Backdrop:

Often you may hear about ‘month end’ flows having a positive or negative effect on a currency during the last day(s) of the month. Thus, we’ve decided to take a look at asset market capitalizations in the major market economies to help us try to determine which direction these ‘flows’ may move. Typically, the largest impacts are seen into the 11am ET fixes (of the last few days of the month) as hedge and/or mutual fund portfolio managers scramble to rebalance their remaining currency exposure in order hedge their overall portfolio.

Market capitalizations for February were mixed across the board – The largest gain was seen in Japan which saw a rise of 164B on the month, while the largest decline was in the EU (collectively), falling 171B (as of 2/25 close). So how do we make sense of this? Well, the more severe a change of the principal assets (primarily equities and bonds), then the more likely portfolio managers are either under or over-exposed to certain currencies. Our model suggests that their exposure is essentially right where it should be, consequently they may not need to meaningfully adjust their USD positioning.

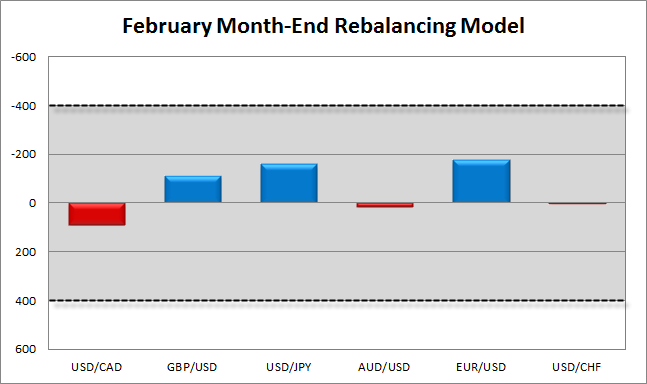

In the chart below we have outlined the expected directional movement broken down pair by pair based upon our proprietary month-end model. Customarily, a reading of +/- 400K on the month produces a stronger bullish or bearish signal. With that said, none of the currency pairs satisfy the aforementioned +/- 400B level on a monthly basis – Thus, we believe the buck is unlikely to see a substantial impact from these flows heading into Thursday’s fixing.

However, a potentially more intriguing way to look at this over the coming days could be in the JPY-crosses, with EUR/JPY and GBP/JPY producing bullish signals. That said, if any of the global equity markets see a rather large gain or loss on the day, and accordingly a change in market capitalization which would meaningfully change the signal, then we’ll post an updated chart of the Rebalancing Model on Twitter.

The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase of sale of any currency. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.