GROWTHACES.COM Forex Trading Strategies

Taken positions

USD/JPY: (Full and regular content - VIP Subscription only)

Pending Orders:

EUR/USD: (Full and regular content - VIP Subscription only)

USD/CHF: (Full and regular content - VIP Subscription only)

EUR/GBP: (Full and regular content - VIP Subscription only)

EUR/JPY: (Full and regular content - VIP Subscription only)

EUR/CAD: (Full and regular content - VIP Subscription only)

CHF/JPY: (Full and regular content - VIP Subscription only)

AUD/NZD: (Full and regular content - VIP Subscription only)

AUD/JPY: (Full and regular content - VIP Subscription only)

EUR/USD: Discussion On ECB Easing Goes On

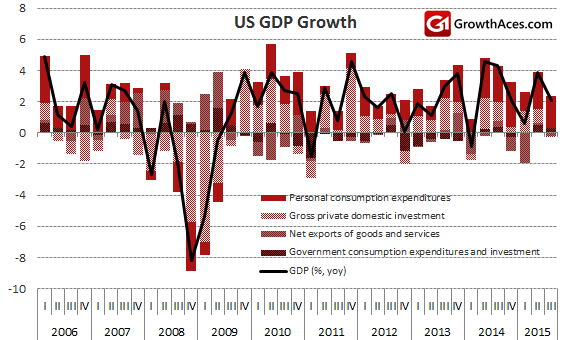

The US Commerce Department said GDP grew at a 2.1% annual pace, not the 1.5% rate it reported last month, as businesses reduced an inventory bloat less aggressively than previously believed. The pace of economic growth, which was also boosted by upward revisions to business spending on equipment, suggests a resilience that could help give the Federal Reserve confidence to raise interest rates next month.

In the third quarter, businesses accumulated USD 90.2 billion worth of inventories, instead of the USD 56.8 billion reported last month. That followed more than USD 100 billion worth of inventories accumulated in each of the prior two quarters.

As a result, the change in inventories chopped off only 0.59 percentage point from third-quarter GDP growth, rather than the 1.44 percentage points the government reported in October.

Consumer spending grew at a still strong 3.0% rate in the third quarter, down from the 3.2% rate estimated last month. A measure of private domestic demand, which excludes trade, inventories and government spending, was revised down to a still sturdy 3.1% pace from the previously 3.2% rate.

A trade deficit that was larger than previously estimated subtracted 0.22 percentage point from GDP growth in the third quarter. Yesterday’s data showing a smaller goods trade deficit suggested trade would contribute to fourth-quarter growth.

Deep spending cuts by energy firms following a collapse in oil prices continued to weigh on growth. Spending on mining exploration, wells and shafts tumbled at a 47.1%, rather than the 46.9% pace reported last month.

However, business spending on equipment was revised up to a 9.5% rate from a 5.3% pace.

Investors generally shrugged off Tuesday's data showing the US economy grew at a healthier clip in the third quarter than initially thought.

Other data on Tuesday showed consumer confidence fell further in November, hitting a 14-month low, as sentiment towards the labor market surprisingly soured. November 13 attacks in Paris and rising tensions in the Middle East may have weighed on consumer confidence.

The S&P/Case Shiller composite index of 20 US metropolitan areas gained 5.5% in September on a year-over-year basis compared with 5.1% in the year to August. It was above the market consensus of 5.1%.

Ahead of the Thanksgiving holiday on Thursday, a run of US economic data will be published later in the day, including durable goods orders, personal consumption, initial jobless claims and house prices.

Little over a week before the meeting to set the ECB's policy course, numerous alternatives are open, from snapping up the bonds of towns and regions to introducing a two-tier penalty charge on banks that park money with the ECB.

In order to soften the impact of negative deposit rate on banks, ECB officials are discussing a split-level rate, a contested step that would impose a higher charge on banks depending on the amount of cash they deposit with the ECB. Any such staggered approach would blunt a straightforward increase in the charge, which would particularly hit banks from Germany or France, who park most with the ECB. Mario Draghi must now find a compromise that will win the blessing of a majority of the 19 central bank heads around the Eurozone.

(Full and regular content - VIP Subscription only)

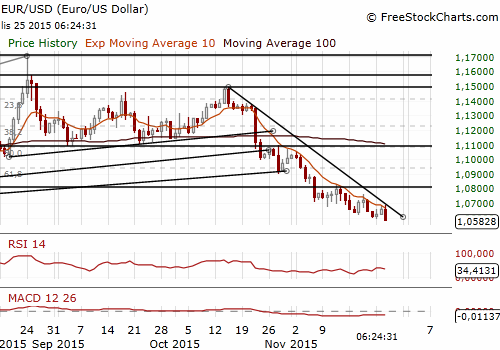

Significant technical analysis levels:

Resistance: 1.0684 (10-day ema), 1.0763 (high Nov 19), 1.0830 (high Nov 12)

Support: 1.0571 (low Apr 15), 1.0532 (low Apr 14), 1.0521 (low Apr 13)

EUR/GBP: All Eyes On Osborne Today

(Full and regular content - VIP Subscription only)

USD/CAD: CAD Supported By Geopolitical Tensions

(Full and regular content - VIP Subscription only)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.