With many trading centers closed Friday and many in Europe closed today as well, trading is light and the dollar is little changed in early European trading Monday. It was higher against JPY, CAD and NZD, and in the EM currencies, higher vs TWD, HUF and TRY, while the RUB gained. Otherwise, less than 0.1% movement compared with Friday morning. I would expect to see a similar lack of movement during the European day today, at least until US trading begins.

The main change, such as it was, was in JPY, which weakened on news of a wider-than-expected trade deficit in March as exports barely grew (+1.8% yoy vs +6.5% expected) while imports soared (+18.1% vs +16.2% expected). The small growth in exports compared with February (+9.8% yoy) could be just a function of the rise in the consumption tax, which boosted domestic demand in March (department store sales were up an astonishing 25.4% yoy, compared with +3.0% yoy in February). Some companies may have diverted shipments to the domestic market rather than overseas. Yet overall, the data show why I expect the yen to continue to weaken over the medium term.

Many economists blame the rise in imports on the fact that the country’s nuclear power plants are shut down, but in fact that only accounted for 4.9 percentage points of the 16.2% yoy growth in imports in February (using 12m moving sum). More importantly however, we should not lose track of the fact that a country’s current account balance is ultimately the difference between its savings and investment. PM Abe’s program is lowering the country’s savings, because prices are rising but salaries aren’t. So in order to keep their consumption steady, people have to cut back their savings. This might be offset by the rise in the consumption tax, which will increase government savings (or more accurately, reduce government dissavings, since the government is a borrower). However this year at least the rise in the consumption tax will be offset by a rise in government spending, and in the future too, I expect the government will find it impossible to hold its spending steady. Investment on the other hand will have to increase in order to make up for the decline in the workforce as the country ages. In my view, the result is likely to be further contraction in the current account surplus, probably eventually shifting it into deficit, at which point the yen will be in serious, serious trouble.

CAD also weakened despite Friday’s news of a higher-than-expected inflation rate in March of 1.5% yoy, up from 1.1% in February. While the news initially triggered some CAD buying on Friday, it quickly ran its course and the currency weakened. Bank of Canada Gov. Poloz has said he will dismiss faster inflation this year as temporary, because of slack in the economy, so at least for now higher inflation numbers are only going to lower Canadian real yields and therefore weaken the currency.

The news calendar is quite light today. In the US, the Conference Board leading index for March is estimated to have accelerated to +0.7% mom from +0.5% mom in February.

As for the rest of the week, on Tuesday we have Switzerland’s unemployment rate for March and Eurozone’s preliminary consumer confidence for April. In the US, we have the Federal Housing Finance Agency (FHFA) house price index for February and the existing home sales for March. The Richmond Fed manufacturing Activity index for April is also coming out. The former Fed Chairman Ben Bernanke speaks at the Economic Club of Canada. On Wednesday, during the Asian morning, we get Australia’s CPI data for Q1 and China’s HSBC preliminary manufacturing PMI for April. The European day continues with the preliminary manufacturing and service-sector PMIs from France, Germany and Eurozone as a whole. The Bank of England releases the minutes of its latest policy meeting. On Thursday, the Reserve Bank of New Zealand holds its monetary policy meeting. It’s widely expected that the Bank will raise its official cash rate by another 25 bps to 3.00%. In Europe, the German Ifo survey for April is coming out, while the ECB President Mario Draghi speaks at a conference. From the US we get durable goods orders for March. Finally on Friday, from Japan we get the national CPI for March and the Tokyo CPI for April. We also have the UK retail sales for March and the US University of Michigan final consumer sentiment for April.

THE MARKET

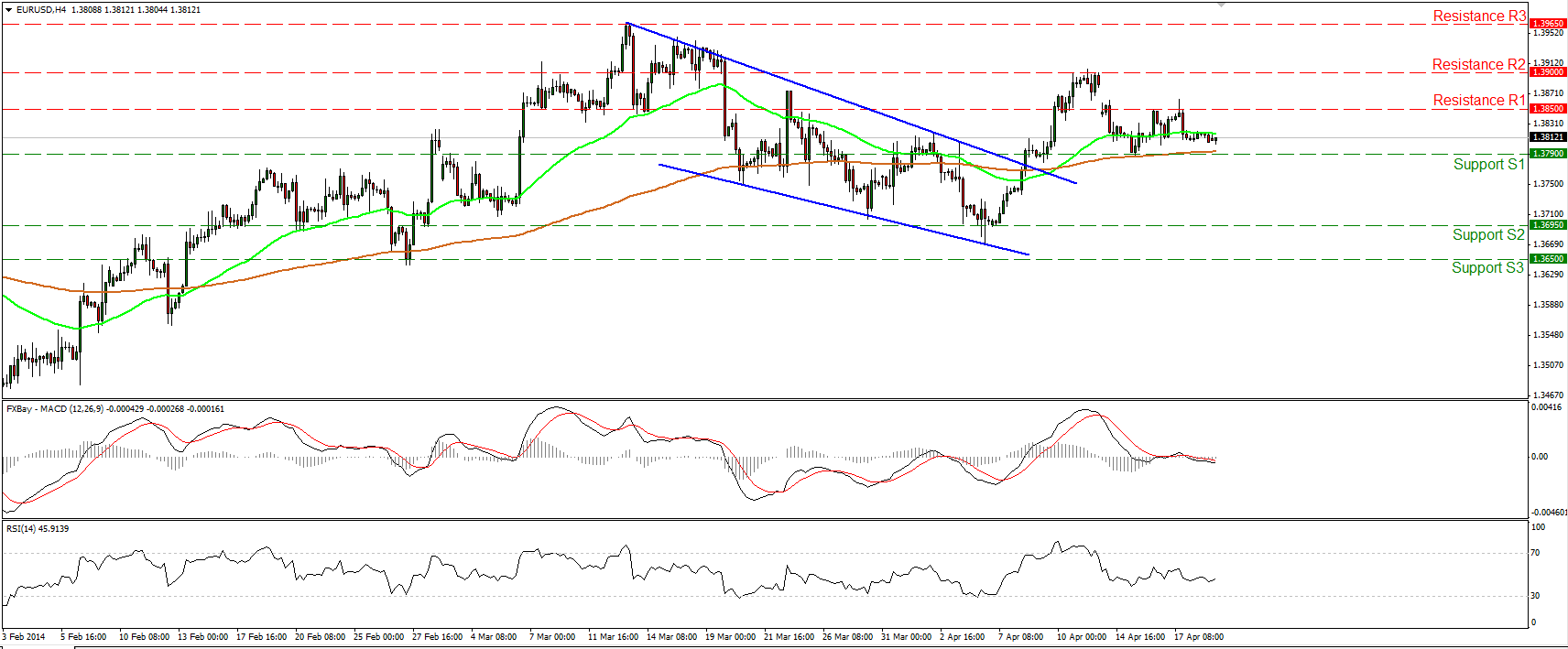

EUR/USD

EUR/USD moved in a consolidative mode, remaining between the support of 1.3790 (S1) and the resistance of 1.3850 (R1). Both the RSI and the MACD lie near their neutral levels, while both the moving averages are pointing sideways, confirming the sideways path of the currency pair. A clear move above 1.3850 (R1) could probably challenge the resistance of 1.3900 (R2), where a break would confirm a forthcoming higher high and perhaps pave the way towards the 1.3965 (R3) obstacle. On the downside, a dip below the support of 1.3790 (S1) may have larger bearish implications and target the lows of 1.3695 (R2). On the daily chart, we can identify a series of indecisive candlesticks, adding to the neutral picture of the rate.

Support: 1.3790 (S1), 1.3695 (S2), 1.3650 (S3).

Resistance: 1.3850 (R1), 1.3900 (R2), 1.3965 (R3).

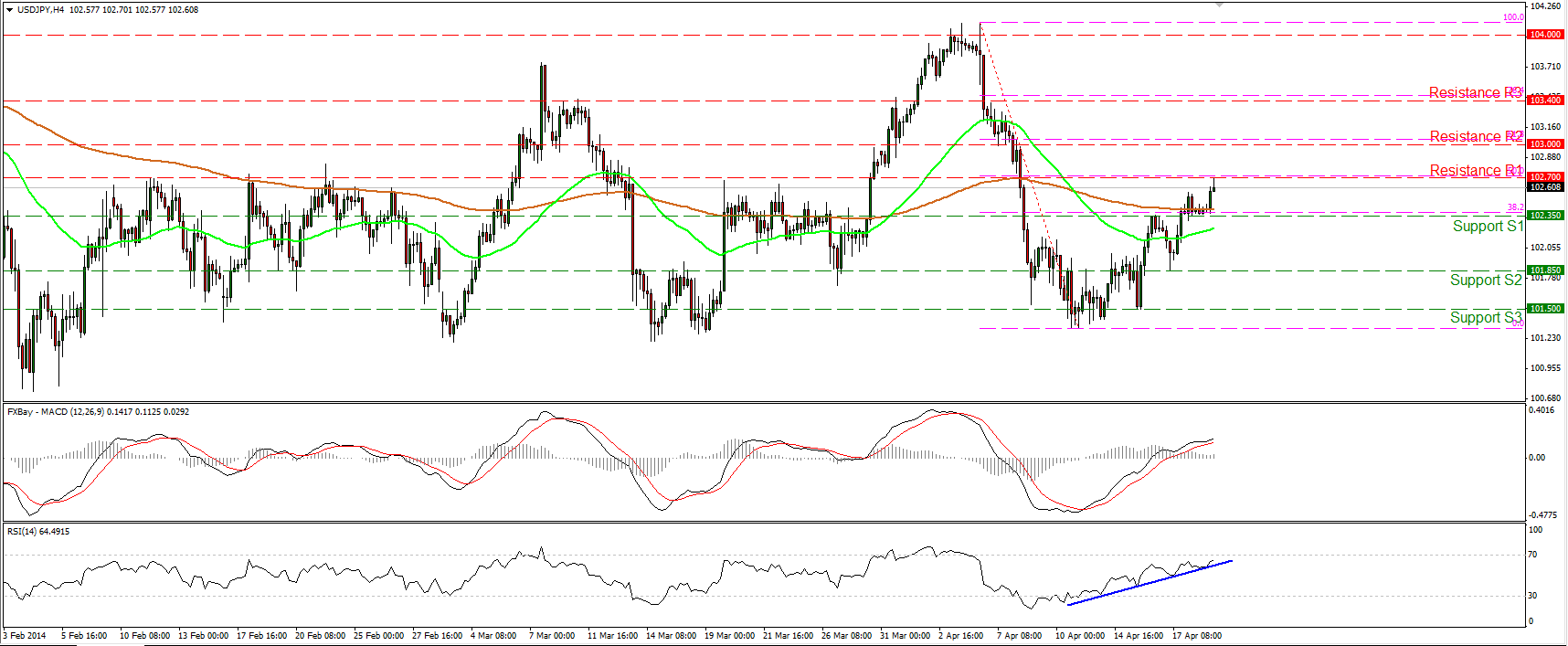

USD/JPY

USD/JPY rebounded from the support bar of 102.35 (S1) and moved higher to meet resistance at the 102.70 (R1) obstacle, which coincides with the 50% retracement of the 4-11 Apr. decline. A break above that bar may challenge the next resistance at 103.00 (R2), near the 61.8% retracement of the aforementioned decline. The RSI follows an upward path, while the MACD lies above both its signal and zero lines, confirming the recent bullish momentum of the price action. On the daily chart, the pair is in a sideways mode between 101.20 and 104.00.

Support: 102.35 (S1), 101.85 (S2), 101.50 (S3).

Resistance: 102.70 (R1), 103.00 (R2), 103.40 (R3).

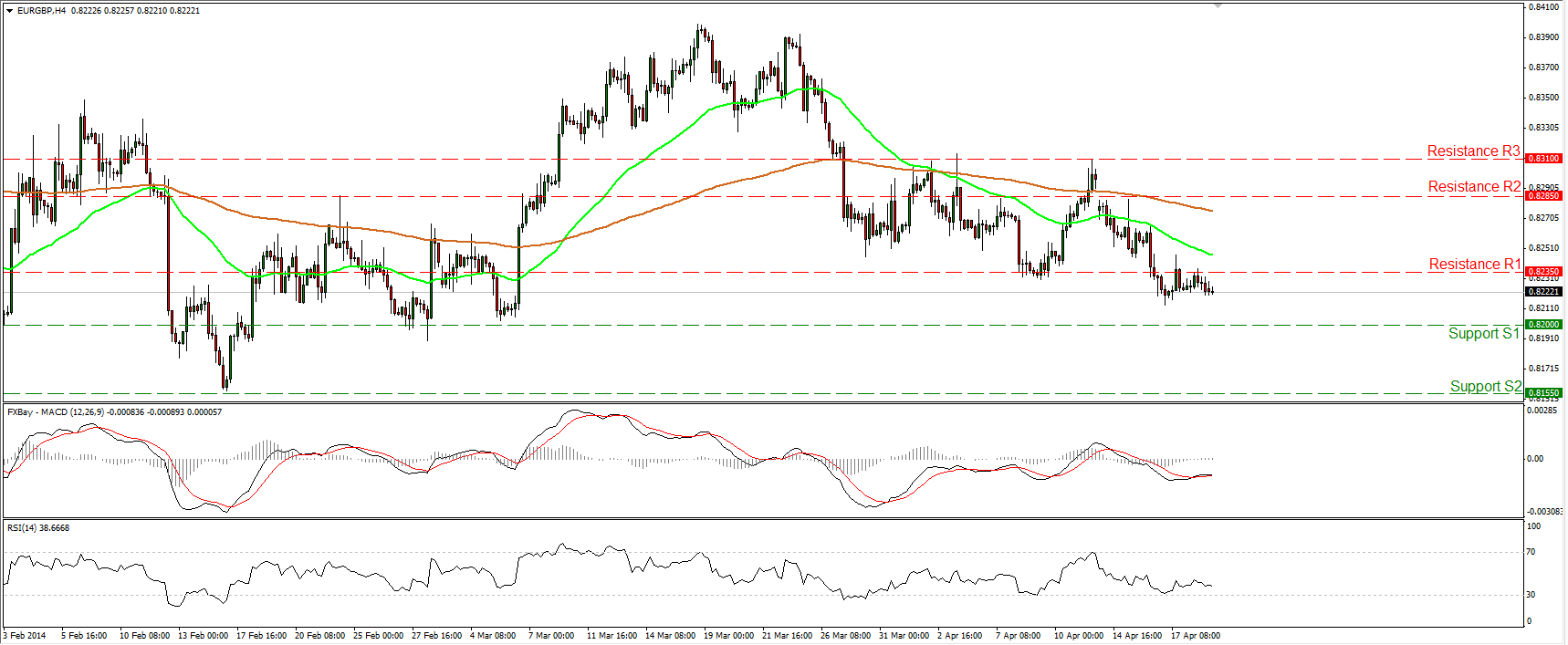

EUR/GBP

EUR/GBP is trading slightly below the resistance barrier of 0.8235 (R1). If the bears are strong enough to maintain the rate below that resistance, I would expect them to drive the battle lower and challenge the support of 0.8200 (S1). The MACD, although in bearish territory, lies above its trigger line, thus some consolidation before the bears prevail again cannot be ruled out. The rate lies below both the moving averages, keeping the outlook mildly bearish for now.

Support: 0.8200 (S1), 0.8155 (S2), 0.8085 (S3).

Resistance: 0.8235 (R1), 0.8285 (R2), 0.8310 (R3).

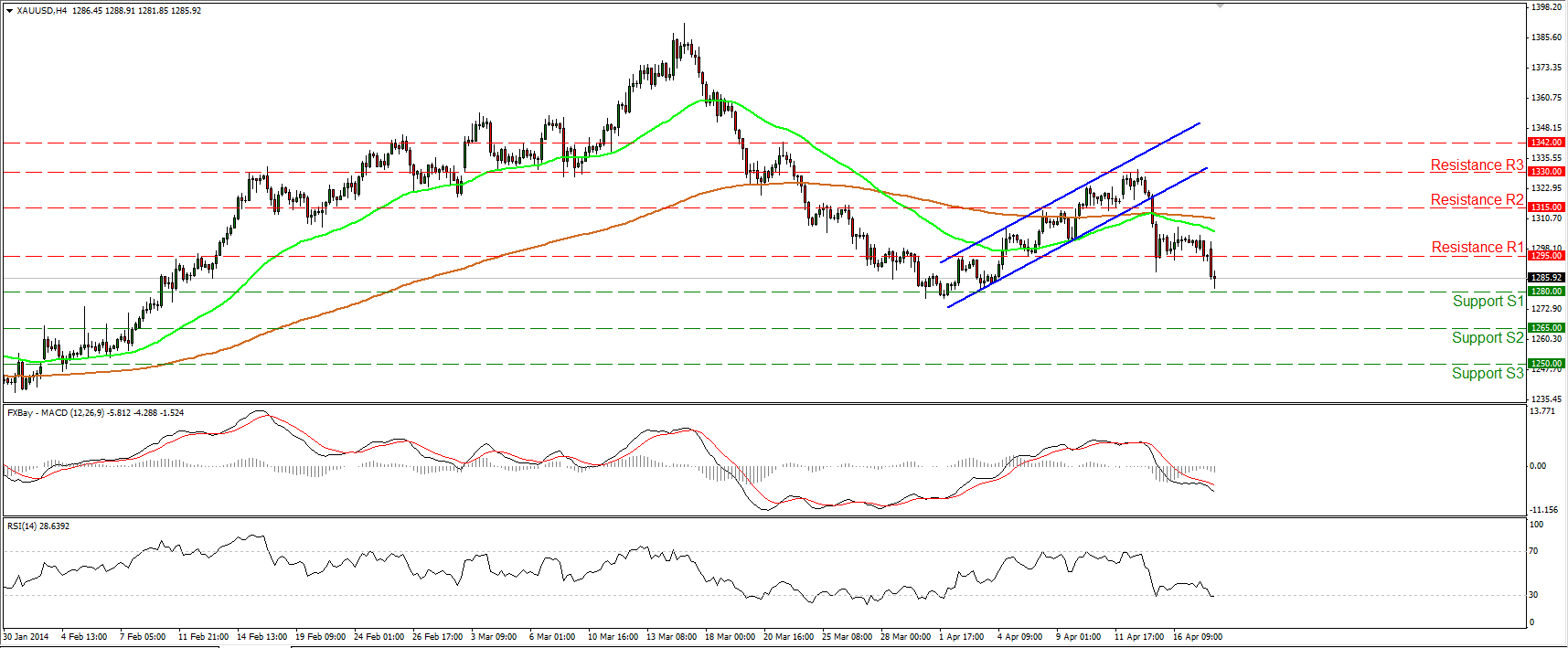

GOLD

Gold fell below the 1295 hurdle to find support slightly above the 1280 (S1) bar. A break below the 1280 (S1) support level may trigger further extensions towards the next support at 1265 (S2). The MACD remains below both its trigger and zero lines, keeping the momentum to the downside. However, the RSI is testing its 30 barrier, thus some consolidation or a corrective wave cannot be ruled out. As long as the precious metal is trading below both the moving averages and below the resistance bar of 1315 (R2), the short-term outlook remains negative.

Support: 1280 (S1), 1265 (S2), 1250 (S3).

Resistance: 1295 (R1), 1315 (R2), 1330 (R3).

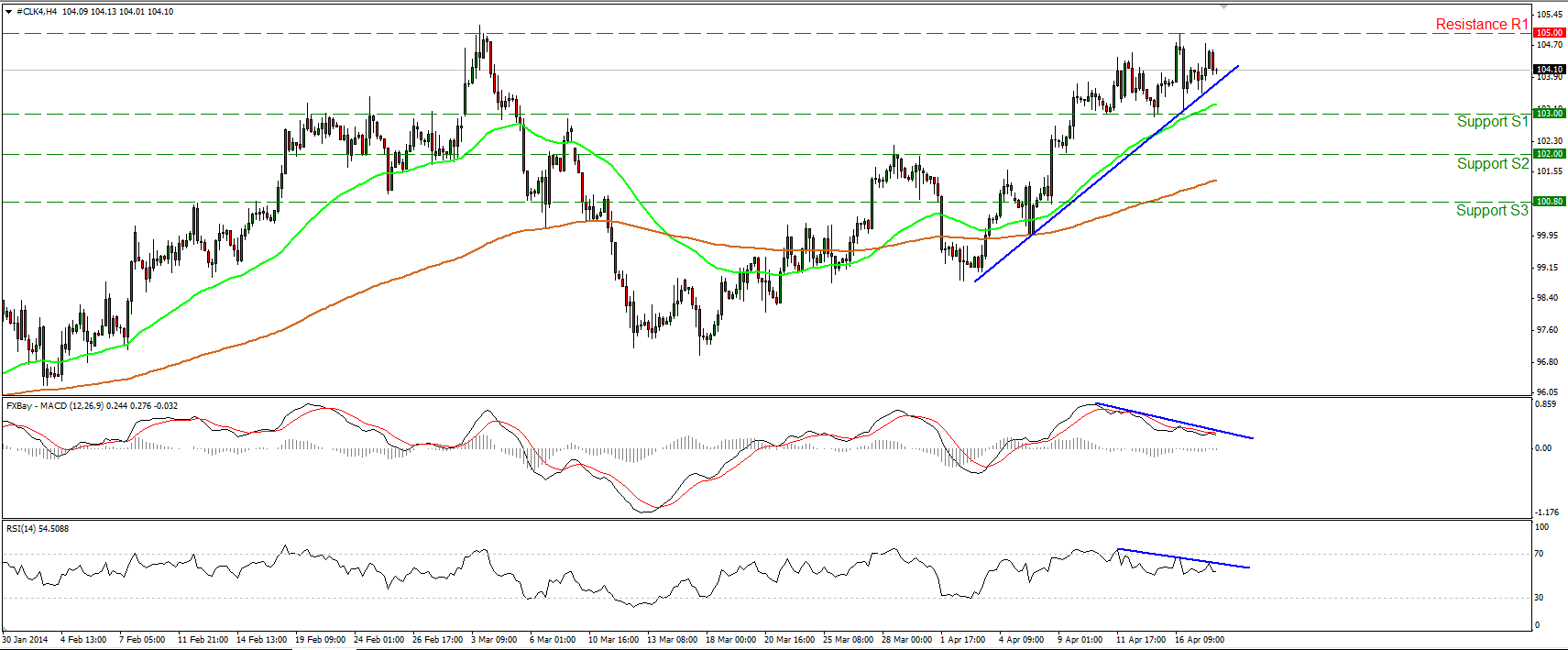

OIL

WTI failed to reach the 105.00 (R1) resistance this time and moved lower. The price remains above both the moving averages and the blue uptrend line, keeping the uptrend intact. Nonetheless, I would keep a neutral stance for now since the negative divergence between our momentum studies and the price action remains in effect. A dip below the 103.00 (S1) support would confirm the divergence and may challenge the 102.00 (S2) bar. On the upside, only a clear break above 105.00 (R1) may have larger bullish implications and will probably pave the way towards the 108.00 (R2) area.

Support: 103.00 (S1), 102.00 (S2), 100.00 (S3).

Resistance: 105.00 (R1), 108.00 (R2), 110.00 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.