EUR/USD: Dollar Weaker In Tepid Trading

Atlanta Fed President Dennis Lockhart said the Fed’ promise of gradual rate hikes in coming months means the central bank will not raise rates at every meeting. The more probable pace of upcoming hikes "will be more like every other meeting," Lockhart said. The Fed's policy-setting Federal Open Market Committee meets eight times a year.

Lockhart said he sees growth next year as "improved...but not jumping off the charts...I am not going to overstate the momentum of the economy but it is solid and that is the way this decision should be interpreted.”

The global economy should also help more than hurt in coming months with China's growth rate "stabilized" at between six and six-and-a-half percent and Europe likely "to improve a little," Lockhart said.

The Atlanta Fed president voted in favor of the Fed's quarter-point interest rate hike last week. He will not be a voter on the Fed's rate-setting committee in 2016.

European Central Bank policymaker Jens Weidmann said economic recovery in the Eurozone should accelerate slightly next year but not by enough to reduce unemployment. He added that Eurozone member states needed to further consolidate their budgets given their high debt levels but warned that many were failing to do so.

ECB governing council member Vitas Vasiliauskas said there is no need for further monetary stimulus from the European Central Bank as economic conditions in the euro zone are "quite good" already. He highlighted growth in lending to households and companies and a favourable EUR/USD exchange rate as two positives for the Eurozone's economic outlook.

The EUR/USD was tied down in tight range with investors increasingly confident of ruling out further big moves before the end of the year in sagging volumes of trade. We keep our EUR/USD long with the target of 1.1000.

US third-quarter GDP data revision will be released today (13:30 GMT), but we do not anticipate a stronger market impact.

AUD/USD: Help For AUD From China

The AUD and NZD were the only big movers on major currency markets today, buoyed by steadier oil prices and hopes of more official action to support growth in China.

Wrapping up a key meeting of China's Communist leadership, the government announced a series of reforms, including plans to make China's monetary policy more flexible and to expand the government's budget deficit next year. The government has been struggling to reach its economic growth target of about 7% this year, despite a raft of policy easing steps in recent months. President Xi Jinping has said China must keep annual average growth of no less than 6.5% over the next five years to hit a goal of doubling GDP and per capita income by 2020 from 2010.

Australia slashed its price forecast for the country's No. 1 export earner iron ore to USD 40.40 a tonne from USD 50 a tonne estimate in September, and warned that increased commodities production would only partly offset a collapse in prices. The government also cut its price forecasts for metallurgical coal to USD 83.80 a tonne and thermal coal to USD 59 a tonne, from USD 94.30 and USD 61 respectively in its previous forecast. Coal is Australia's second-most valuable export-earning commodity.

The latest official quarterly forecast cut the value of Australia's resources and energy exports in the 2015/16 financial year by around 6% to AUD 166 billion versus AUD 176 billion forecast in September.

Australia poured hundreds of billions of dollars into new mines and gas fields over the past decade to feed China's hunger for raw materials, but slower Chinese growth has seen unsold stocks stacking up at many of its ports and prices slumping.

Despite strong fall of iron ore price since September the AUD has slightly appreciated. This suggests that the AUD/USD bottomed out in September and the outlook for the coming months is bullish. We do not change our AUD/USD long position opened at 0.7170 with the target at 0.7350.

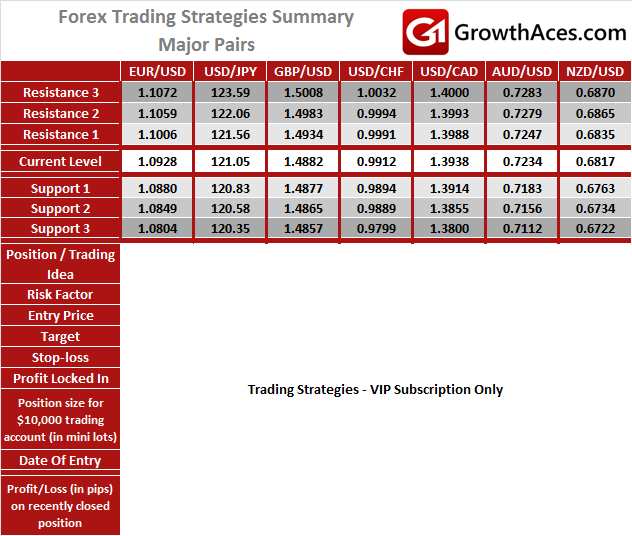

MAJOR PAIRS:

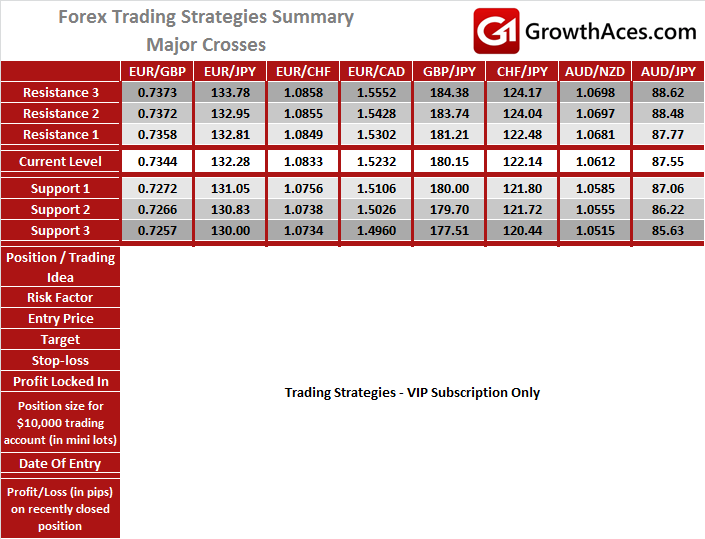

MAJOR CROSSES:

How to read these tables?

1. Support/Resistance - three closest important support/resistance levels

2. Position/Trading Idea: BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level. LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.

3. Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

4. Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

5. Position Size - position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

6. Profit/Loss on recently closed position - is the amount of pips we have earned/lost on recently closed position.

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD tests the major level of 1.0650; followed by the nine-day EMA

EUR/USD remains lackluster during the early Tuesday, hovering near 1.0650. From a technical perspective, analysis suggests a bearish sentiment for the pair as it struggles below the pullback resistance at the 1.0695 level.

GBP/USD: Flat lines around mid-1.2300s, bearish potential seems intact

GBP/USD holds steady on Tuesday amid subdued USD demand, albeit lacks bullish conviction. The divergent Fed-BoE policy expectations turn out to be a key factor acting as a headwind. The technical setup suggests that the path of least resistance for the pair is to the downside.

Gold could see a rebound before resuming the correction

Gold price sees a fresh leg down in Asia on Tuesday even as risk flows dissipate. Receding fears over Middle East escalation offset subdued US Dollar and Treasury bond yields. Gold remains heavily oversold on the 4H chart, rebound appears in the offing.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle price is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

After Monday's relief rally, attention shifts to earnings and policy fronts

With the easing of tensions in the Middle East, safe-haven demand reversed course; global stock markets experienced a modicum of relief. Indeed, in a classic relief rally fashion, Monday saw a rebound in the S&P 500, snapping a six-day losing streak.