EUR/USD: Buy At 1.0830

The minutes of the Fed's December 15-16 meeting released on Wednesday said: “Nearly all participants were now reasonably confident inflation would move back to 2% over the medium term.” Federal Reserve policymakers decided to raise interest rates last month. But "some members said that their decision to raise the target range was a close call, particularly given the uncertainty about inflation dynamics." The minutes cast light on the fissures that remain in the US central bank despite a unanimous decision from policymakers last month to raise rates by a quarter point from near zero, the first increase in a decade. The move to hike in December while promising a gradual path of future increases was a compromise between policymakers who had been ready to raise rates for months and those who feel the economy is still at risk from weak inflation and slow global growth. Fed policymakers generally expect four quarter-point rate hikes in 2016, but the minutes made clear that some officials will be wary of further increases if higher inflation does not materialize, and all agreed that persistently low inflation was a worry.

Eurozone retail sales fell 0.3% mom and rose 1.4% yoy in November vs. a rise by 2.4% in October. Unemployment rate in the Eurozone fell to 10.5% from 10.6% in the previous month.

The EUR/USD rose after the FOMC minutes. The rate broke above the 10-day exponential moving average at 1.0848 today. Our yesterday’s buy order at 1.0765 was not filled. But in our opinion the outlook is bullish now and we have raised our EUR/USD bid to 1.0830.

Investors are waiting for US non-farm payrolls report on Friday. The market expects a reading of 200k. The ADP National Employment Report said on Wednesday that US private companies added 257k jobs in December (vs. 192k expected). After strong ADP reading we should not expect a substantial EUR/USD reaction to slightly better data. We should remember that employment subindex of the manufacturing ISM was very low, which shows there is a risk of jobs report tomorrow. In our opinion the EUR/USD reaction will be more significant in case of weaker data than in case of higher data.

AUD/JPY Under Pressure Of Increased Risk Aversion

The Australian and New Zealand dollars skidded to multi-week lows on Thursday after China's central bank fixed its yuan currency far lower than many expected, spurring speculation that it was aiming for a sustained depreciation to boost exports. On the other hand, the JPY, which is a traditional safe-haven currency, strengthened.

The latest blow came after China surprised the market for the second day with a sharp weakening of the yuan, fuelling fears of a currency war. The Chinese central bank fixed the midpoint of the yuan's daily trading range 0.5% lower than Wednesday's fix, the biggest move since a near 2% devaluation of the currency in August last year.

The AUD/JPY, which is a good gauge of risk aversion, continues to fall. It is currently at the lowest level since September. Not helping the outlook were tensions in the Korean Peninsula and falling commodity prices, including iron ore, Australia's top export earner.

Australian approvals to build new homes fell 12.7% in November vs. forecast of a 3.0% drop. Australia reported a trade gap of AUD 2.90 billion in November 2015, a decrease of 11% from a downwardly revised AUD 3.25 billion deficit in a month earlier and below market expectations, as exports rose while imports fell.

A mixed bag of Australian data did little to alter expectations of a 25-basis point-cut to 1.75% by the Reserve Bank of Australia. Interbank futures implies a 40% chance of an easing by April. In our opinion the RBA will keep rates unchanged.

We have withdrawn our sell AUD/JPY order, as in our opinion it is too risky to get short at current levels. The nearest support level is at 82.02.

We expect an improvement in the risk appetite in the long term and our long-term AUD/JPY is bullish. Our trading strategy will be to get long if only there are signs of recovery on this pair.

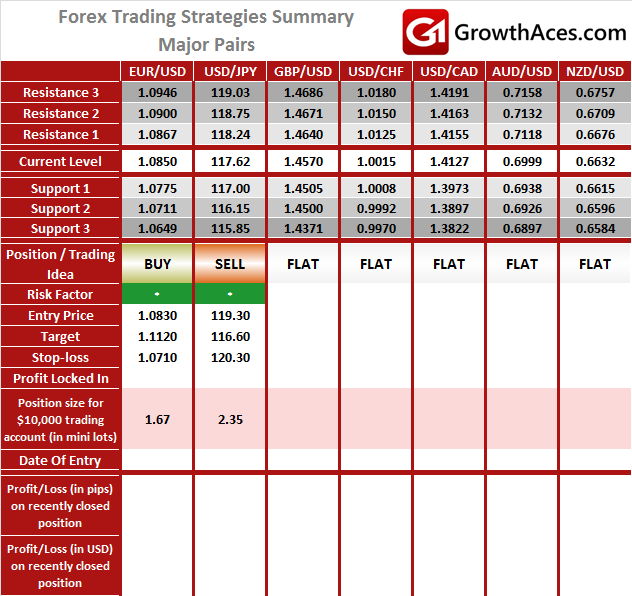

MAJOR PAIRS:

MAJOR CROSSES:

How to read these tables?

1. Support/Resistance - three closest important support/resistance levels

2. Position/Trading Idea: BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level. LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.

3. Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

4. Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

5. Position Size - position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD/USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

6. Profit/Loss on recently closed position - is the amount of pips we have earned/lost on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.