GROWTHACES.COM Forex Trading Strategies

Taken Positions:

EUR/GBP: short at 0.7075, target 0.6950, profit locked in at 0.7035, risk factor ***

EUR/CAD: short at 1.4320, target 1.3950, profit locked in at 1.4265, risk factor **

More strategies - GrowthAces.com VIP subscription only

EUR/USD Recovery Is Likely To Be Limited, Eyes On FOMC Minutes

The Federal Reserve reported that industrial production slipped 0.2% m/m in October, a disappointing move compared to the consensus call of 0.1% growth. Factory output, however, was up a respectable 0.4% vs. expected up just 0.2%, with mild weather pulling utility output down 2.5% and ongoing energy weakness leading to a 1.5% drop in mining output.

A rise in manufacturing output is a surprisingly good reading given how weak the factory surveys have been recently. All five regional Fed surveys were negative in both September and October, and the ISM national PMI eked out prints of just 50.2 and 50.1. Respondents to some surveys have continued to complain about the stronger USD, as they have nearly all year, while high levels of inventories throughout the supply chain have conspired to keep orders down.

Capacity utilization slipped again, to 77.5% from 77.7% (revised up from 77.5%). That's its lowest in 20 months, certainly providing no sign of supply-side inflation pressure.

Despite the decent manufacturing number this month, we do not expect great improvement there in the near future. The headwinds remain, with unplanned inventory accumulation having built up a very large overhang - September's 1.377 inventories / sales ratio was the highest since the end of the recession. Meanwhile, manufacturers are still having a hard time adapting to the currency environment.

In the 12 months through October US consumer price index advanced 0.2% after being unchanged in September. The market expected CPI edging up 0.1% from a year ago. Signs of stabilization in prices after a recent downward spiral is likely to be welcomed by Fed officials and give them some confidence that inflation will gradually move toward the central bank's 2.0% target.

The so-called core CPI, which strips out food and energy costs, increased 1.9% yoy after rising by the same margin in September.

(EUR/USD trading strategies - GrowthAces.com VIP subscription only)

Significant technical analysis' levels:

Resistance: 1.0692 (session high Nov 18), 1.0759 (10-day ema), 1.0778 (high Nov 16)

Support: 1.0630 (low Nov 17), 1.0624 (low Apr 16), 1.0571 (low Apr 15)

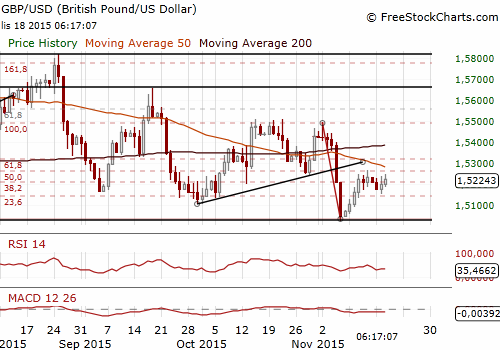

GBP/USD: Broadbent Downplayed BoE Forecasts

Bank of England Deputy Governor Ben Broadbent said that pricing in financial markets for when Britain's record-low interest rates are likely to rise could be misleading and risked changing quickly. He also cautioned investors not to “focus obsessively” on the BoE's inflation forecasts and instead to concentrate on the broader factors driving growth. Broadbent said the Bank's inflation forecasts were a far from perfect indicator of what was likely to happen with borrowing costs.

Business surveys measuring private-sector growth had in the past offered a better guide to how the Bank's rate-setters would vote over the following three months than looking at how far the BoE forecast inflation would miss its target, he said.

Broadbent said markets appeared to push expectations for the timing of rate hikes much further back than economists at times of risk aversion among investors, such as now as concerns mount about the global economy. Yield curves factored in risks, such as the desire of investors to insure against an unexpected global slump, that did not directly feed into when the BoE was most likely to start to raise rates.

Our economists expect a rate hike in the second quarter of 2016. But markets are only fully pricing in a 25 basis point increase in early 2017.

Ben Broadbent said Britain's large current account deficit is of some concern, although he would be surprised if it were to affect the central bank's policy decisions. He also said he thought the current account deficit was more likely to improve than worsen, and added that he saw no virtue in moving interest rates in increments of less than 25 basis points.

(GBP/USD trading strategies - GrowthAces.com VIP subscription only)

Significant technical analysis' levels:

Resistance: 1.5263 (high Nov 13), 1.5318 (61.8% of 1.5498-1.5027), 1.5401 (high Nov 5)

Support: 1.5155 (low Nov 17), 1.5149 (50% of 1.5027-1.5270), 1.5120 (61.8% of 1.5027-1.5270)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.