For the first time since November 2009 inflation has fallen below the government’s target of 2%. The Office for National statistics (ONS) said that the fall in inflation pressure was not down to a single sector; rather it was price movements in recreational goods and services, furniture and household items, alcohol and tobacco that triggered the slow-down in the rate of price growth. In contrast, goods and services prices edged up, but not enough to counteract the slight downward bias last month.

The ONS pointed out that in 24 of the last 27 months, prices in housing, water, electricity and gas have been the largest contributors to the inflation rate, making up a quarter of inflation. Thus, whether prices fall further may be dependent on these sectors.

The ONS’s admission that housing and utility costs are the largest contributor to price changes makes the future trajectory of UK prices a little opaque as these sectors tend to be fairly volatile. They are also impacted by sterling, particularly energy prices, and a strong pound helped to keep energy prices in check in recent months.

However, at this stage deflation is not a threat for the UK. On the house price front, there was some good news for people looking to buy a house (not such good news if you are looking to sell) according to the ONS house prices rose by 5.5% in December, which is lower than the 6% expected. This is still a robust rate of growth and we expect to see larger increases in house prices for the rest of this year as typically house sales slowdown around year end and pick up once the worst of the winterer is behind us.

The Goldilocks scenario

Fairly robust growth combined with low price pressures is considered the goldilocks scenario for an economy: not too hot, not too cold. This description hasn’t been used to describe the UK’s economy since well before the financial crisis, which is suggestive of the UK economy’s return to growth. This could also ease pressure on the BOE to raise interest rates in the near-term. Last week’s BOE Inflation Report was considered less dovish than expected, which pushed rate expectations forward from Q2 2015 to Q1 2015, however in the last couple of days rate expectations have drifted back to April 2015. If prices fall further over the coming months then we could see rate expectations get pushed even further out, causing the BOE to strengthen its forward guidance, which could weigh on GBP.

Inflation and GBP:

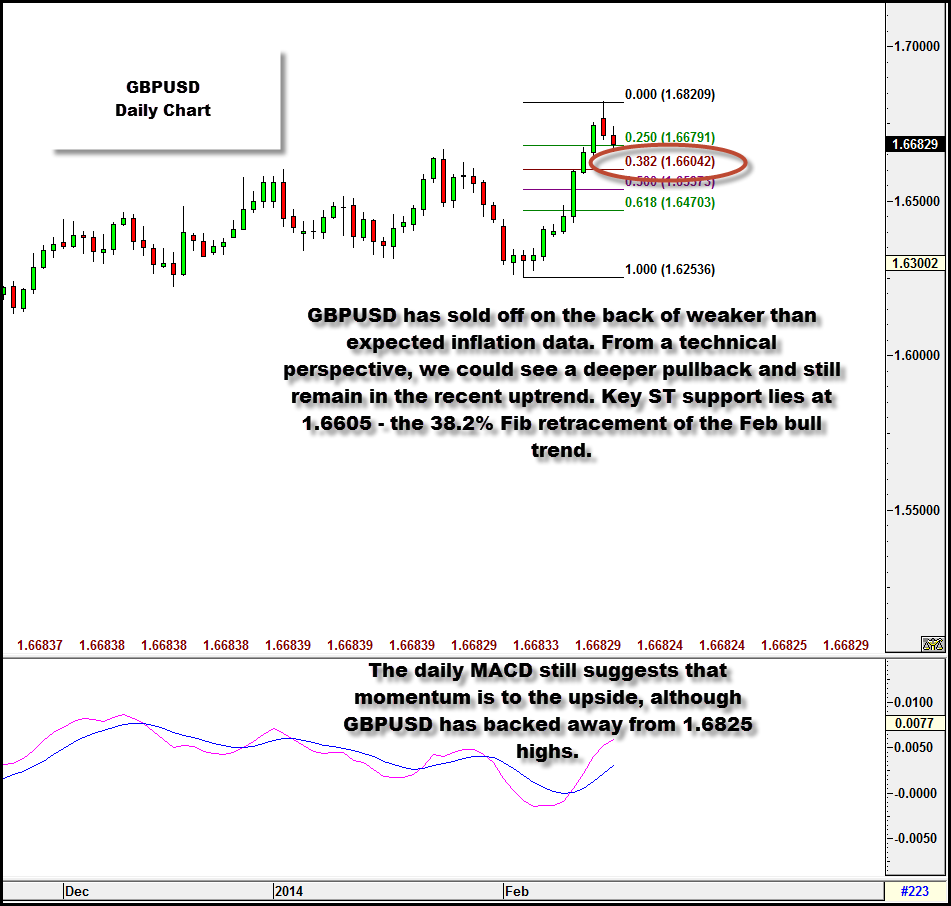

GBPUSD has taken a tumble in the last 24 hours, dropping from a high of 1.6825 on Monday and is now testing 1.6650. We would have to fall below 1.6450 – the 50-day sma and the low from 24th Jan – to negate the current trend higher. Thus, even if we see a significant move to the downside GBPUSD could still remain in an uptrend.

In the short term, we think that GBPUSD has further to fall even after the drop in the last 24 hours. We may not see any respite from this selling pressure until we reach these key support levels:

- 1.6605 – the 38.2% Fib retracement of the most recent move higher.

- 1.6535 – the 50% retracement of this move.

- 1.6450 – the 50-day sma mentioned above.

On the upside, 1.6823 – the high from Monday – unleashed a tsunami of selling pressure on this pair and it now looks like a short-term top.

Over the next few days there are key event risks for GBP including:

- Wednesday: BOE minutes. This may reflect the recent Inflation Report and could limit any selling in GBP in the short term.

- Wednesday: Labour market data – a positive tone to data could also support GBP.

- Friday: retail sales for Jan, these are likely to be impacted by the recent bad weather.

Takeaway:

- Weak inflation and strong growth is considered a sweet spot for the UK economy.

- This reduces the pressure on the BOE to tighten policy in the near-term and interest rate expectations have been pushed deeper into 2015 this week.

- GBPUSD has fallen since it reached a high of 1.6825 on Monday, but a pullback within the uptrend is considered healthy at this stage.

- GBPUSD downside could be limited as we lead up to other event risks this week (see above).

Figure 2:

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.