%.

The products offered by Saxo Markets UK Limited ("SCML") include but are not limited to Foreign Exchange, Stock, Index and Commodity CFDs, Options and other derivative products. These products may not be suitable for all investors, as trading derivative products carries a high level of risk to your capital. It is possible to lose more than your initial investment so before deciding to trade you should ensure you understand the risks involved and seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.