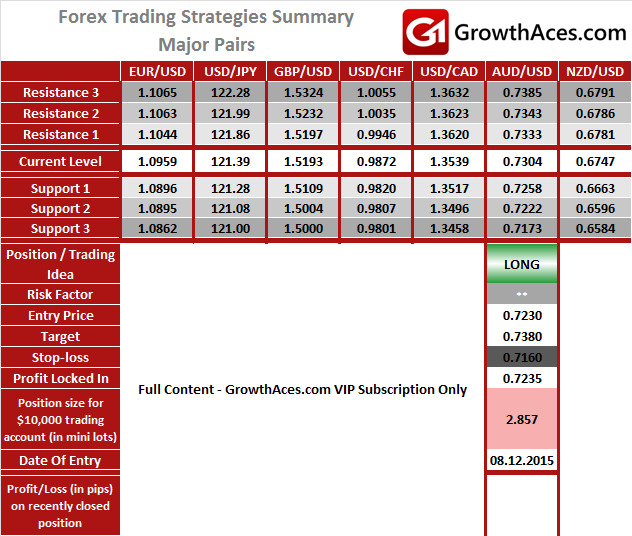

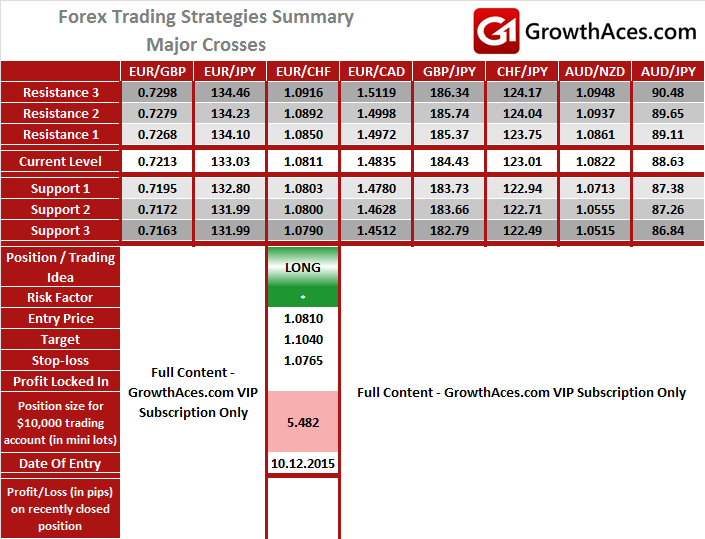

GROWTHACES.COM Forex Trading Strategies

How to read these tables?

1. If Position/Trading Idea is "LONG/SHORT" it means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.

2. Stop-Loss/Profit Locked In - If the position had been already opened and the stop-loss level had been moved above (in case of LONG) or below (in case of SHORT) the Entry price it means that we have locked in profit on this position.

3. If Position/Trading Idea is "BUY/SELL" it means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level.

4. Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

5. Position Size - position size for a $10,000 trading account in mini lots. You can calculate your position size as follows: (your account size / $10,000) * (our position size). You should always round the result down. For example, if it was 2.671, your position size should be 2 mini lots.

6. Profit/Loss is the amount of pips we have earned/lost on recently closed position.

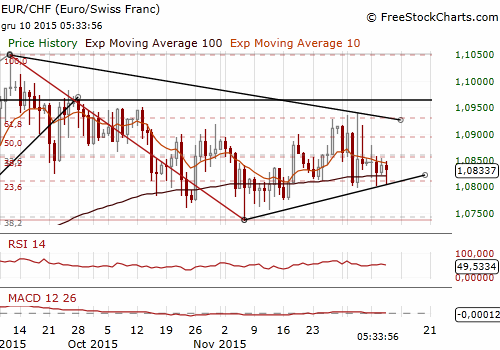

EUR/CHF: SNB Kept Rates On Hold, As Expected

As expected, Switzerland's central bank kept its target range for three-month Libor at between -1.25% and -0.25%. It also maintained a 0.75% charge on some cash deposits at the SNB. But the SNB reiterated that it remains ready to further increase its already strong policy support if developments in the franc so warrant. It stressed that “despite depreciating somewhat in recent months, the Swiss franc is still significantly overvalued.”

European Central Bank policy moves last week that disappointed market expectations for aggressive easing meant the franc has not strengthened against the euro and kept the SNB from having to cut rates further.

Negative interest rates in Switzerland and currency market interventions have helped the CHF stabilise at around 1.08 per EUR. As long as the stability on EUR/CHF is maintained it is unlikely that the SNB will want to be more active on policy. What is more, in the near term, the need for action could be limited by a slight rise in inflation related to a smaller drag from energy prices and a begin of Fed tightening cycle.

The CHF rose slightly against the EUR in the immediate aftermath of the policy decision. But the EUR/CHF did not manage to break below 1.08. In our opinion current EUR/CHF level could be a good opportunity to get long on this pair. We have opened our EUR/CHF long at 1.0810.

Significant technical analysis levels:

Resistance: 1.0850 (daily cloud base), 1.0892 (daily cloud top), 1.0916 (high Dec 4)

Support: 1.0803 (session low Dec 10), 1.0800 (low Dec 3), 1.0790 (low Nov 18)

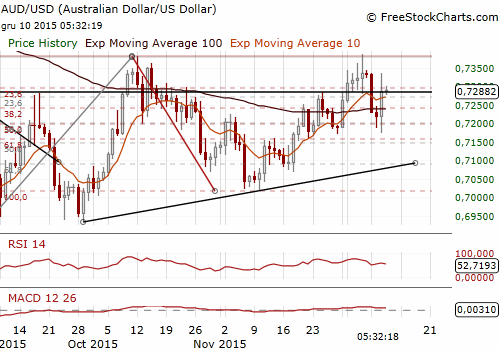

AUD/USD: AUD Positions In Good Shape After Strong Jobs Report

The Australian Bureau of Statistics reported a staggering 71.4k net new jobs were created in November, confounding market forecasts for a drop of 10k. It was the second straight month of huge gains with October enjoying a rise of 56.1k. Taken together that was the strongest two-month total in 28 years.

The surprises kept coming as the jobless rate dipped to 5.8%, when market had looked for a rise to 6.0%, and the participation rate jumped to its highest since 2012 at 65.3%.

Leading indicators of labour demand including vacancies and business surveys, have been pointing to a pick up, just not as exuberant as the jobs report suggests. While miners have been retrenching, the sector at its peak only ever accounted for around 2% of all jobs. Instead, service sector employment has been expanding by almost 250k a year, led by healthcare, professional and technology services, accommodation, recreation, and transport.

The Australian Bureau of Statistics has had trouble with its jobs survey in the past that resulted in large revisions in both directions. The agency noted that the new entrants in its survey sample in both October and November had higher employment and participation rates than the average, which may wash out in the December sample.

Interbank futures now imply around a one-in-three chance of a cut next year, down from two-in-three previously.

Strong jobs report was good news for our long AUD/USD position. The AUD/USD jumped to 0.7333 just after the data and the AUD/JPY broke above 89.00, which means that our long AUD/JPY position taken at 87.70 is in good shape now. In our opinion the outlook remains bullish and we do not change our positions.

Significant technical analysis levels:

Resistance: 0.7333 (session high Dec 10), 0.7343 (high Dec 7), 0.7385 (high Dec 4)

Support: 0.7258 (10-day ema), 0.7222 (session low Dec 10), 0.7173 (low Dec 9)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'