Taken positions

AUD/NZD: long at 1.0950, target 1.1300, stop-loss 1.0830, risk factor **

AUD/JPY: long at 88.30, target 91.00, profit locked in at 88.60, risk factor **

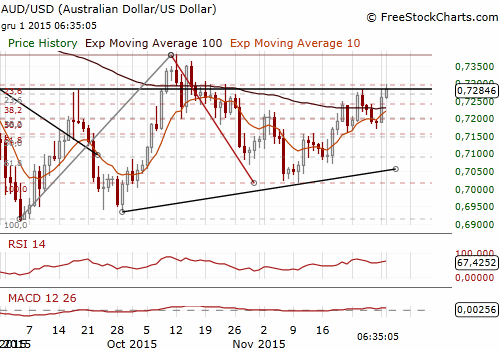

AUD/USD: RBA On Hold, As Expected

(stay sideways)

Australia's central bank kept interest rates steady for a seventh month today, as expected.

RBA Governor Glenn Stevens said: “The Board again judged that the prospects for an improvement in economic conditions had firmed a little over recent months and that leaving the cash rate unchanged was appropriate.” He added that while the local economy is suffering from lower priced commodities, falling terms of trade and low capital investment, the economy is slowly transitioning to non-mining-led growth.

Policymakers have been encouraged by signs of recovery ranging from strong employment to better business sentiment and a big boost to tourism from a low local dollar.

Data due on Wednesday (0:30 GMT) should show the economy regained some momentum in the third quarter after a lacklustre second quarter. Net exports alone likely added an eye-popping 1.5 percentage points to growth - their biggest contribution since early 2009 - as export volumes jumped 5% while imports fell 2%. The contribution from trade helped offset a drag from government investment which dropped over 9% in the third quarter from the previous three months, partly due to a fall in defence spending.

After strong trade data we have raised our third-quarter GDP forecast to 0.8% qoq, above the market consensus of 0.7% qoq.

Supporting activity has been a boom in home building which looks to have some time to run yet. Approvals to build new homes surprised by rising 3.9% October, with approvals for multi-unit blocks were up almost 30% on a year ago.

Interbank futures still imply around a 50-50 chance of an easing next year, with the RBA's next meeting in early February. In our opinion the likelihood of another rate cut is very low. We assume that the next interest rate change in Australia will be a hike.

The RBA decision supported the AUD. We keep our constructive view on the AUD. We have locked in profit on our AUD/JPY long at 88.60. We have used today’s fall in the AUD/USD to open long position at 1.0950. But we stay sideways on the AUD/USD because of broad USD strength.

Significant technical analysis levels:

Resistance: 0.7307 (high Oct 19), 0.7337 (high Oct 16), 0.7363 (high Oct 15)

Support: 0.7223 (low Dec 1), 0.7171 (low Nov 30), 0.7160 (low Nov 23)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0650 after PMI-inspired rebound

EUR/USD loses traction and retreats to the 1.0650 area after rising toward 1.0700 with the immediate reaction to the upbeat PMI reports from the Eurozone and Germany. The cautious market stance helps the USD hold its ground ahead of US PMI data.

GBP/USD fluctuates near 1.2350 after UK PMIs

GBP/USD clings to small daily gains near 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling stay resilient against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.