EUR/USD: Yellen Speech In Focus

Monday's report from the Commerce Department showed consumer spending in January was not as strong as previously reported. That, together with other data showing a widening in the goods trade deficit in February, indicated economic growth remained sluggish in the first quarter.

Consumer spending edged up 0.1% as households cut back on goods purchases after a downwardly revised 0.1% gain in January. Consumer spending, which accounts for more than two-thirds of US economic activity, was previously reported to have increased 0.5% in January. In a separate report, the Commerce Department said the advance goods trade deficit widened to USD 62.9 billion in February from USD 62.2 billion, rising for a fourth straight month as an increase in exports was offset by a gain in imports.

Inflation moderated last month, with a price index for consumer spending dipping 0.1% after nudging up 0.1% in January. In the 12 months through February, the personal consumption expenditures (PCE) price index increased 1.0% after rising 1.2% in January. Excluding food and energy, prices gained 0.1% after advancing 0.3% in January. In the 12 months through February, the so-called core PCE price index increased 1.7% after a similar increase in January.

Personal income rose 0.2% after rising 0.5% in January. The slowdown in income growth is likely temporary amid anecdotal evidence that the tightening jobs market, marked by an unemployment rate at an eight-year low of 4.9% and growing skills shortages, is driving up wages.

The Atlanta Federal Reserve's GDPNow forecast model on Monday showed the US economy growing at below an annualised 1% in the first quarter, down from 1.4% in the fourth quarter. The disappointing outcome dimmed prospects for an imminent hike in US interest rates, which some Federal Reserve officials last week said could be as early as next month if the economy maintained its momentum.

Investors await Federal Reserve Chair Janet Yellen's speech at 16:20 GMT for fresh signals on the outlook for US interest rate hikes, after a chorus of hawkish comments from other Fed officials last week. Special attention will most likely be on her comments on inflation after several inflation measures increased above the 2% threshold lately, although yesterday saw the core PCE deflator unchanged at 1.7% yoy.

We do not expect a hike in April and we think today’s Yellen’s speech may be not as hawkish as expected, which may result in weaker USD this week. We went long on EUR/USD yesterday at 1.1200. Technical analysis suggests EUR/USD gains as daily RSI is now biased up and monthly RSI deepens its bull bias.

GOLD: Long At 1220

Gold fell today, extending losses after its biggest weekly drop since early November, as the dollar firmed ahead of a speech by Federal Reserve chair Janet Yellen which will be watched for clues on US monetary policy.

Gold is highly sensitive to US monetary policy, as rising interest rates lift the opportunity cost of holding non-yielding bullion, while boosting the dollar. The precious metal slid 3% last week after hawkish comments from a series of Fed officials.

The message the market received last week from Fed members was that the Fed should not hesitate to raise the rate again, and this could take place as soon as next month. The odds for such an event are still very low, but if Janet Yellen does shows her hawkish side, the possibility of the April meeting becoming a live one could inflate even further.

China's net gold imports via main conduit Hong Kong rose in February from a 17-month low reached in the previous month. The top bullion consumer's net gold imports climbed to 53.869 tonnes last month from 33.041 tonnes in January. China does not provide trade data on gold, and the Hong Kong figures serve as a proxy for flows to the mainland. The Hong Kong data might not provide a full picture of Chinese purchases as imports through Shanghai and Beijing, for which no data is available, have been rising.

China typically imports heavily towards the end of the year to stock up for the Lunar New Year, which is celebrated at the start of a year. Imports tend to taper off after that, but the extent of the decline in January this year surprised many. Despite the increase in February, arrivals remain much lower than the 2015 monthly average, raising doubts over the strength of demand from the top consumer amidst a global price rally.

We opened long position at 1220.00 yesterday as in our opinion today’s speech of Fed Chair Janet Yellen may be less hawkish than expected and lower likelihood of an interest rate hike in April will result in rising gold prices in the coming sessions.

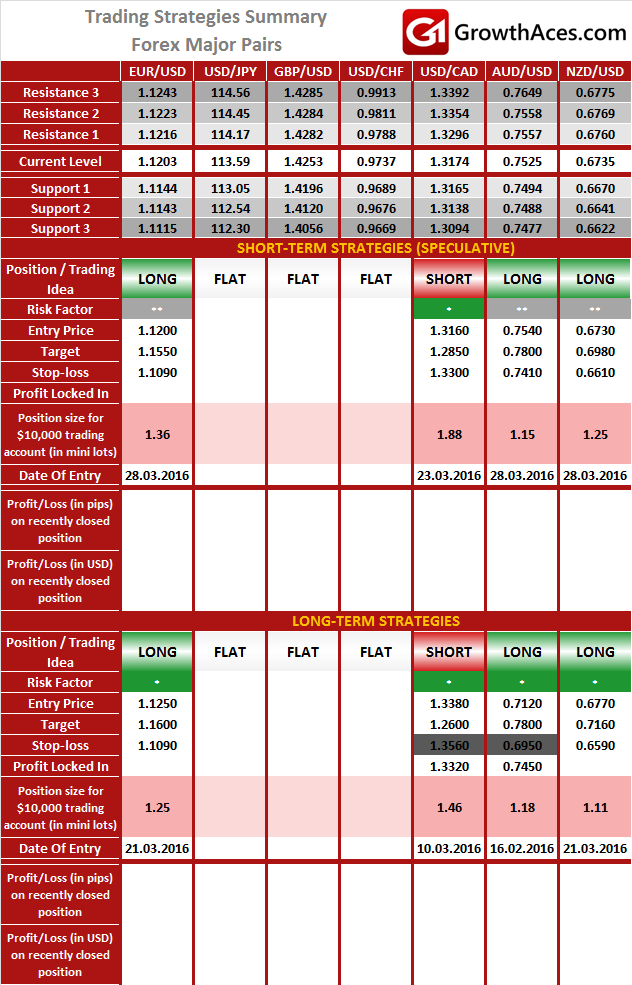

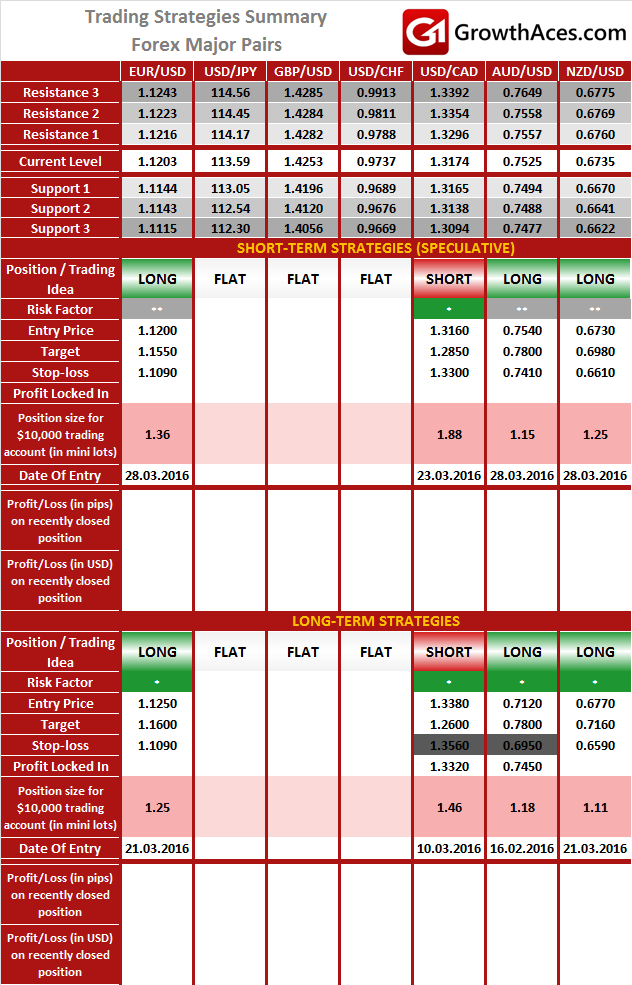

FOREX - MAJOR PAIRS:

FOREX - MAJOR CROSSES:

PRECIOUS METALS:

It is usually reasonable to divide your portfolio into two parts: the core investment part and the satellite speculative part. The core part is the one you would want to make profit with in the long-term thanks to the long-term trend in price changes. Such an approach is a clear investment as you are bound to keep your position opened for a considerable amount of time in order to realize the profit. The speculative part is quite the contrary. You would open a speculative position with short-term gains in your mind and with the awareness that even though potentially more profitable than investments, speculation is also way more risky. In typical circumstances investments should account for 60-90% of your portfolio, the rest being speculative positions. This way, you may enjoy a possibly higher rate of return than in the case of putting all of your money into investment positions and at the same time you may not have to be afraid of severe losses in the short term.

How to read these tables?

1. Support/Resistance - three closest important support/resistance levels

2. Position/Trading Idea:

BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level.

LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.

3. Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

4. Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

5. Position Size (forex) - position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

Position size (precious metals) - position size suggested for a USD 10,000 trading account in units. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size).

6. Profit/Loss on recently closed position (forex) - is the amount of pips we have earned/lost on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Profit/Loss on recently closed position (precious metals) - is profit/loss we have earned/lost per unit on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.