Do you want to know which are the Current Trading Positions of our contributors? Get a glance here.

GOLD Lower On Hawkish Fed Comments

-

Gold fell from a three-week high on Wednesday as the dollar regained some ground. The metal had jumped to a three-week high of USD 1,262.60 on Tuesday.

-

The USD was supported by hawkish comments from US policymakers.

-

Richmond Fed President Jeffrey Lacker said the Federal Reserve will likely have to raise interest rate around four times this year. Fed policymakers signaled in December that four hikes would probably be needed this year, though policymakers cut their view in March to two rate increases for 2016. Lacker, who appears to be in a small minority of Fed policymakers pressing firmly for a resumption in gradual interest rate hikes, argued that firming labor markets and consumer spending would continue to power economic growth and that the tumult in global financial markets earlier in the year did little to slow the economy.

-

San Francisco Fed President John Williams said the Federal Reserve could reasonably raise interest rates two or three times this year. Economic data has in recent months come in generally as expected, Williams said, with inflation on "the right trajectory" toward the Fed's goal of 2% by the end of next year, he said, and unemployment looks likely to fall to 4.75% this year. That decline is actually slower than he had earlier thought because, in a sign of labor market strength, more Americans are returning to the workforce. Unemployment ticked up to 5% in March from 4.9% the prior month, because of the increase in labor force participation.

-

Philadelphia Fed President Patrick Harker said it is still possible that the US central bank could raise interest rates three times this year.

-

Gold is weaker today also on improving risk sentiment reflected in rises of Asian equities after surprisingly upbeat Chinese trade data. The level of 1,260 is a fairly stiff resistance. In our opinion rising prices of commodities and as a result higher inflation data should increase demand for precious metals even in case of Fed monetary tightening.

-

We opened long XAU/USD position at 1220.00 and our target is 1290.00. Our XAG/USD long opened at 15.190 is in a good shape after recent rises. The target is 16.800.

USD/JPY: Back In Black

-

The safe-haven Japanese yen slid from recent peaks against the greenback on Wednesday as solid gains in oil prices helped underpin risk appetite.

-

With hopes of a production cap agreed by top producers Russia and Saudi Arabia back in play, global oil prices climbed to four-month highs overnight. Russia and Saudi Arabia reached a consensus on Tuesday about an oil output freeze, Russia's Interfax news agency quoted a diplomatic source in Doha as saying ahead of producers' meeting there on April 17. Russia's Energy Ministry declined comment. The source also told Interfax that Saudi Arabia's final decision on freezing oil production would not depend on Iran's position about its own oil output.

-

BoJ policy board member Harada said that the BoJ will need to ease without hesitation if risks to the economy materialise. But he said that it is too early to assess the impact of negative rates at present. It is hard to imagine the BoJ will cut rates further as long as they have not assessed the impact of what they have done on the economy.

-

Our USD/JPY long is back in black today. Long-term outlook remains bearish but some recovery is likely in the coming days.

USD/CAD: All Eyes On BoC

-

The day's big set piece is the Bank of Canada’s interest rate decision and updating of its economic forecasts, which come after a strong run higher for the Canadian dollar.

-

No change is expected in interest rates but the meeting will be watched closely for any attempt to talk the currency down.

-

We remain positive on the CAD and will be hunting for higher USD/CAD levels to open another short-term bearish position. First, the loonie is still sizably undervalued against the USD. Second, room for cutting rates in by the BoC is relatively limited compared to the RBA and RBNZ (other commodity currencies). What is more, expected recovery in oil prices should give a boost to the loonie.

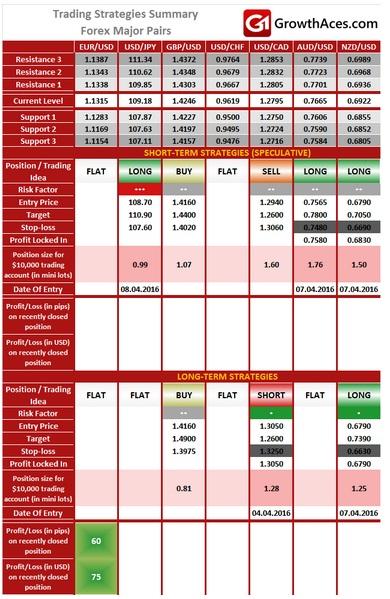

FOREX - MAJOR PAIRS:

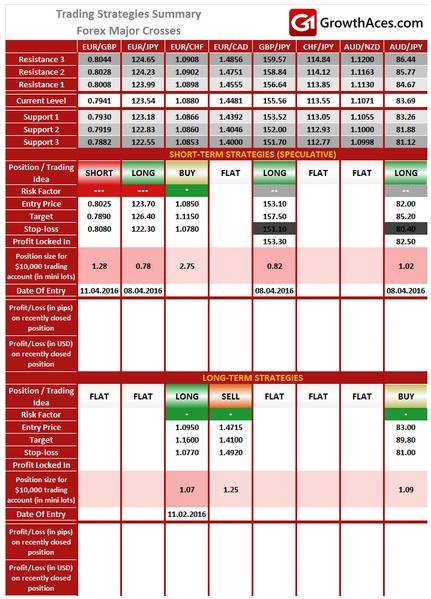

FOREX - MAJOR CROSSES:

PRECIOUS METALS:

It is usually reasonable to divide your portfolio into two parts: the core investment part and the satellite speculative part. The core part is the one you would want to make profit with in the long-term thanks to the long-term trend in price changes. Such an approach is a clear investment as you are bound to keep your position opened for a considerable amount of time in order to realize the profit. The speculative part is quite the contrary. You would open a speculative position with short-term gains in your mind and with the awareness that even though potentially more profitable than investments, speculation is also way more risky. In typical circumstances investments should account for 60-90% of your portfolio, the rest being speculative positions. This way, you may enjoy a possibly higher rate of return than in the case of putting all of your money into investment positions and at the same time you may not have to be afraid of severe losses in the short-term.

How to read these tables?

-

Support/Resistance - three closest important support/resistance levels

-

Position/Trading Idea:

BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level.

LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level. -

Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

-

Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

-

Position Size (forex)- position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD/USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

Position size (precious metals) - position size suggested for a USD 10,000 trading account in units. You can calculate your position size as follows: (your account size in USD/USD 10,000) * (our position size). -

Profit/Loss on recently closed position (forex) - is the amount of pips we have earned/lost on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Profit/Loss on recently closed position (precious metals) - is profit/loss we have earned/lost per unit on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.