Introduction

The RBA governor Glenn Stevens also seemed to convey a tentative attitude towards future monetary policy, in the same way as Janet Yellen has this week. The central bank chief in Australia mentioned that economic expansion would be helped by a lower AUD whilst the flexibility to make further implementations to monetary policy remained prevalent. Indices are lower in Asia with the Nikkei 225 index off by close to 5% after the holiday in Japan yesterday.

Asian Session

AUD/USD trades just above the .7100 figure at the moment after the aforementioned speech from Glenn Stevens and home loan data which disappointed a touch but was largely ignored. Across the Tasman sea, NZD is the largest loser versus the greenback, coming off by 0.75% to trade at .6664 right now. The Antipodean cross trades currently at 1.0654.

USD/JPY has traded to a high of 113.02 overnight, with the BoJ said to be watching currency markets closely. The 110.0 level is clearly a key level to be aware of, both psychologically and in the sense that this was a prominent low in Autumn 2014.

The Korean Kospi index trades significantly lower today, off by close to 1.5% as real money flows move away from stocks in Asia. USD/KRW trades currently at 1211.54, whilst the ADXY index of Asian currencies versus USD has moved lower.

The day ahead in Europe and NY

German inflation data has been released already and sent EUR/USD lower through the 1.1300 figure. The YoY GDP figure printed at 1.3% in comparison to 1.7% previously and 2.3% anticipated. Importantly, the ECB meets next Thursday.

In the main EUR crosses, EUR/GBP trades right now at .7762 whilst EUR/CHF stands at 1.1011 currently. EUR/SEK trades at 9.4773 after the Riksbank cut its main policy rate further than anticipated yesterday. Eurozone GDP data is released at 09:00 GMT today.

The G10 USD index has taken something of a bettering recently, moving from 99.0 in early February to below 96.0 today. US retail sales figures are released at 13:30 GMT today and will be a key focus, whilst consumer sentiment info. and a speech by William Dudley of the NY Federal Reserve at 15:00 GMT will also be of attention.

Spot

| Last | % since US Close | High | Low | |

| EURUSD | 1.1286 | -0.34% | 1.1334 | 1.1281 |

| USDJPY | 112.44 | 0.01% | 113.02 | 111.67 |

| GBPUSD | 1.4497 | 0.14% | 1.4529 | 1.4459 |

| AUDUSD | 0.7097 | 0.17% | 0.7129 | 0.7085 |

| NZDUSD | 0.6667 | -0.73% | 0.6739 | 0.6657 |

| EURCHF | 1.1011 | 0.02% | 1.1022 | 1.1003 |

| USDCAD | 1.3921 | 0.12% | 1.3939 | 1.3890 |

| USDCNH | 6.5346 | -0.08% | 6.5487 | 6.5285 |

FXO

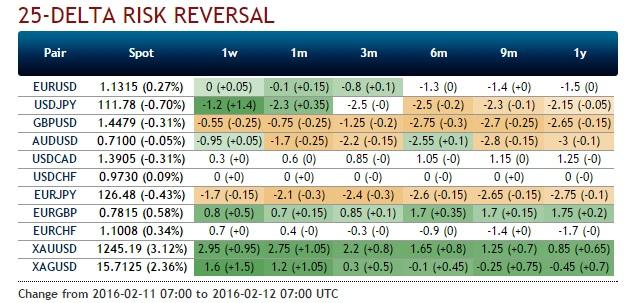

Thursday EUR/USD options trade with a bid tone ahead of a very important ECB meeting next week. The one month straddle in EUR/USD has a mid. volatility of 12.45% whilst retail currency options traders at Saxo Bank A/S are 55% in favour of upside positioning.

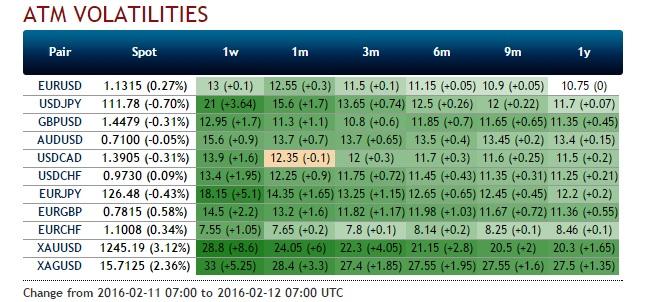

Gamma is understandably bid across the board, with USD/JPY fron-end options the most notably so for obvious reasons. The one week 25-delta risk reversal in the USD/JPY space has a mid. volatility differential of 1.2% after trading at 2.65% earlier in the week and coming back offered.

The products offered by Saxo Markets UK Limited ("SCML") include but are not limited to Foreign Exchange, Stock, Index and Commodity CFDs, Options and other derivative products. These products may not be suitable for all investors, as trading derivative products carries a high level of risk to your capital. It is possible to lose more than your initial investment so before deciding to trade you should ensure you understand the risks involved and seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.