Analysis for September 2nd, 2014

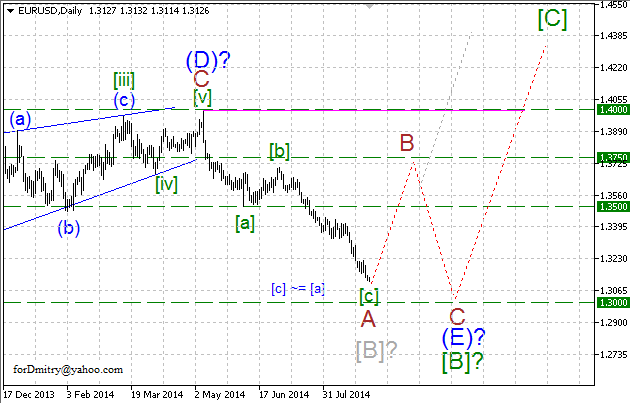

EUR USD, “Euro vs US Dollar”

One of the possible scenarios implies that Euro is forming the final descending wave (E) of [B], which may take the form of a large zigzag, flat or some double pattern. Right now, the pair is expected to start an ascending correction B of (E) of [B].

Probably, the price is finishing a descending impulse [c] of A and the whole zigzag A, which may be followed by an ascending zigzag B.

Possibly, the pair is completing a descending impulse (v) of [c] of A and the whole zigzag A, which may be followed by an ascending zigzag B.

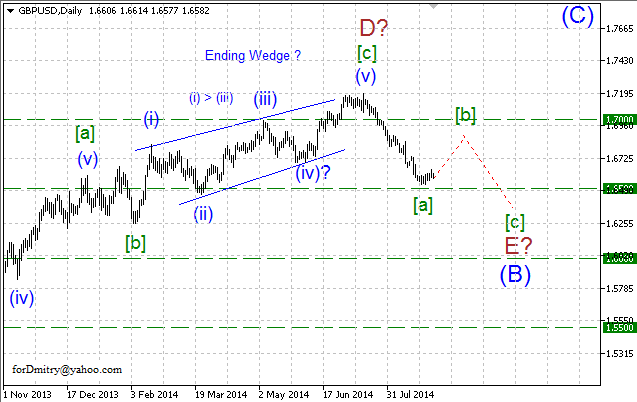

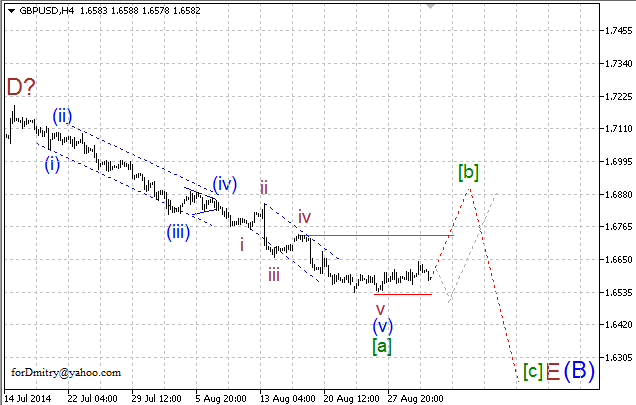

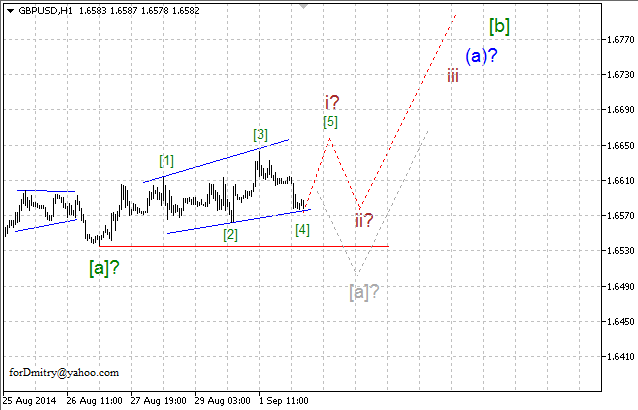

GBP USD, “Great Britain Pound vs US Dollar”

Probably, Pound completed the final wedge [c] of D of an ascending zigzag D of (B) of a large skewed triangle (B). Right now, the pair is forming the final descending wave E of (B), which may take the form of (double) zigzag.

Possibly, the price is forming an impulse [a] of E of the final descending wave E of (B), which may be followed by an ascending zigzag [b] of E.

Probably, the pair completed a descending impulse [a] and is starting an ascending zigzag [b].

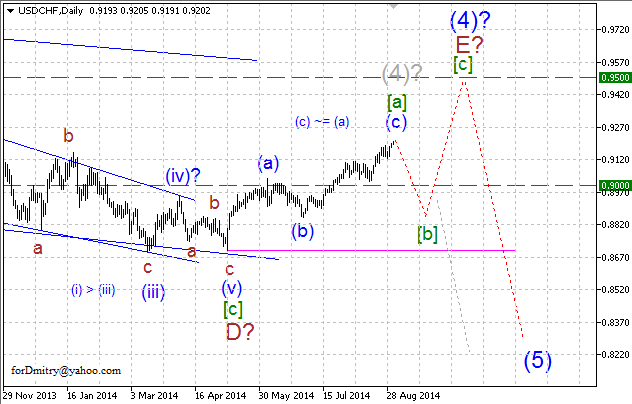

USD CHF, “US Dollar vs Swiss Franc”

One of the possible scenarios implies that Franc is forming the final ascending wave E of (4), which may take the form of a large zigzag, flat, or some double pattern. Right now, the price is expected to start a descending correction [b] of E of (4).

Probably, the pair is finishing an ascending impulse (c) of [a] and the whole zigzag [a], which may be followed by a descending zigzag [b].

Possibly, the pair is completing an ascending diagonal triangle v of (c) of [a] and the whole zigzag [a], which may be followed by a descending zigzag [b].

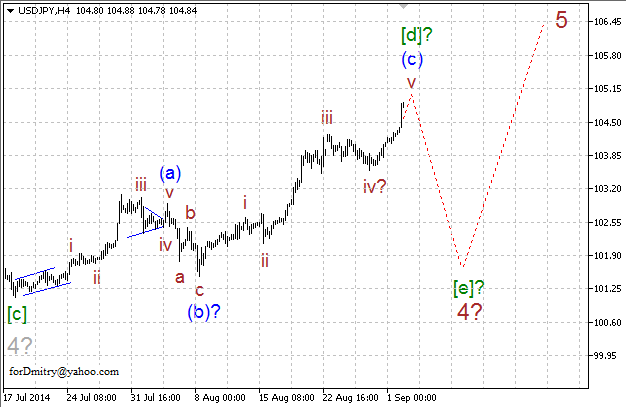

USD JPY, “US Dollar vs Japanese Yen”

Probably, right now Yen is expected to start forming a descending zigzag [e] of 4 of (A) of a long horizontal correction 4 of (A). In this case, later the price is expected to make the final ascending movement inside wave 5 of (A).

Probably, the pair is completing an ascending zigzag [d] of 4, which may be followed by the final descending zigzag [e] of 4.

Possibly, the price is finishing an ascending impulse (c) of [d] of and the whole zigzag [d]. If this assumption is correct, then after completing zigzag [d] of 4, the pair is expected to start the final descending zigzag [e] of 4.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.