Introduction

Only equities in Hong Kong traded overnight in Asia as the Japanese took a bank holiday. The Hang Seng index moved lower by close to 4% and USD/JPY moved to a low of 112.28. The move has been extravagant in this currency pair and shows the extent of the flight to JPY that has taken place amidst intense risk-off sentiment. The Fed. chair did not rule out a base interest rate rise in the US this year, which comes as no surprise of course, but ultimately after some initial positivity, the market sold USD and oil, moving WTI crude futures to a low of US$26.72.

Asian Session

It is important to remember that USD/JPY traded at the high so far this year of 121.69 less than two weeks ago. Talk of the BoJ checking prices and placing bids at around the 115.0 mark may or may not have been true, but this support has now been taken out as a Fibonnacci level at 111.75 is eyed.

The Asian Dollar index trades at the 105.85 right now with Yellen set to speak for the second day in a row today. Emerging Asian currencies have all made limited gains, but those gains are essentially across the board.

The NEISR released its GDP estimate for the UK overnight. Considered an important number, the figure came in at 0.4% compared to 0.6% previously and GBP/USD trades currently at 1.4511.

The day ahead in Europe and NY

The idea that the central bank in Japan may step in to the interbank market in order to stabilise the USD/JPY pair is not out of the question after such a large move recently. In the JPY crosses, EUR/JPY and GBP/JPY trade lower at 127.22 and 163.56 respectively.

The Eurogroup meets today whilst Swiss inflation data prints at 08:15 GMT. The figures are anticipated to prove in line with expectations of a YoY print at -1.3% and a MoM number at -0.4%.

USD/RUB trades at 79.09 ahead of the release of central bank reserve figures today at 13:00 GMT. Later in the states, initial jobless claims figures will be released as well as natural gas storage data. The active natural gas future contract trades currently at US$2.055.

Spot

| Last | % since US Close | High | Low | |

| EURUSD | 1.1289 | -0.03% | 1.1320 | 1.1274 |

| USDJPY | 112.44 | -0.80% | 113.60 | 112.28 |

| GBPUSD | 1.4511 | -0.22% | 1.4564 | 1.4485 |

| AUDUSD | 0.7097 | 0.02% | 0.7153 | 0.7083 |

| NZDUSD | 0.6663 | -0.33% | 0.6735 | 0.6656 |

| EURCHF | 1.0974 | 0.17% | 1.0995 | 1.0969 |

| USDCAD | 1.3961 | 0.16% | 1.3966 | 1.3883 |

| USDCNH | 6.5359 | 0.16% | 6.5504 | 6.5275 |

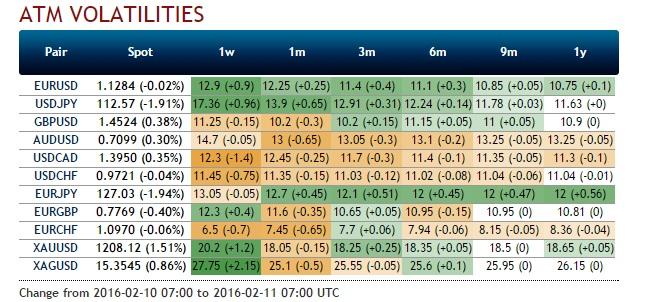

FXO

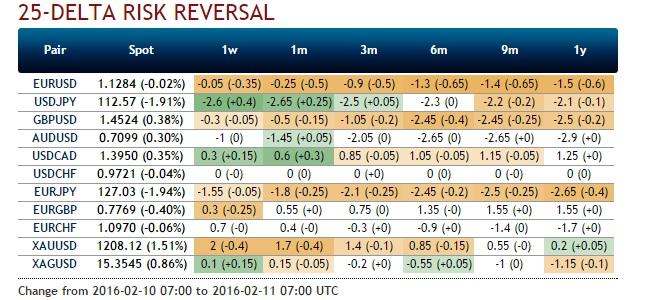

The one month 25-delta risk reversal trades at an approx. volatility differential of 2.6% in favour of the downside this morning. This is a jump of over half a vol. The one week straddle opens this morning very high, at a mid. volatility of approx. 17.5%.

Sentiment within the currency options space at Saxo Bank A/S has moved significantly regarding USD/CHF and EUR/GBP options. 57% and 84% of traders favour the downside in these currency pairs, with the long call and/or short put positioning moving over the last day or so by -18% and 8% respectively.

The products offered by Saxo Markets UK Limited ("SCML") include but are not limited to Foreign Exchange, Stock, Index and Commodity CFDs, Options and other derivative products. These products may not be suitable for all investors, as trading derivative products carries a high level of risk to your capital. It is possible to lose more than your initial investment so before deciding to trade you should ensure you understand the risks involved and seek independent advice if necessary.

Recommended Content

Editors’ Picks

GBP/USD remains on the defensive below 1.2450 ahead of UK Retail Sales data

GBP/USD remains on the defensive near 1.2430 during the early Asian session on Friday. The downtick of the major pair is backed by the stronger US Dollar as the strong US economic data and hawkish remarks from the Fed officials have triggered the speculation that the US central bank will delay interest rate cuts to September.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.