GROWTHACES.COM Forex Trading Strategies

Taken Positions:

USD/JPY: (Full Access - VIP Subscription Only)

USD/CHF: (Full Access - VIP Subscription Only)

EUR/GBP: (Full Access - VIP Subscription Only)

EUR/JPY: (Full Access - VIP Subscription Only)

EUR/CAD: (Full Access - VIP Subscription Only)

Pending Orders:

USD/CAD: (Full Access - VIP Subscription Only)

AUD/USD: (Full Access - VIP Subscription Only)

NZD/USD: (Full Access - VIP Subscription Only)

CHF/JPY: (Full Access - VIP Subscription Only)

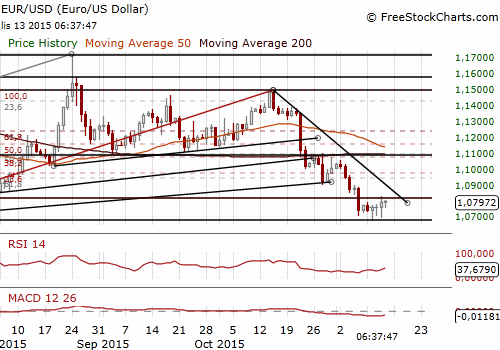

EUR/USD: Fed Hike In December But What’s Next?

(stay sideways)

We had a series of opinions from the Fed policymakers yesterday. They confirmed that a hike in December is a done deal, but suggested gradual hiking path next year.

Fed Vice Chairman Stanley Fischer said US inflation should rebound next year as pressures related to the strong USD and low energy prices fade. He expects the central bank's preferred measure to rebound to 1.5% next year and to hit a 2% goal in the “medium term.”

New York Fed President William Dudleysaid after progress made by the Fed in keeping inflation expectations near 2% the risk of waiting too long to tighten monetary policy could lead to those expectations becoming “unanchored to the upside.” He said international economic outlook absolutely should be considered in terms of how it weighs on the US economy. He added the international outlook seemed less problematic than it did just a few months ago.

Richmond Federal Reserve President Jeffrey Lacker, who has twice voted this year to raise rates when the rest of his Fed policymaker colleagues decided to stay put, said that the expected rate of monetary tightening after an initial rate hike was likely to be gradual. He also reiterated his view that the Fed should begin winding down its balance sheet as soon as possible after it begins to raise rates.

St. Louis Federal Reserve President James Bullard said that a pace of rate hikes would depend on how the economy performs and could be faster than expected “if the economy booms.”

In the opinion of Chicago Fed President Charles Evansthe Fed will have a lot to assess after it raises interest rates, especially since tighter monetary policy will make it even harder to reach the Fed's 2% inflation. It could take six months, he suggested, for the Fed to really be able to measure the effects of its first rate hike on inflation.

Federal Reserve Chair Janet Yellen is stressing the need to review the unconventional monetary policies that central banks around the world deployed in response to the 2008 global financial crisis. In her brief remarks, Yellen did not address current economic conditions or future policy moves by the Fed.

The EUR/USD has fallen sharply recently on expectations that the Federal Reserve may raise interest rates next month, weeks after the European Central Bank adds to its already unprecedented monetary stimulus. European Central Bank governing council member Jens Weidmann said the Eurozone did not face the imminent threat of falling into deflation. He said that currently low euro zone inflation, which is fuelling market expectations that the ECB will step up its unconventional monetary stimulus at a meeting next month, was caused primarily by low energy prices, rather than by weak economic demand of the sort that can trigger deflation. He added that diverging paths of monetary policy in the Eurozone and the United States would likely drive exchange rate fluctuations.

Eurostat showed today that Eurozone GDP expanded only 0.3% qoq for a 1.6% yoy increase in the third quarter. The market expected a 0.4% quarterly rise and a 1.7% annual rise. The Eurozone's two biggest economies, Germany and France, both grew in line with expectations at 0.3% on a quarterly basis. But the third biggest Italy, with 0.2% quarterly growth, fell short of expectations of a 0.3% expansion and the Netherlands grew only 0.1% against expectations of 0.3%.

Despite weaker-than-expected GDP data the EUR/USD rebounded from a yesterday’s low of 1.0691. We have closed our EUR/USD short position at 1.0760. In our opinion no position is justified from the risk/reward perspective now, especially that we are still USD/CHF long, which is highly correlated with the EUR/USD.

US retail sales data (13:30 GMT) will be the most important event today. The data will not change the Fed plans to hike in December, but there is a risk of weaker USD in case of lower-than-expected reading.

Significant technical analysis' levels:

Resistance: 1.0816 (session high Nov 13), 1.0828 (high Nov 12), 1.0831 (10-day ema)

Support: 1.0691 (low Nov 12), 1.0674 (low Nov 10), 1.0666 (low Apr 23)

GBP/USD: BoE Haldane’s Comments Weigh On Sterling

(Full Access - VIP Subscription Only)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.