The dollar received little support from US economic data on inflation. In the US, the core consumer price index for March accelerated to +1.7% yoy from +1.6% yoy, suggesting that consumer demand in the world's largest economy is reheating. However, at the same time we had the Empire State manufacturing survey for April which fell below its previous readings and did not leave much room for the greenback to appreciate against most of the other G10 currencies.

The euro was virtually unchanged after the German ZEW survey for April. The current situation index rose to 59.5 from 51.3, beating estimates of 51.5 by far, while the expectations index fell to 43.2 from 46.6, missing forecasts of 45.0.

Commodity currencies were the biggest decliners among the majors. The main loser was the New Zealand dollar after New Zealand’s CPI for Q1 slowed to +1.5% yoy from +1.6% yoy. The kiwi fell to its lowest in over a week.

China reported economic growth a touch above forecasts, a relief for investors. The Aussie was trading lower but recovered after the release of the data.

Bank of Japan Governor Haruhiko Kuroda on Wednesday affirmed his upbeat view of the economy, stressing that growth will pick up around mid-year.

In commodities, gold tumbled about 2% on Tuesday. On Wednesday, during the Asian morning, the precious metal recovered some of its lost ground. Brent crude fell for the first time after the China data release.

Today, the UK unemployment rate for February is expected to have declined to 7.1% from 7.2%, while the UK jobless claims for March are forecast to have fallen by 30.0k after a 34.6k decline in February. Eurozone’s final CPI for March is also coming out. As usual, the forecast is the same as the initial estimate.

In the US, the Fed releases its Beige Book survey, two weeks before the FOMC meeting. As for the US indicators, industrial production for March is forecast to have slowed to +0.5% mom from +0.6% mom in February. Housing starts are forecast to have improved in March, while building permits for the same month are estimated to have declined. The MBA mortgage applications for the week ended on April 11 are also coming out.

In Canada, we have the Bank of Canada interest rate decision. The market expects the Bank to maintain its policy rate unchanged at 1.00%, so the focus will fall on the Bank’s updated outlook for economy and inflation. A press conference by Governor Poloz will follow.

Besides BoC Governor Poloz, we have four Speakers scheduled on Wednesday. Fed Chair Yellen speaks to the Economic Club of New York. Atlanta Fed President Dennis Lockhart, Dallas Fed President Richard Fisher and Fed Governor Jeremy Stein will also speak.

THE MARKET

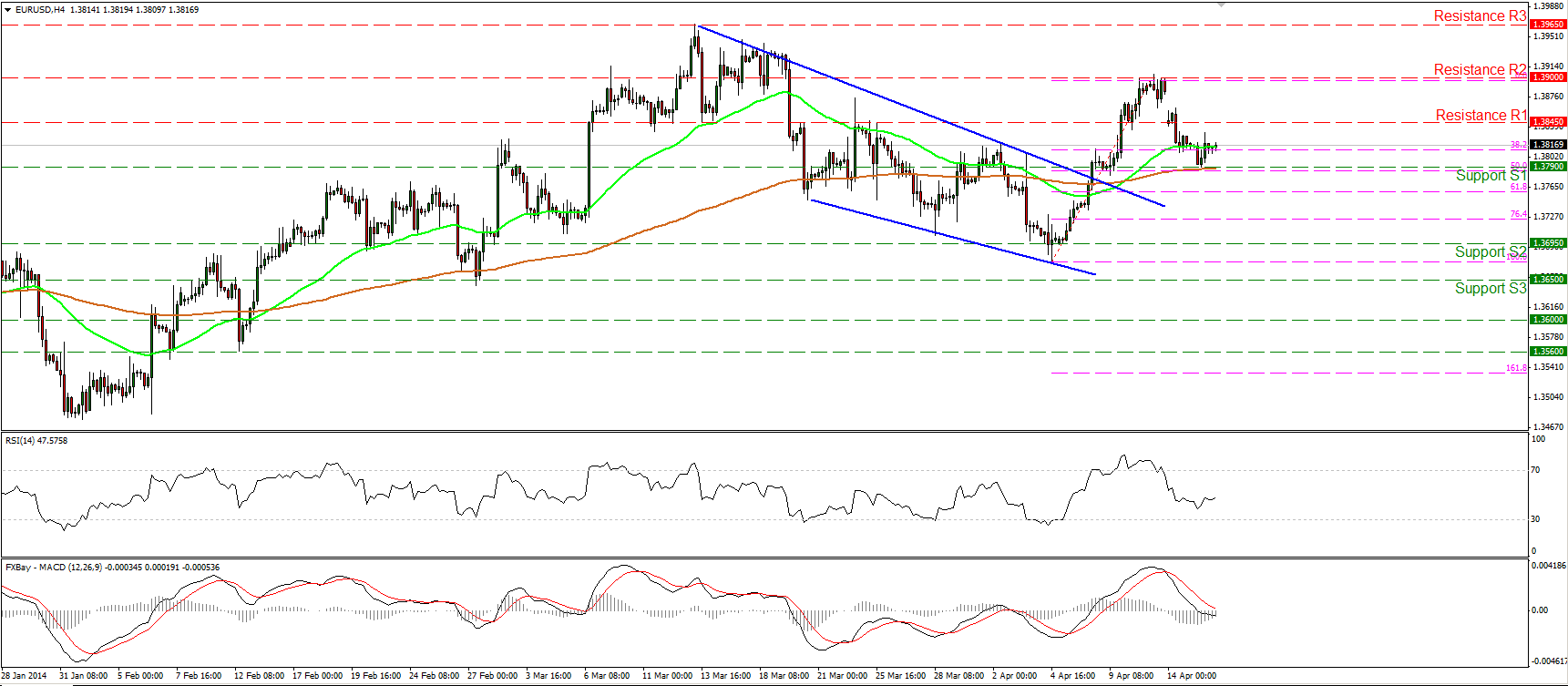

EUR/USD

EUR/USD moved slightly lower but met support near the 200-period moving average, and the 50% retracement level of the 4th-11th Apr. advance. I still consider the recent decline as a correcting phase since the possibility for a higher low still exists and as a result I would maintain my neutral stance as no signs or reversal are provided yet. A dip below that support zone may trigger extensions towards the lows of 1.3695 (S2). On the upside, a clear break above the 1.3900 (R2) is needed to signal the continuation of the upside path and may pave the way towards the highs of 1.3965 (R3).

Support: 1.3790 (S1), 1.3695 (S2), 1.3650 (S3).

Resistance: 1.3845 (R1), 1.3900 (R2), 1.3965 (R3).

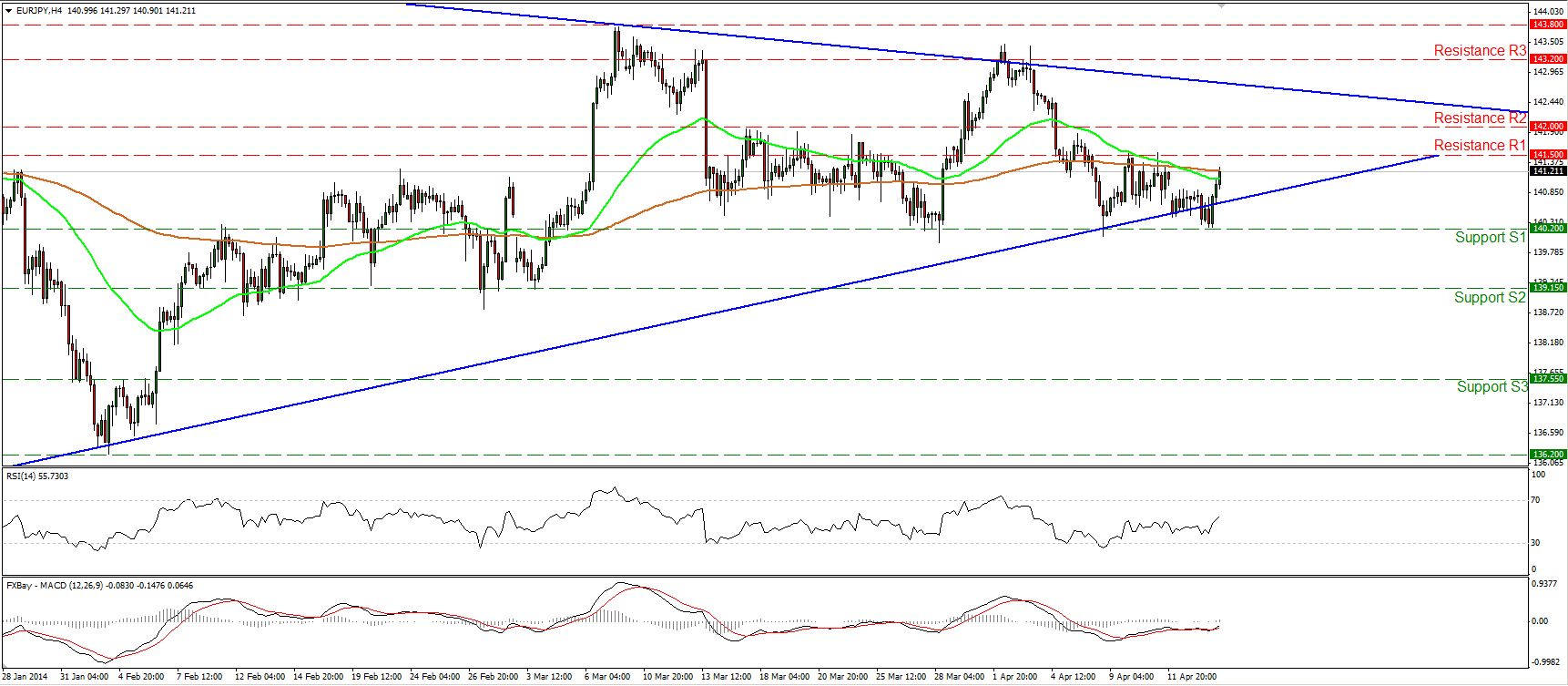

EUR/JPY

EUR/JPY tried to break below the lower boundary of the triangle formation, identified on the daily chart, but met strong support at 140.20 (S1) and moved significantly higher. The rate has oscillated between that support and the resistance of 141.50 (R1) since the 8th of April, thus I still consider the short-term outlook to remain neutral. The non-trending mode is also confirmed by the daily MACD and RSI, which still lie near their neutral levels.

Support: 140.20 (S1), 139.15 (S2), 137.55 (S3)

Resistance: 141.50 (R1), 142.00 (R2), 143.20 (R3).

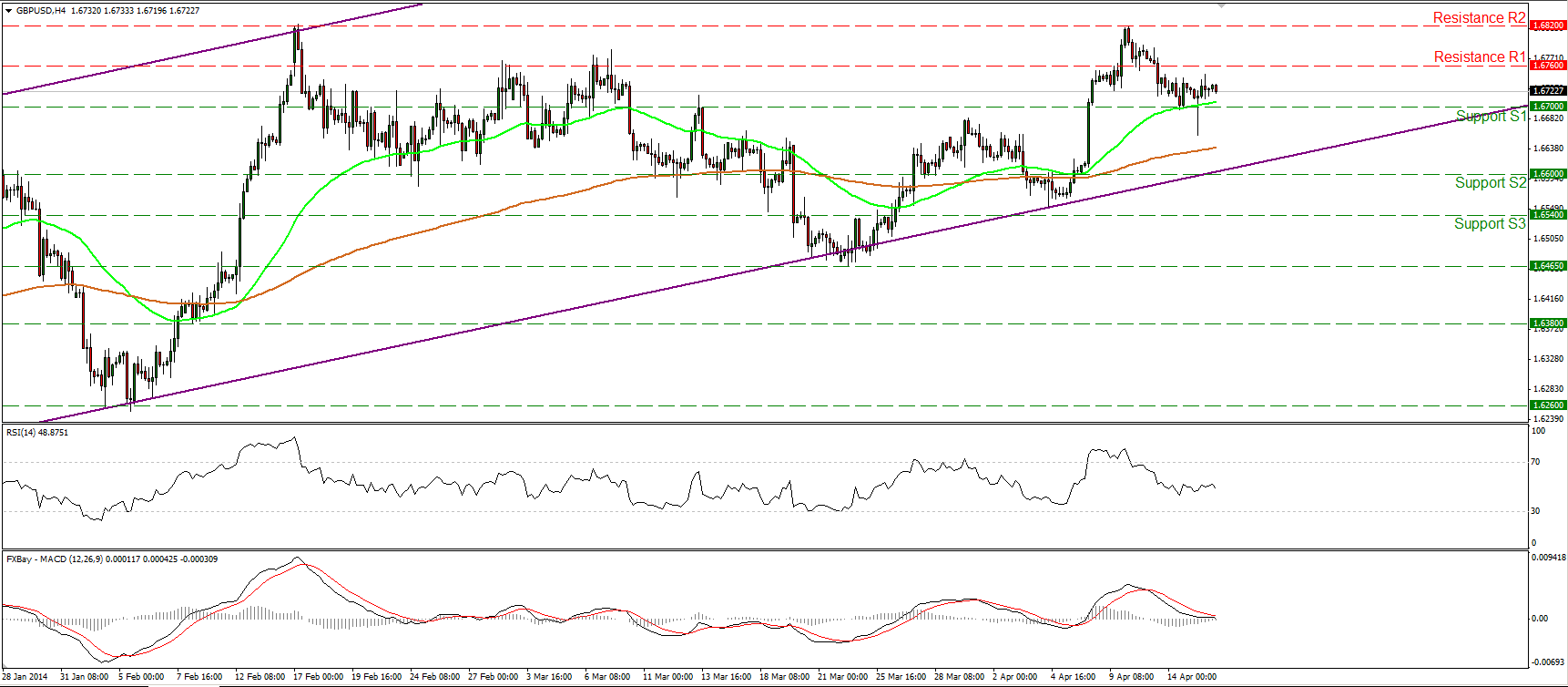

GBP/USD

GBP/USD remained supported by the 1.6700 (S1) and the 50-period moving average, after an unsuccessful attempt to break below that support zone. The rate moved in a consolidate mode and this is also confirmed by the neutral readings of both our momentum studies. A rebound near that support zone may challenge once again the highs of 1.6820 (R2), where a clear break may reinforce the positive short-term picture. In the bigger picture, cable remains within the upward sloping channel, keeping the long-term outlook to the upside.

Support: 1.6700 (S1), 1.6600 (S2), 1.6540 (S3).

Resistance: 1.6760 (R1), 1.6820 (R2), 1.6885 (R3).

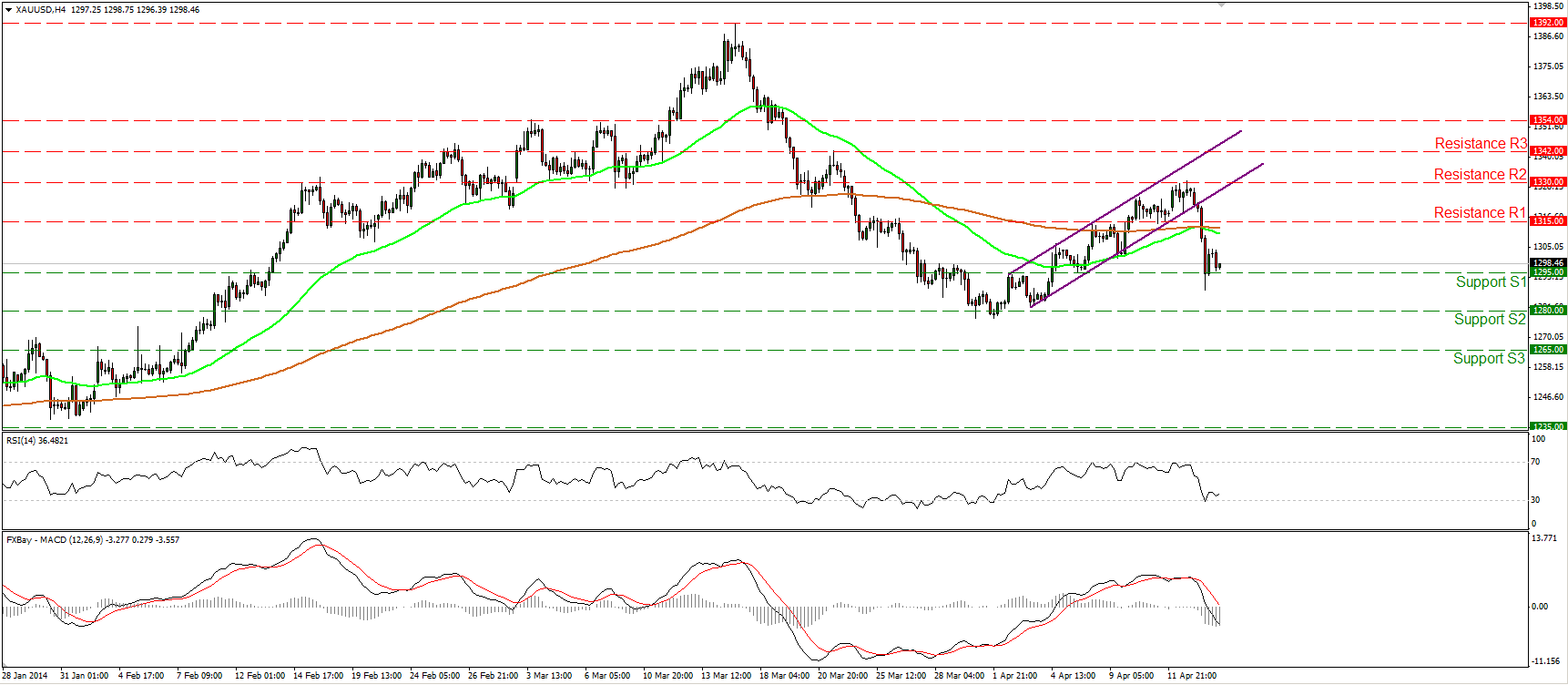

GOLD

Gold fell below the 1315 barrier and reached the support of 1295 (S1). The precious metal confirmed a lower low and turns the picture negative, in my view. If the bears are strong enough to drive the battle below 1295 (S1), I would expect them to target the next hurdle at 1280 (S2). The MACD crossed below its zero line, confirming the recent bearish momentum, but the RSI met support at its 30 barrier and moved higher. Thus, some consolidation or an upward corrective wave, before the bears prevail again, cannot be ruled out.

Support: 1295 (S1), 1280 (S2), 1265 (S3).

Resistance: 1315 (R1), 1330 (R2), 1342 (R3)

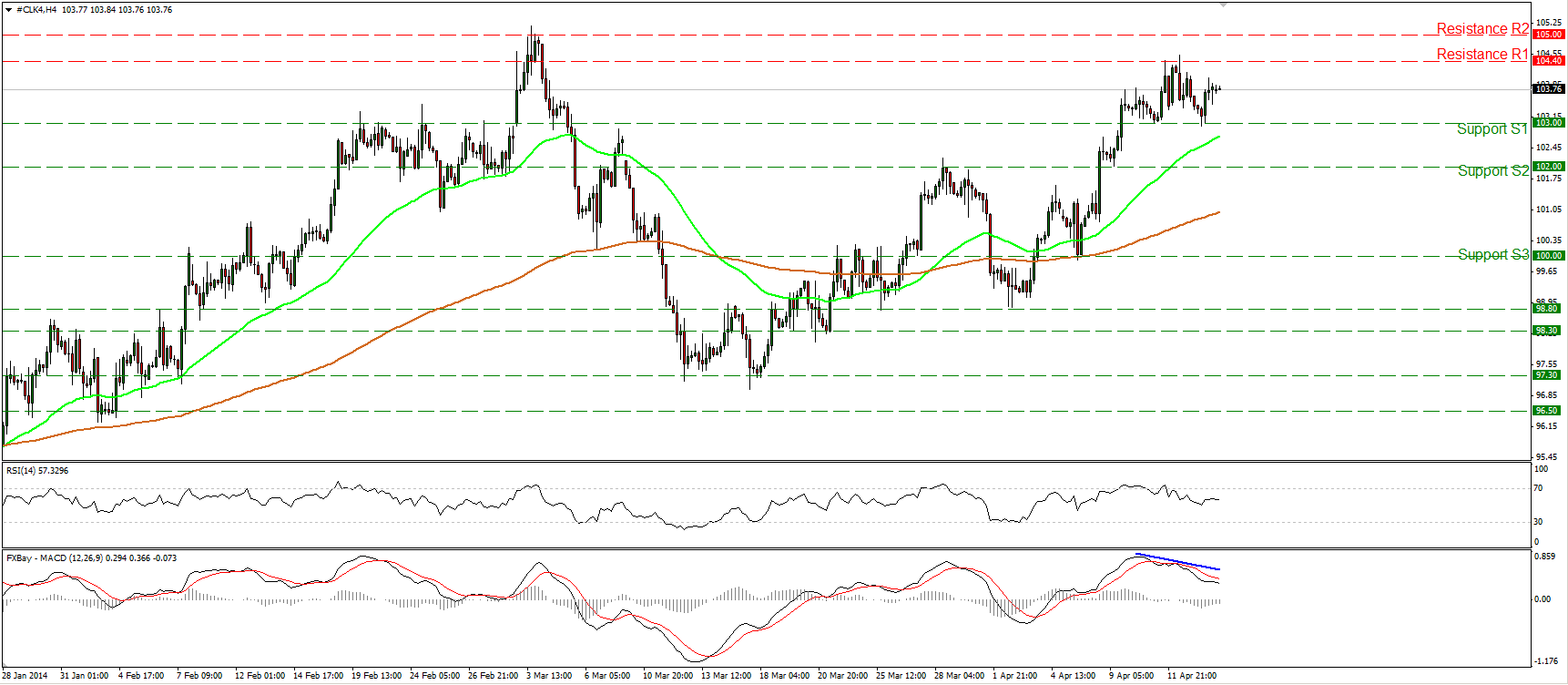

OIL

WTI met support at the 103.00 (S1) bar and moved higher. The price remains between that support and the resistance of 104.40 (R1). Considering that the negative divergence between the MACD and the price action is still in effect, I would maintain my neutral stance. A dip below the 103.00 (S1) hurdle would confirm the weakness signs provided by our momentum studies and may pave the way towards 102.00 (S2). On the upside, a break above 104.40 (R1) would confirm a forthcoming higher high and may revive the bullish case.

Support: 103.00 (S1), 102.00 (S2), 100.00 (S3)

Resistance: 104.40 (R1), 105.00 (R2), 108.00 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.