GROWTHACES.COM Forex Trading Strategies

Taken Positions:

USD/JPY: (Full Access - VIP Subscription Only)

GBP/USD: (Full Access - VIP Subscription Only)

USD/CHF: (Full Access - VIP Subscription Only)

USD/CAD: short at 1.3305, target 1.3120, stop-loss 1.3325, risk factor **

AUD/USD: (Full Access - VIP Subscription Only)

NZD/USD: (Full Access - VIP Subscription Only)

Pending Orders:

EUR/USD: (Full Access - VIP Subscription Only)

EUR/CAD: (Full Access - VIP Subscription Only)

EUR/JPY: (Full Access - VIP Subscription Only)

CHF/JPY: sell at 123.70, target 120.20, stop-loss 124.70, risk factor **

AUD/NZD: (Full Access - VIP Subscription Only)

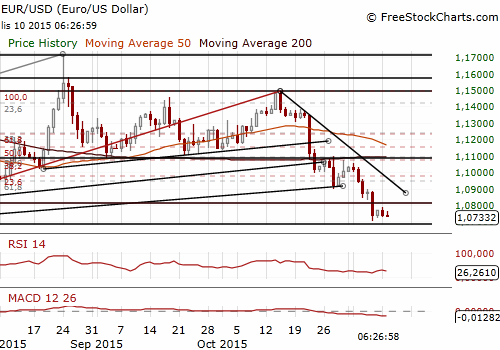

EUR/USD Recovery Short-Lived, ECB Will Cut In December

The ECB last month raised the prospect of more monetary easing at its December 3 meeting to combat ultra-low inflation, which is at risk of undershooting the target of nearly 2% as far ahead as 2017 due to low commodity prices and weak growth.

A rate cut aims to discourage banks from parking money at the central bank and start lending to generate growth. It can also weaken the currency as cash leaves the Eurozone in search of higher returns, boosting inflation as imports become more expensive.

The ECB cut its deposit rate to -0.2% in September 2014 and said it could not go any lower. However, other central banks have cut further, including the Swiss and Danish central banks to -0.75%, showing that deeper cuts are possible.

The debate is now about the size of the rate cut. The market expects a reduction by 10 basis points. However, the ECB used to deliver policy moves in excess of market expectations. For a largely bank based credit creation system in the Eurozone, it makes sense to focus on putting the liquidity to work as opposed to creating more excess liquidity.

The risk in the cut is a squeeze on margins in the banking sector, already under pressure, and it is not clear that banks would boost lending to avoid the punitive rate for parking money with the central bank. Further complicating the matter is the ECB's earlier communication that the deposit rate was at lower bound so a cut would break the guidance putting some pressure on the bank's credibility.

Although several Governing Council members have been critical of further policy easing, Germany's Bundesbank, a big initial opponent of quantitative easing, has been relatively quiet since the last ECB meeting. We should notice that a lower exchange rate supports German economy and probably that is why the Bundesbank is silent.

Traders will eye comments from Bundesbank chief Jens Weidmann, one of hawks on the ECB governing council, as he speaks for the first time since the central bank hinted at more policy easing.

European Central Bank's governing council member Erkki Liikanen, one of the most hawkish members, said the Eurozone inflation and growth prospects are facing downside risks, adding the ECB is “willing and able” to act to achieve its price growth target. His comments suggest a deposit rate cut is very likely.

An aggressive deposit rate cut in December by the ECB at a time when the Fed is expected to start its own normalisation process should help to maintain a sell on rallies stance on the EUR/USD.

Eric Rosengren, the dovish president of the Boston Fed, said the "very high" USD gives the Federal Reserve more impetus to raise interest rates only gradually. In his opinion the USD strength has been a problem for manufacturers looking to export overseas. But he said domestic demand should help offset strength in the USD and weakness among US trading partners, two factors that have kept inflation below the Fed's 2% target.

We closed our EUR/USD long at the entry level of 1.0730, as the recovery was weak and short-lived and this would be too risky now to stay long or get long again. (Full Access - VIP Subscription Only)

Significant technical analysis' levels:

Resistance: 1.0880 (10-day ema), 1.0894 (high Nov 6), 1.0898 (high Nov 5)

Support: 1.0705 (low Nov 6), 1.0666 (low Apr 23), 1.0660 (low Apr 21)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.