Analysis for August 27th, 2014

EUR USD, “Euro vs US Dollar”

One of the possible scenarios implies that Euro is forming the final descending wave (E) of [B], which may take the form of a large zigzag, flat or some double pattern. Right now, the pair is expected to start an ascending correction B of (E) of [B].

Possibly, the price finished a descending impulse [c] of A and the whole zigzag A, which may be followed by an ascending zigzag B.

Probably, the pair completed (or is completing) a descending impulse (v) of [c] of A and the whole zigzag A. Later the price is expected to start an ascending zigzag B.

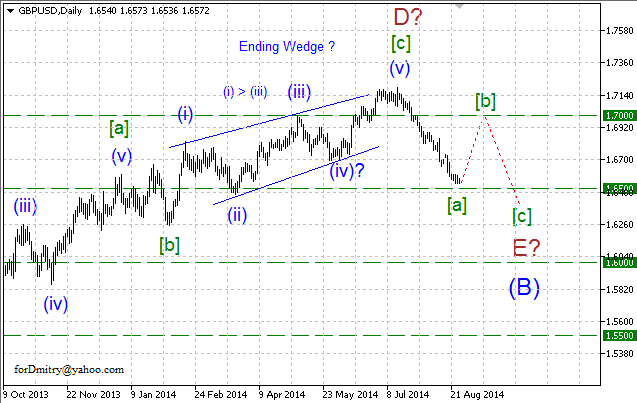

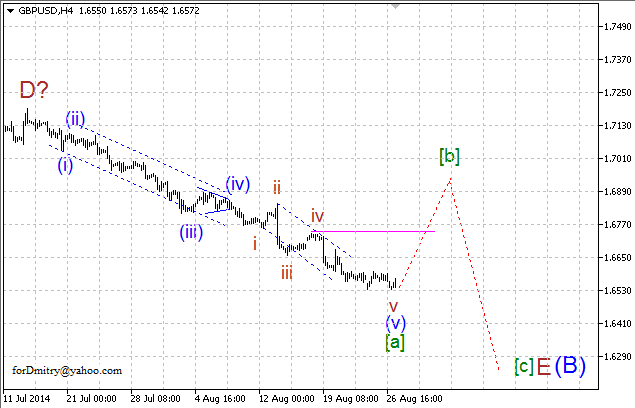

GBP USD, “Great Britain Pound vs US Dollar”

Probably, Pound completed the final wedge [c] of D of an ascending zigzag D of (B) of a large skewed triangle (B). Right now, the pair is forming the final descending wave E of (B), which may take the form of (double) zigzag.

Probably, the price is forming an impulse [a] of E of the final descending wave E of (B), which may be followed by an ascending zigzag [b] of E.

Possibly, the pair completed a descending impulse v of (c) of [a], which may be followed by an ascending zigzag [b].

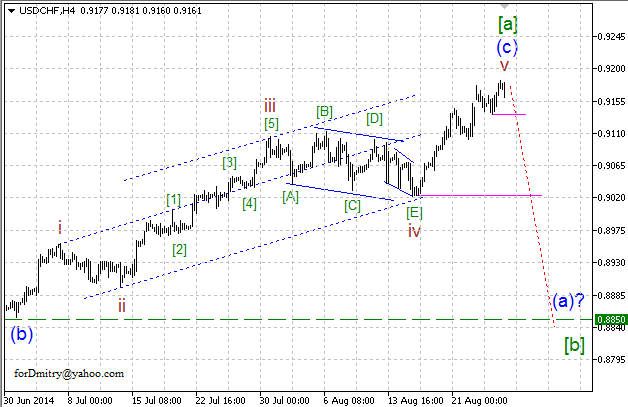

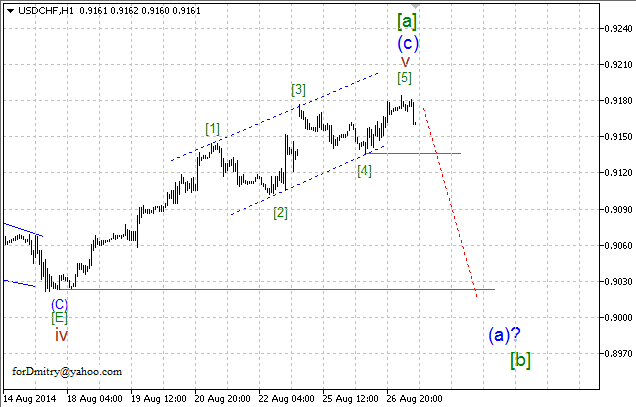

USD CHF, “US Dollar vs Swiss Franc”

One of the possible scenarios implies that Franc is forming the final ascending wave E of (4), which may take the form of a large zigzag, flat, or some double pattern. Right now, the price is expected to start a descending correction [b] of E of (4).

Possibly, the pair finished an ascending impulse (c) of [a] and the whole zigzag [a], which may be followed by a descending zigzag [b].

Probably, the pair completed an ascending impulse v of (c) of [a] and the whole zigzag [a], which may be followed by a descending zigzag [b].

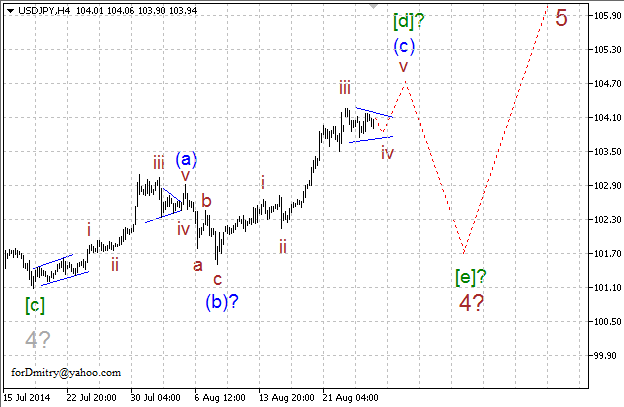

USD JPY, “US Dollar vs Japanese Yen”

Probably, right now Yen is expected to start forming a descending zigzag [e] of 4 of (A) of a long horizontal correction 4 of (A). In this case, later the price is expected to start the final ascending movement inside wave 5 of (A).

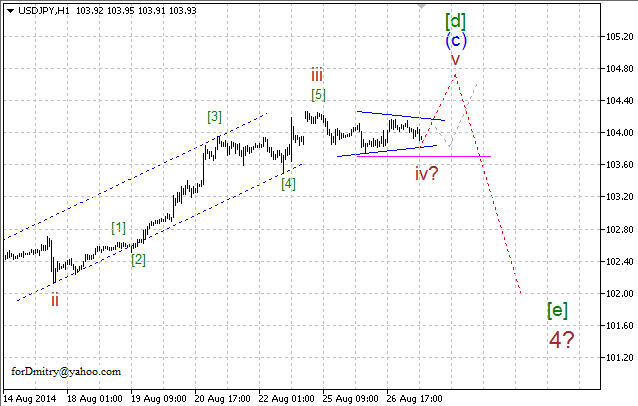

Possibly, the pair is completing an ascending zigzag [d] of 4, which may be followed by the final descending zigzag [e] of 4.

Probably, the price is finishing an ascending impulse (c) of [d] of and the whole zigzag [d]. If this assumption is correct, then after completing zigzag [d] of 4, the pair is expected to start the final descending zigzag [e] of 4.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.