Every dog has its day

Or week, in this case. The precious metals were the big winners last week, but with some noticeable twists. The precious metals with industrial uses – palladium, silver, platinum – rose more than gold, as did WTI. This suggests the move had more to do with renewed optimism for the global economy than any increased confidence in QE. But then why did copper lag? Perhaps because it is simply less volatile (standard deviation of 6.4% so far this year, vs 16.0% for silver) or perhaps because of the continued slowdown in China (see below). Nonetheless given the overall drop in the dollar last week, gold’s performance can only be termed disappointing. It simply confirms to me that baring some unforeseen disaster, the trend for gold remains down.

The most important indicator for the day (and perhaps the week) is already out: China 2Q GDP. It hit the consensus forecast exactly at +7.5% yoy, down from +7.7% in Q1. That confirms the slowdown in the economy. But with the Finance Minister recently saying that growth of 6.5% or 7.0% wouldn’t be a problem, it may be somewhat of a relief, because even if it were worse, the government wouldn’t necessarily have done anything to boost growth. In addition, industrial production, fixed asset investment and retail sales for June were announced at the same time and they too were largely on target and confirmed the slowdown. Retail sales on the other hand accelerated, perhaps showing that the government is having some success in reshaping the economy to be more dependent on domestic demand. Nonetheless the business climate index and entrepreneur confidence index both fell, indicating that businessmen are getting nervous.

No doubt the recent spike in interbank rates and the difficulty in getting loans is having an impact on business sentiment. It seems likely that the slowdown in China will continue for some time, especially with the problems in the banking system. That suggests a weaker AUD and struggling base metal prices, in my view.

The other main event of the week will be Fed Chairman Bernanke’s testimony to the US House and Senate Banking Committees on Wednesday and Thursday, in which he will once again get an opportunity to send the markets into wild gyrations as he repeats himself for the umpteenth time. I don’t expect anything new from him; the only question is how the markets react to what he says. It appears from last week’s action that investors have finally gotten the message, which would imply little volatility, but one never knows. For today, there are no major Eurozone indicators out. Mr. Asmussen of the ECB will be speaking. Last week he sent EUR/USD to the low for the year with his comment that the ECB’s pledge to keep rates low for “an extended period of time” extends beyond 12 months. The ECB quickly backpedalled his comments in an email sent to journalists. He’s not likely to make that same mistake again and so I do not expect anything particularly revealing from him. The calendar in the US is thin but worth watching. The Empire State manufacturing index is forecast to have slipped a bit in July to 5.0 from 7.84 in June; retail sales on the other hand are forecast to have risen by 0.8% mom in June vs +0.6% in May. The retail sales “control group” (excluding autos dealers, building materials and petrol stations) is forecast to show the same +0.3% mom rise as it did the previous month. Continued growth in retail sales would probably be supportive of USD, given the US economy’s reliance on consumption.

The Market

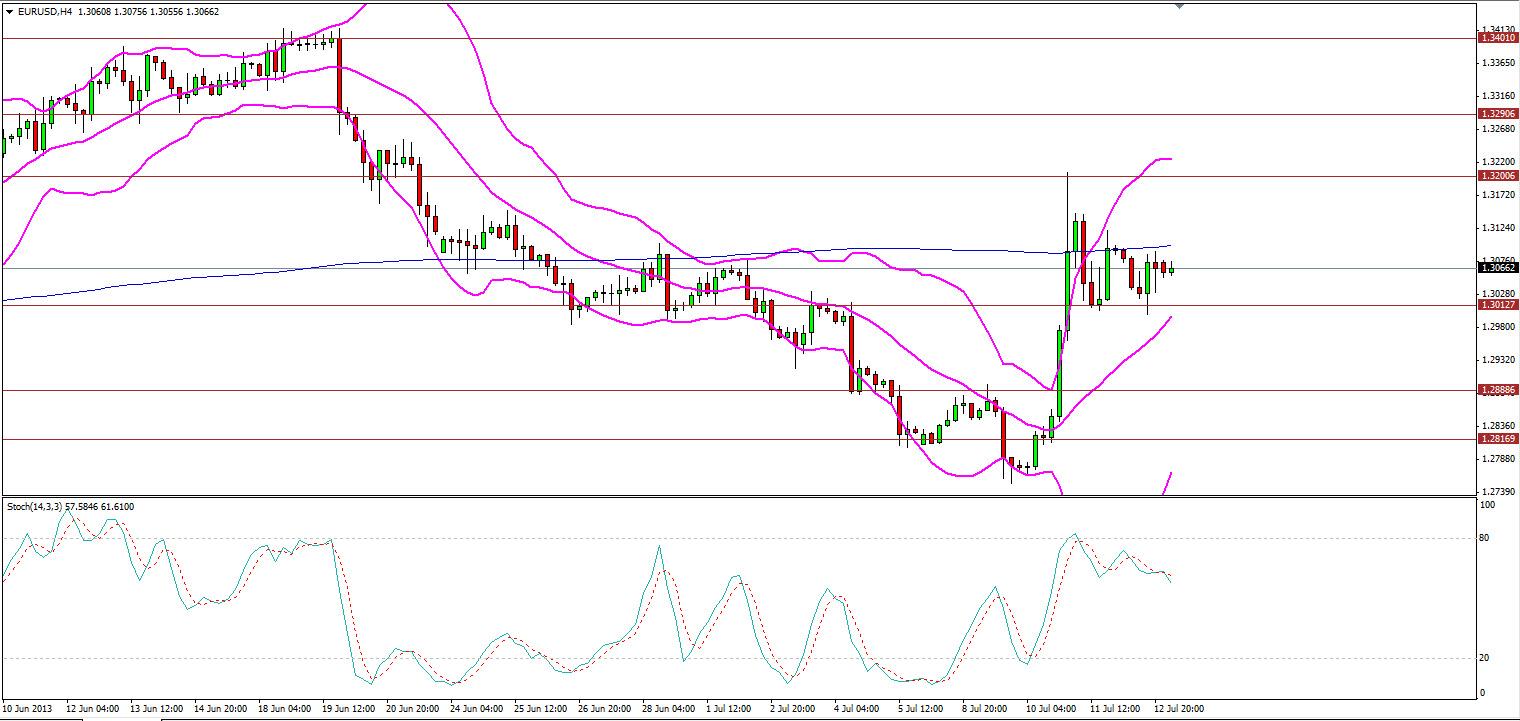

EUR/USD

EUR/USD remains unchanged since Friday with outlook remaining to the upside. Resistance levels can be found at 1.3200 and 1.3290, support at 1.3014 and 1.2890.

USD/JPY

USD/JPY ended slightly higher. Outlook remains to the upside. Resistance levels can be found around the 99.80-100.00 region and 100.70, support at 98.60 and 97.00.

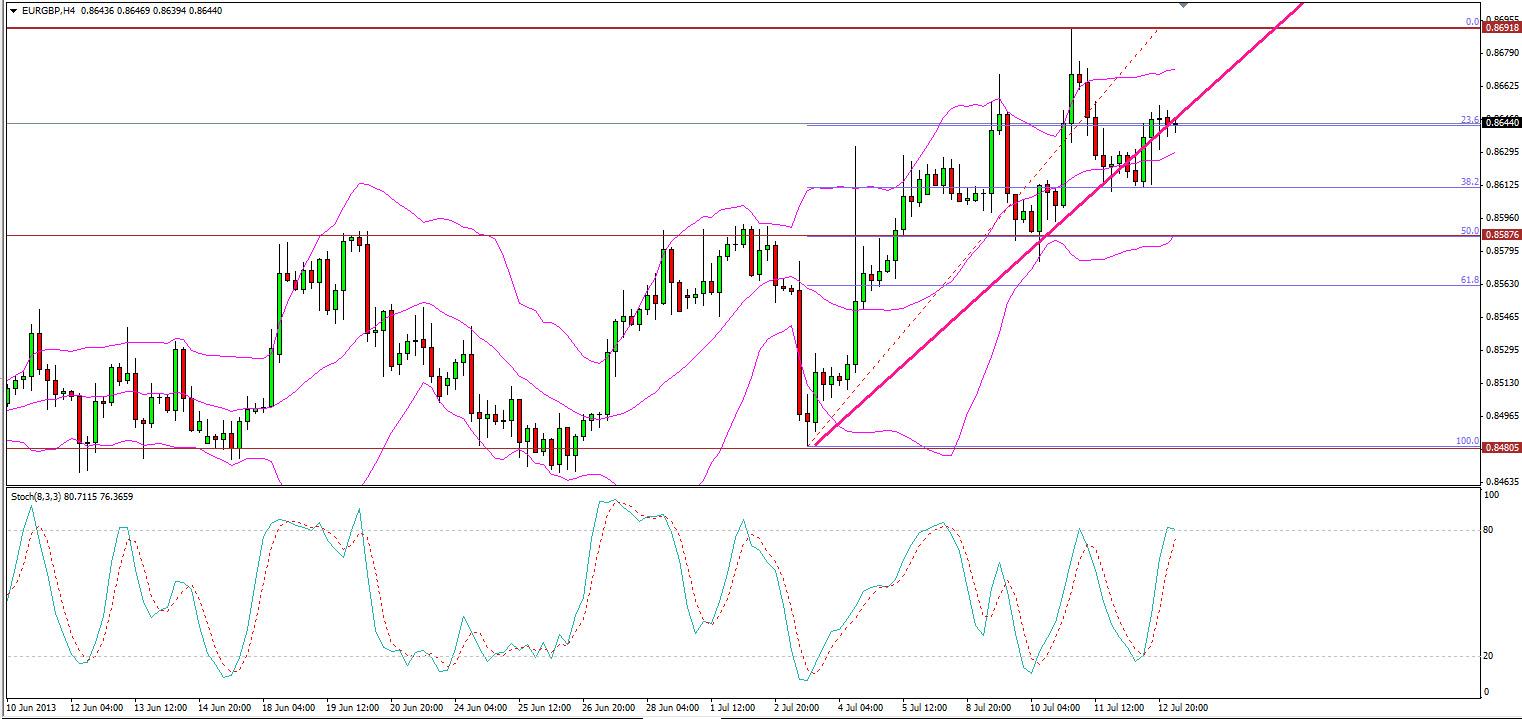

EUR/GBP

EUR/GBP ended slightly higher. The outlook for the pair remains to the upside back up by a strong rising trend line support. Stochastic is in overbought region so a break of this trendline may see an imminent drop. Resistance is the 0.8690 level followed by 0.8790, support is at 0.8610 followed by 0.8590

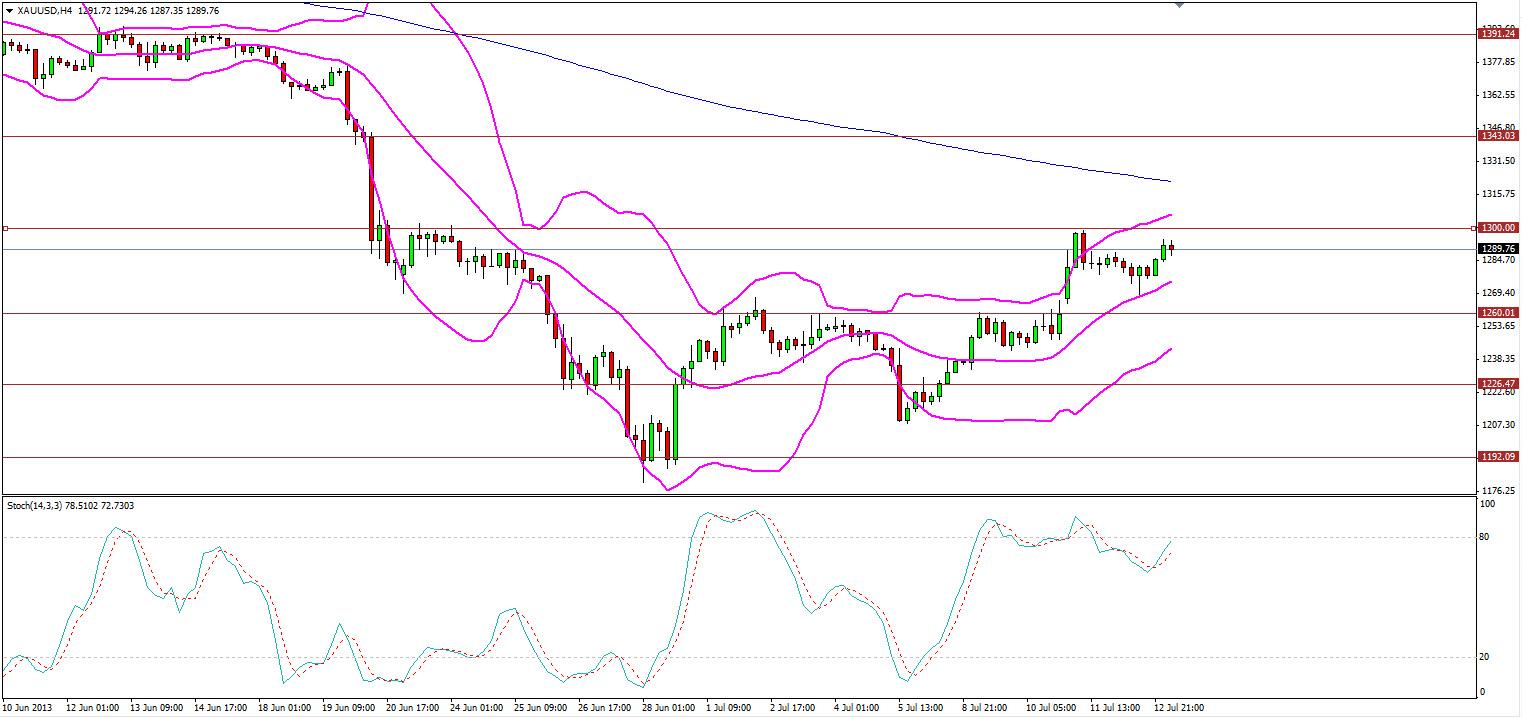

Gold

Gold continued its gaining streak after bouncing higher from its middle Bollinger Bands (4-Hour). Gold maintains strong momentum and we think it is highly likely that the 1300 level may be tested. A breakout of this level could see Gold soar much higher. However with the stochastic being in overbought region we may observe a down correction today if this level is not broken. Resistance levels can be found at 1300.00 with a breakout leading all the way to 1343, support at 1260.00 followed by 1226.50

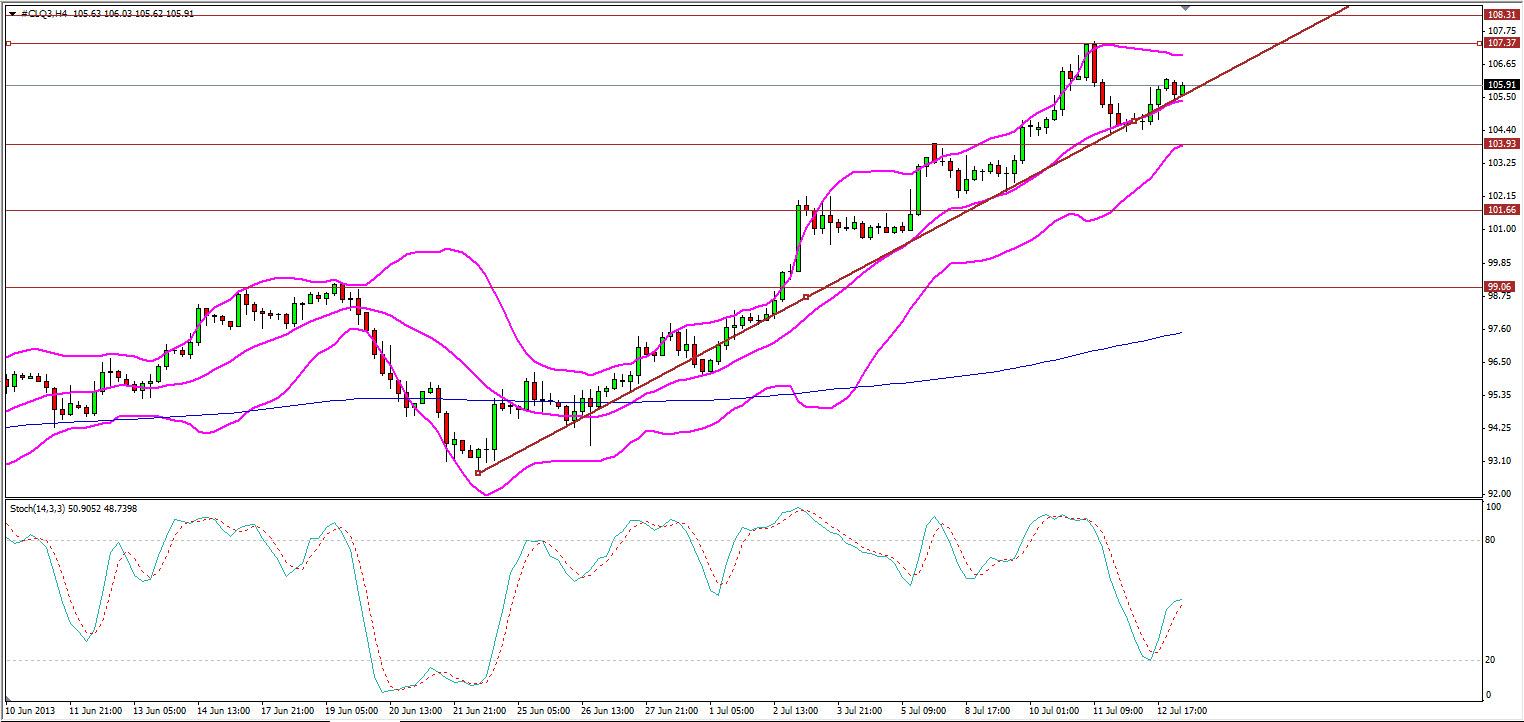

Oil

WTI moved higher after bouncing up from the 104.50 support, its middle Bollinger Bands. A further move to the upside may be expected as it maintains a strong rising trend line support. Resistance levels can be found at 107.40 with a breakout leading all the way to 108.30, support at 103.40 followed by 101.70

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.