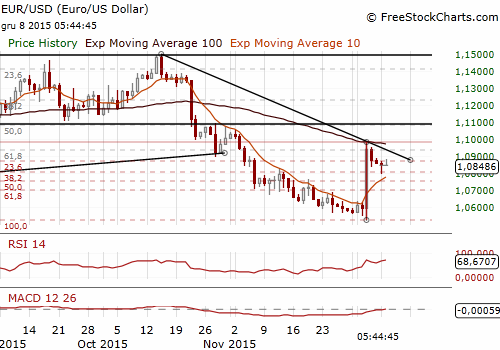

EUR/USD: Eurozone GDP In Line With Expectations

Eurostat confirmed that economic growth in the Eurozone was 0.3% qoq in the July-September period and 1.6% yoy, as estimated earlier and expected by markets.

Household consumption added 0.2 percentage points to the final outcome in the third quarter and inventories another 0.2 points. Government spending also helped with 0.1 point, but foreign trade subtracted 0.3 points as imports rose by much more than exports.

The EUR/USD is likely to unwind last week's rally. The last short-squeeze of similar magnitude occurred in August. Although EUR/USD shorts were smaller then, USD longs were similar in size as seen before last week's ECB. The China-led rout of stock markets spurred the Aug unwind. Presumably, profitable USD longs were cut to cover equity losses. Last week, EUR shorts were pared on ECB easing disappointment. In both cases, the core reason to be short EUR/USD remained. US/EZ yield spreads may have narrowed but still strongly suggest EUR/USD heads south. In August, the EUR/USD rallied almost 7% in a week yet gave back those gains over a similar period. But with fundamentals backing the bear camp in the short term, a slow drift back down could well see EUR/USD pushing recent lows before the Fed pulls the trigger.

We have changed our strategy and placed a sell EUR/USD order at 1.0880 with the target at 1.0760. But we will probably shift this strategy to long just before the Fed meeting next week, as we expect dovish FOMC statement.

Although we expect the EUR/USD to fall in the coming days, the medium-term EUR/USD is slightly bullish now.

Significant technical analysis levels:

Resistance: 1.0887 (high Dec 7), 1.0956 (high Dec 4), 1.0981 (high Dec 3, Nov 4)

Support: 1.0796 (low Dec 7), 1.0764 (10-day ema), 1.0523 (low Dec 3)

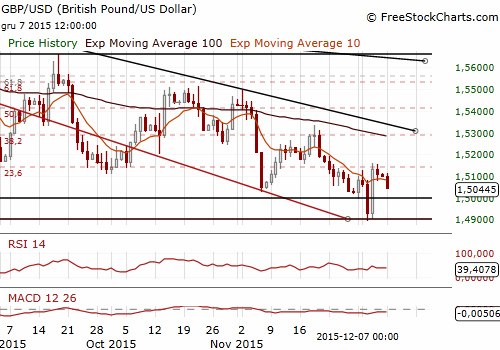

GBP/USD: Will BoE Be More Hawkish On Thursday?

British manufacturing output fell 0.4% on the month in October, against expectations for it to stagnate and compared to a 0.9% increase in September. Industrial output increased 0.1% on the month as expected, while on the year it was up 1.7% for a 1.2% upswing. The Office for National Statistics said other manufacturing and repair. notably the repair of aircrafts, was the biggest downward driver on industrial production in October.

The Monetary Policy Committee is expected to leave borrowing costs unchanged at 0.5% on Thursday. In our opinion current BoE dovishness is ultimately directed at preventing a weakening in EUR/GBP if EUR/USD moves lower on the back of new ECB stimulus measures. The central bank may fear that a further strengthening of sterling against the euro would increase headwinds that have been weighing on the UK manufacturing sector, in particular. These concerns should fade as the reaction to recent ECB action shows that bearish EUR/USD trend is probably over. There is a chance the Bank of England's meeting minutes on Thursday would take a slightly more hawkish tack than its recent rhetoric.

The BoE's governor Mark Carney said yesterday that the bank was monitoring real estate investment trusts as a sharp rise in British commercial property prices raises concerns about financial stability.

The US Federal Reserve will raise rates next week. Even if money markets have pushed expectations for a first rise in UK interest rates far out into next year, the BoE is still seen as the most likely to follow in the footsteps of the Fed. This should support the GBP in the coming weeks.

We have placed our GBP/USD bid at 1.4880. If the order is filled the target will be near recent highs, at 1.5150.

Significant technical analysis levels:

Resistance: 1.5073 (10-day ema), 1.5115 (high Dec 7), 1.5155 (high Dec 4)

Support: 1.4903 (low Dec 3), 1.4897 (low Dec 2), 1.4857 (low Apr 21)

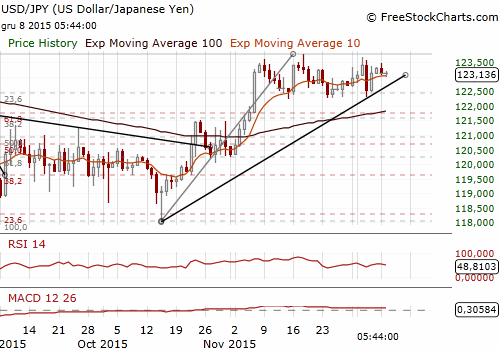

USD/JPY: Strong GDP Data In Japan

Japan's economy avoided recession in the third quarter with the initial estimate of a contraction revised to an annualised expansion of 1.0%. The revision to 1.0% growth from the preliminary estimate of a 0.8% fall considerably exceeded the median market forecast for 0.1% growth.

Capital expenditure was revised up to a 0.6% gain in July-September from a initially estimated 1.3% fall. The upgrade was amplified by a slower-than-expected fall in inventory, which works to push up growth but suggests that companies are struggling to sell goods in the face of weak demand. Private consumption, which accounts for 60% of Japan's GDP, added 0.4% from the previous quarter, following a preliminary reading of a 0.5% increase.

Exports were upwardly revised from a preliminary reading of 2.6% to 2.7%, while imports remained unchanged at an increase of 1.7%.

And while the latest data shows that businesses have been spending after all, the Finance Ministry along with the central bank will be eager to ensure that big businesses here, who netted record profits in the recording period, go on to not just invest, but to pass on their profits to their employees and raise wages, and, further augment their capital expenditure, to ensure the economy stays on a moderate recovery path.

The data may ease pessimism over the outlook and allow the Bank of Japan to hold off on additional easing even as inflation slides further away from its 2% target. BoJ Governor Haruhiko Kuroda said today that Japan’s price trend was clearly improving. Ha added the central bank would adjust monetary policy without hesitation if needed.

Japan's Economics Minister Akira Amari has said that third-quarter GDP was a sign companies were gradually starting to implement their bullish capital expenditure plans. But he said meeting the government's estimate of 1.5% economic growth in the current fiscal year to March 2016 remained "quite ambitious" even with the revised July-September GDP figures.

Japan’s current account surplus stood at JPY 1.46 trillion in October, up from a JPY 846.4 billion surplus in October last year.

The USD/JPY is falling after surprisingly good Japan’s GDP data. However, this fall may not last long because the market is preparing for Fed rate hike next week. We think the USD/JPY may go up slightly in the coming days. We have changed our trading strategy to buy at 122.50.

But in our opinion the medium-term USD/JPY outlook is bearish. We think that it could be a good idea to switch the position to short just before the Fed meeting next week, as we expect dovish FOMC statement that may disappoint USD bulls.

Significant technical analysis levels:

Resistance: 123.56 (high Dec 3), 123.68 (high Dec 2), 123.77 (high Nov 18)

Support: 122.48 (low Dec 4), 122.30 (low Dec 3), 122.26 (low Nov 25)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.