Draghi gives in ECB President Draghi has signalled that the ECB is finally going to take some action against low inflation. Speaking on Saturday after the IMF meeting, Draghi said, “The strengthening of the exchange rate requires further monetary stimulus. That is an important dimension for us.” The message coming out from the meeting was that a cut in interest rates is likely at first, possibly into negative territory. Only after that would the ECB attempt a quantitative easing program. As for when the easing measures are likely to begin, press reports say that the Bundesbank is unlikely to support any moves until the ECB revises its economic forecasts in June. However, a lower-than-expected inflation print for April could prompt an earlier response, as happened last November. The preliminary Eurozone CPI for April, due to be released on 30 April, is forecast to rebound from the surprisingly low level of +0.5% yoy in March. No consensus forecast is available yet but some economists have estimated it will return to +0.9% yoy. In any event, Draghi’s comment should be the key for a weaker EUR going forward. The clear divergence between the Fed and the ECB is likely to pressure the euro and support the dollar.

The dollar is starting the week generally higher against both G10 and EM currencies, although EUR is not as weak as one might have expected after the Draghi comments and the worsening crisis in Ukraine. EUR/GBP for example is barely changed from Friday’s opening levels, suggesting to me that EUR has further to fall. The dollar also gained against most EM currencies, although the likelihood of further easing in the Eurozone should keep carry trades in fashion and support the EM currencies vs EUR. Investors who are thinking of putting on EM carry trades should consider putting them on against EUR.

Friday’s US data were relatively positive for the dollar, continuing a string of good US numbers. The producer price index rose more than expected, hinting at a build-up in inflationary pressure that could make the Fed more willing to countenance higher rates. And US consumer sentiment hit a nine-month high. This follows last week’s better-than-expected jobless claims, which fell to a cyclical low. Jobless claims are subject to seasonal factors however and they tend to soar in the week that includes Good Friday, which is April 18th this year. So we could see a big jump in claims when this weeks’ number is released on 24 April. However, they tend to decline by a similar magnitude three weeks later, so the market may ignore the figure.

Today’s news should also be USD-supportive. Retail sales excluding auto and gasoline for March are forecast to have accelerated to +0.4% mom from +0.3% mom, bringing good news about consumption. As for the rest of the week, tomorrow we get the CPI for March, which is expected to accelerate on a yoy basis. That may change some peoples’ view of how quickly the Fed is likely to raise rates. Speeches by Fed Chair Janet Yellen on Tuesday and Wednesday will of course be closely watched for any clues on this matter, and particularly if she clarifies the confusion over whether the FOMC’s stock phrase that “a highly accommodative policy will remain appropriate for a considerable time after asset purchases end” means six months, a number that did not show up in the recent FOMC minutes.. On Wednesday we also get the Fed’s Beige Book, which will give the first hints of how the FOMC is likely to view the economy at its meeting on April 30th.

There are no major European indicators out today, only Italy’s final CPI for March and Eurozone’s industrial production for February. Eurozone’s IP is forecast to have risen 0.2% mom after falling by the same pace in January. The figure is not usually market affecting, however.

There are two speakers today: French Central Bank Governor Christian Noyer and Fed Governor Daniel Tarullo speak at the Europlace Financial Forum at the New York Stock Exchange.

As for the rest of the week, on Tuesday, the Reserve Bank of Australia releases the minutes from its latest meeting. During the European day, we have the German Zew survey for April and UK’s CPI data for March. On Wednesday, we have UK employment data for February and Eurozone’s final CPI for March. Meanwhile the Bank of Canada holds its policy meeting. On Thursday, we get Canada’s CPI for March and on Friday we have Japan’s Tertiary industry index for February.

THE MARKET

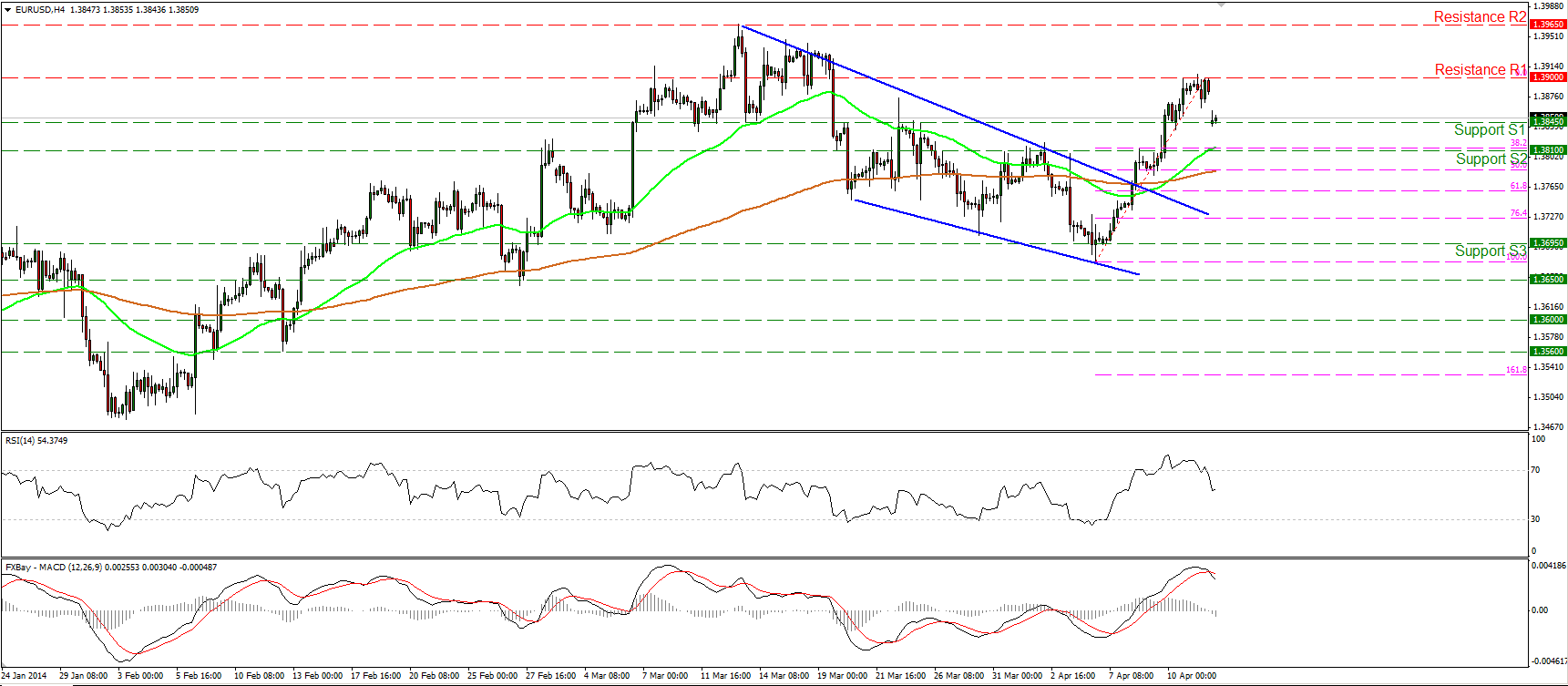

EUR/USD

EUR/USD opened the Asian day with a downside gap after ECB President Mario Draghi said “the strengthening of the exchange rate requires further monetary stimulus”. The pair met support near the 1.3845 (S1) barrier and since the possibility for a higher low still exists, the short-term technical outlook has turned neutral for now. Considering that the RSI exited overbought conditions while the MACD, although in its positive territory, fell below its trigger line, we may experience the continuation of the decline for a test at the 1.3810 (S2) hurdle, near the 38.2% retracement of the 4th–11th Apr. advance. On the upside, a clear break above the 1.3900 (R1) is needed to signal the continuation of the upside path and may pave the way towards the highs of 1.3965 (R2).

Support: 1.3845 (S1), 1.3810 (S2), 1.3695 (S3).

Resistance: 1.3900 (R1), 1.3965 (R2), 1.4000 (R3).

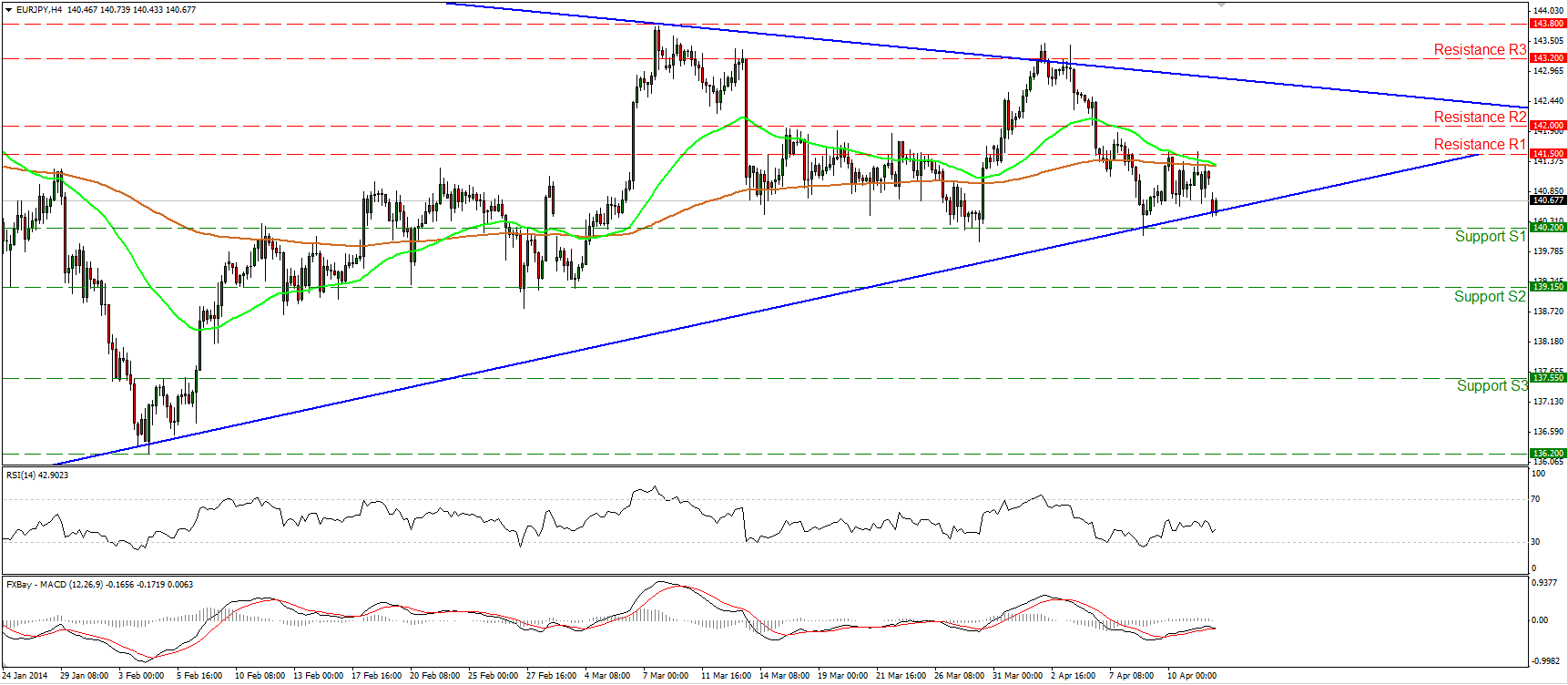

EUR/JPY

EUR/JPY also opened with a bearish gap on Draghis comments, but the rate met support at the lower boundary of the triangle formation, identified on the daily chart. I still consider the overall picture to be neutral since the pair is not in a clear trending phase and this is also confirmed by the daily MACD and RSI, which lie near their neutral levels. A clear break below the hurdle of 140.20 (S1) may signal the exit from the formation may have larger bearish implications.

Support: 140.20 (S1), 139.15 (S2), 137.55 (S3)

Resistance: 141.50 (R1), 142.00 (R2), 143.20 (R3).

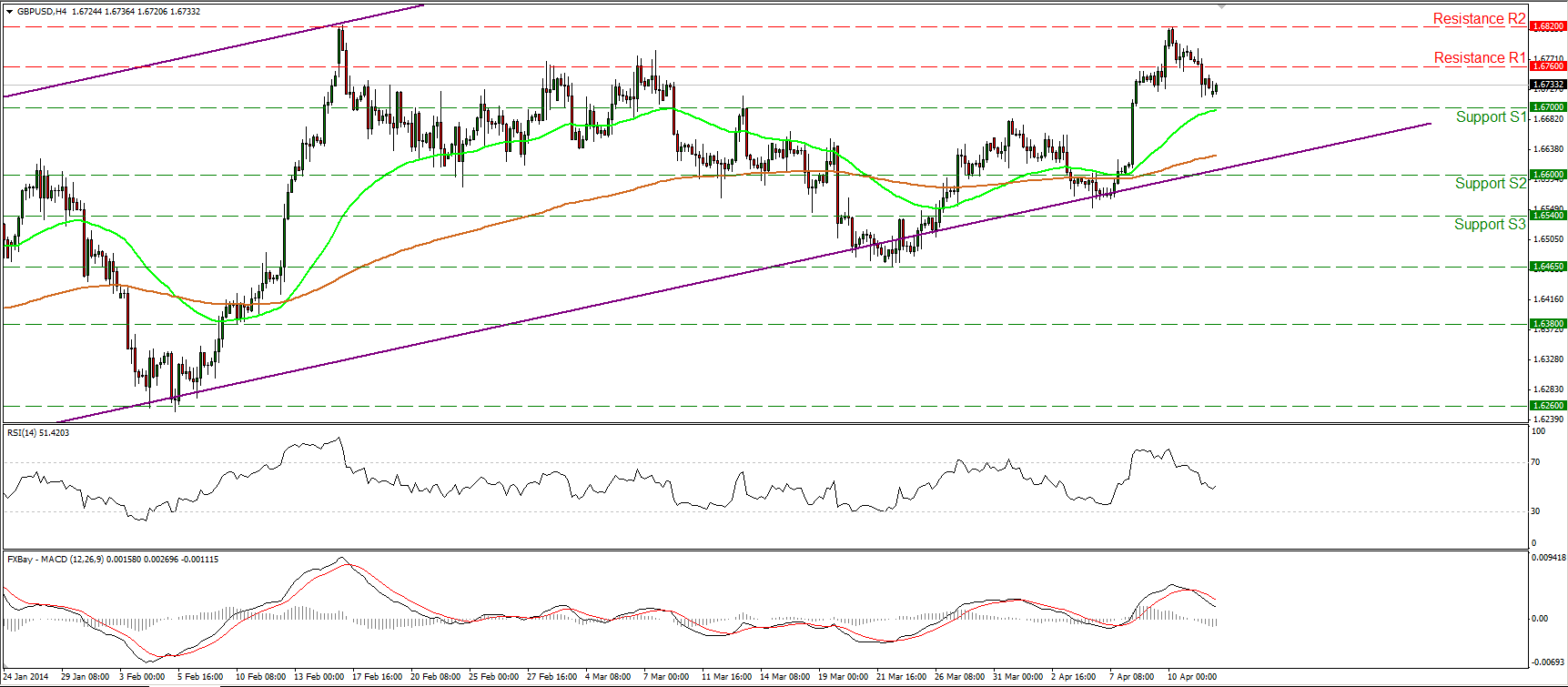

GBP/USD

GBP/USD fell below the 1.6760 bar and is now trading between that resistance and the key support of 1.6700 (S1). A rebound near that area would confirm a higher low and may challenge once again the highs of 1.6820 (R2), where an upward violation may trigger extensions towards the next resistance at 1.6885 (R2). In the bigger picture, cable remains within the upward sloping channel, keeping the long-term outlook to the upside.

Support: 1.6700 (S1), 1.6600 (S2), 1.6540 (S3).

Resistance: 1.6760 (R1), 1.6820 (R2), 1.6885 (R3).

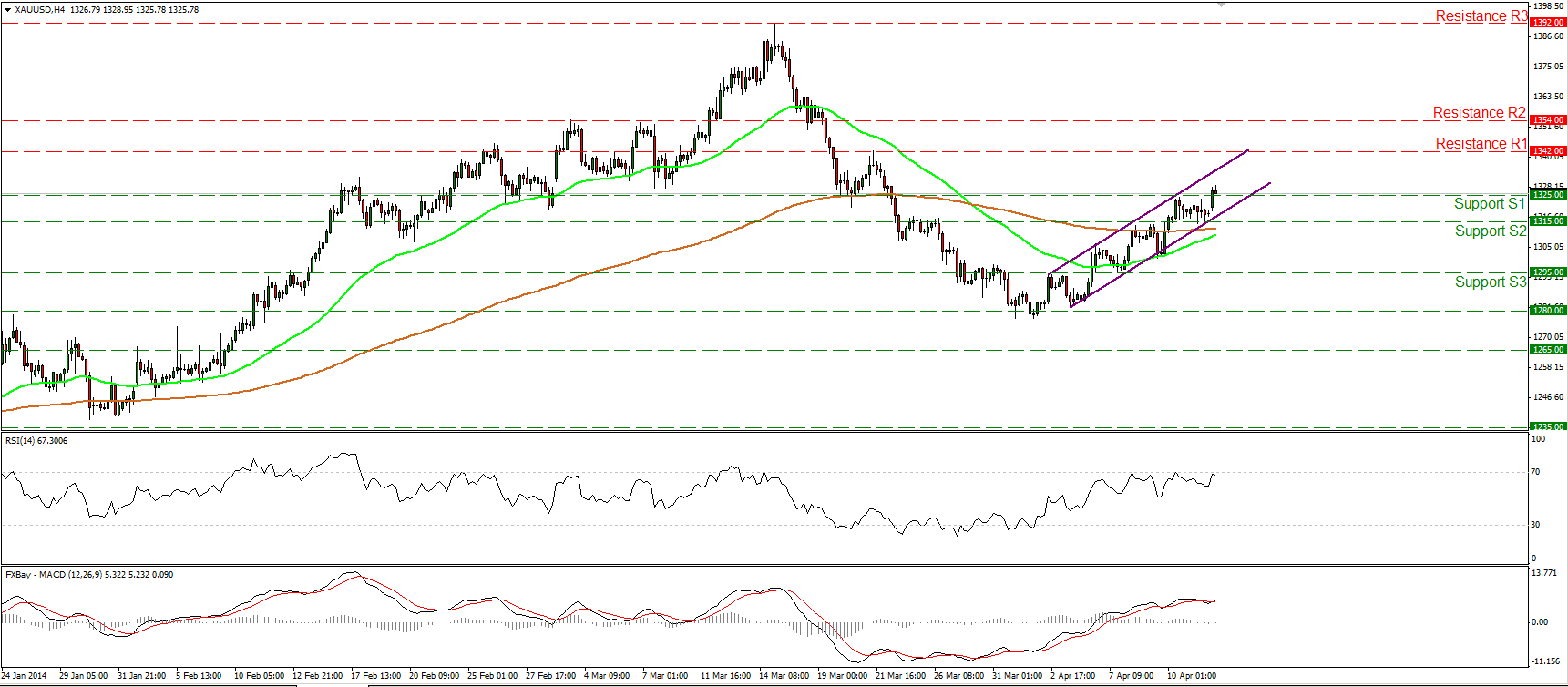

GOLD

Gold rebounded once again from the lower boundary of the short-term upward sloping channel and moved above the 1325 bar. As long as the precious metal is printing higher highs and higher lows within the channel, I consider the short-term picture to remain positive and I would expect the longs to trigger extensions towards the 1342 bar. My only concern is that the RSI met resistance at its 70 barrier, thus some consolidation or a pullback cannot be ruled out.

Support: 1325 (S1), 1315 (S2), 1295 (S3).

Resistance: 1342 (R1), 1354 (R2), 1392 (R3)

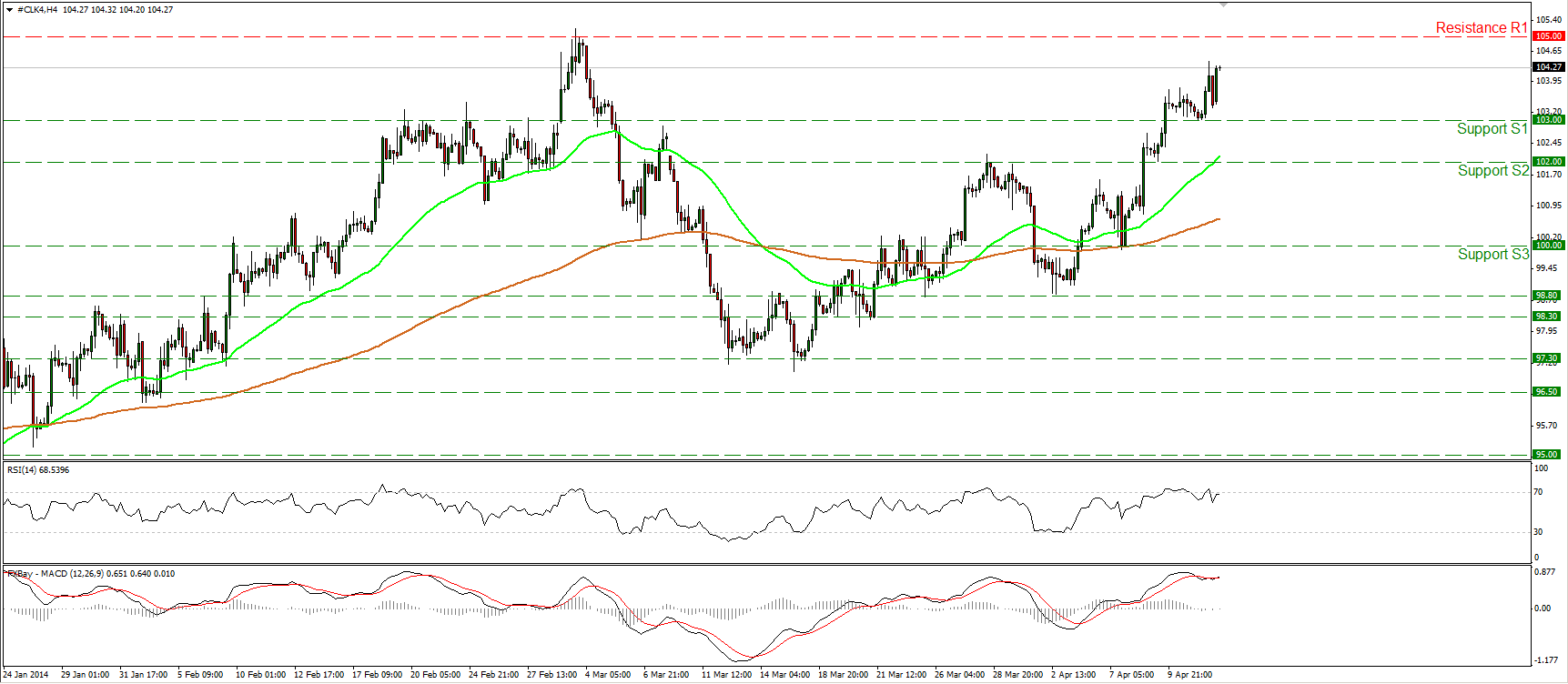

OIL

WTI rebounded from the 103.00 (S1) support level and moved significantly higher. I would expect the bulls to continue driving the price higher and challenge the highs of 105.00 (R1). A clear violation of that hurdle will confirm a forthcoming higher high on the daily chart and may have larger bullish implications. As long as WTI is printing higher highs and higher lows above both the moving averages, the price path remains to the upside.

Support: 103.00 (S1), 102.00 (S2), 100.00 (S3)

Resistance: 105.00 (R1), 108.00 (R2), 110.00 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.