EUR/USD: Fed Decision – The Final Countdown

Exactly seven years after slashing its target rate to the zero lower bound (a range of 0%-0.25%), the Federal Reserve will almost certainly announce a 25 bp rate hike today. This would be the first increase in the short-term interest rate in nine-and-a-half years, by far the longest period without a rate hike by the Fed to date.

A hike is widely expected and priced in by the market. That is why the main focus will be on the release the updated summary of economic projections. We do not anticipate any significant revisions to the growth or inflation forecast. And while some FOMC members may lower their jobless rate forecast a bit further, that may not be enough to affect the median either.

After more than a year of anticipation, investors are more eager to know how quickly the central bank will tighten following the initial rate adjustment. The most important thing in today’s statement will be interest rates projections (so called dot-plots). In September, the median dots for 2017 and 2018 stood at 2.625% and 3.375%, respectively. As many Fed officials have repeatedly stressed that the rate hike path will be extremely gradual, we think that the median dots for 2017 and 2018 will come down by 25bp each. The forecast for the longer-run rate will probably stay at an unchanged 3.50% for now, after having been lowered by 25bp in September. But there is also a risk that we will see also a further cut (to 3.25%) in the longer-run rate.

GrowthAces.com anticipates a “dovish hike” i.e. some cautious language that suggests the hiking path will be gradual. In such a case, we think that the USD will come under some downside pressure.

The decision will be released at 19:00 GMT. It is to be followed by a press conference by Fed Chair Janet Yellen to elaborate on the central bank's latest policy statement.

In the days to come the Fed will have to prove that a new set of tools for managing interest rates will work as expected, see how higher US rates affect domestic and global financial conditions and hope that weak world demand and commodity prices do not lead to an overall bout of deflation and force the Fed to reverse course.

The Labor Department said yesterday its so-called core CPI, which excludes food and energy, increased 0.2% last month and 2.0% yoy, the largest gain since May 2014, after rising 1.9% yoy in October. The increase in core CPI reflected steady gains in the cost of rents, airline fares, new motor vehicles and medical care. They were, however, offset by falling gasoline prices, leaving the overall CPI unchanged last month after a 0.2% mom increase in October. In the 12 months through November, the CPI increased 0.5%, the largest gain since last December, after rising 0.2% in October. The Fed targets 2% inflation.

Eurostat revised up Eurozone inflation data to 0.2% yoy in November from 0.1% yoy. HICP inflation in October amounted to 0.1% yoy.

France's ECB governing council member Francois Villeroy de Galhau said measures announced on December 3 by the European Central Bank were sufficiently accommodative and the market reaction excessive. The EUR/USD jumped as much as 3.1% and bond yields surged in response. He there was no great divergence between the monetary policies of the Eurozone and the United States.

Today’s Eurozone PMI data are overshadowed by expectations for the Fed statement. Manufacturing PMI slipped to 54.0 from November's 54.2. PMI pointed to fourth quarter economic growth of 0.4%

The USD strengthened strongly after the CPI data. In our opinion EUR/USD drop could be a good opportunity to buy the EUR/USD ahead of Fed statement, which we expect to be dovish.

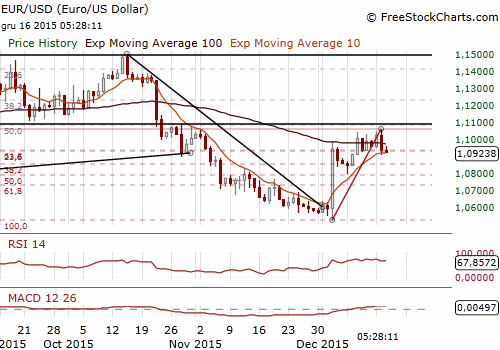

Significant technical analysis levels:

Resistance: 1.0979 (daily cloud base), 1.1060 (high Dec 15), 1.1073 (high Oct 30)

Support: 1.0905 (low Dec 15), 1.0874 (10-day ema), 1.0796 (low Dec 7)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.