GROWTHACES.COM Forex Trading Strategies

Taken Positions:

EUR/CHF: (Full Access - VIP Subscription Only)

Pending Orders:

EUR/USD: (Full Access - VIP Subscription Only)

USD/JPY: (Full Access - VIP Subscription Only)

EUR/GBP: sell at 0.7140, target 0.6950, stop-loss 0.7190, risk factor **

EUR/CAD: (Full Access - VIP Subscription Only)

GBP/JPY: buy at 186.20, target 188.60, stop-loss 185.20, risk factor **

CHF/JPY: (Full Access - VIP Subscription Only)

AUD/NZD: (Full Access - VIP Subscription Only)

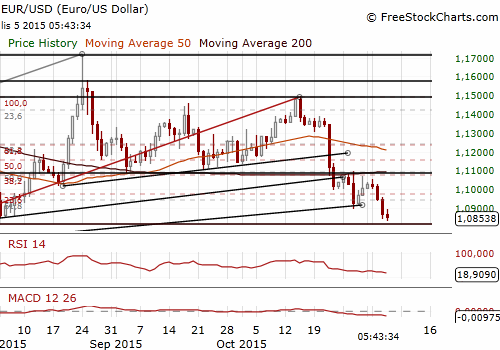

EUR/USD: Market Expectations For Fed Hike Are Converging To Our Forecast

Federal Reserve Chair Janet Yellen in her first public comments since the Fed's meeting last week Yellen laid out what now appears the base case at the Fed - that low unemployment, continued growth and faith in a coming return of inflation means the country is ready for higher interest rates. She said: “What the committee has been expecting is that the economy will continue to grow at a pace that is sufficient to generate further improvements in the labor market and to return inflation to our 2% target over the medium term.”

Moving sooner rather than later to begin tightening policy, Yellen said, would allow the Fed to take a gradual approach to further hikes, slow enough to ensure that housing and other key markets are not disrupted by rising rates.

Her remarks caused investors to reset their expectations of a December rate hike above 60%, a sign that markets are finally taking the Fed's language seriously after a period in which US central bankers were frustrated by the gap between their own outlook and market bets about their likely course of action.

William Dudley, the influential president of the New York Fed and a permanent voter on policy, said that he would "completely agree" with Yellen. He said December "is a live possibility, but we will see what the data shows.”

Fed governor Lael Brainard said: “The improvement in the labor market has been extremely steady (…) There are certain aspects of the US outlook that are encouraging.” Brainard emphasized that the Fed has not yet made a decision, and that incoming economic data would have to meet the central bank's expectations of how the economy is performing.

In the opinion of Fed Vice Chairman Stanley Fischer the Fed may quickly meet its 2% inflation target once the price of oil stabilizes and the dollar stops rising. Fischer said despite a low headline inflation rate, the central bank may be closer than thought to its target. On the other hand, Fischer acknowledged some of the forces holding down US inflation could be tough to reverse. He particularly noted that lending and investment remained at less-than-expected levels, with banks and companies still cautious after the shock of the 2007 to 2009 financial crisis and recession.

US ISM non-manufacturing index rose to 59.1 last month from 56.9 in September. The reading came well above the market forecast of 56.5.

The Commerce Department said the trade gap fell 15% to USD 40.8 billion, the smallest deficit since February. The drop in the trade deficit reversed the widening seen in August, though the prior month's figure was revised slightly down to USD 48 billion from the previously reported UD 48.3 billion.

Exports in September rose 1.6%. There were increases in exports of capital goods and automobiles. Exports of industrial supplies and materials, however, were the lowest since October 2010. Imports fell 1.8%. Imports of industrial supplies and materials fell to the lowest level since August 2009. Petroleum imports were the lowest since May 2004, reflecting increased domestic energy production and lower oil prices.

Trade had a neutral impact on gross domestic product for the third quarter, which expanded at a 1.5% annual rate. The sharp step-down in growth from the second quarter's brisk 3.9% rate mainly reflected a slow pace of inventory accumulation and ongoing spending cuts by energy firms.

The ADP National Employment Report showed US private employers added 182k jobs in October, a tick above market expectations of 180k. Private payroll gains in September were revised down to 190k from an originally reported 200k increase. The ADP figures come ahead of the US Labor Department's more comprehensive non-farm payrolls report on Friday, which includes both public and private-sector employment. Our forecast for non-farm payrolls is slightly above the market consensus.

Eurozone retail sales dropped 0.1% mom and rose 2.9% yoy in September vs. market forecast for a rise by 0.2% mom and 3.0% yoy. In August, sales were unchanged month-on-month and up a revised 2.2% yoy.

Yesterday’s comments from Yellen strengthened our view that the Fed will hike rates in December. Investors are waiting for Friday’s non-farm payrolls data. In our opinion even weaker-than-expected reading will not stop Fed policymakers.

The EUR/USD may be under pressure in the coming weeks and we are looking to use upticks to get short. The nearest bears’ target is 1.0810, but even deeper move is likely later this month.

The strategy of selling the EUR/USD could be justified for a few weeks. The EUR/USD may recover not sooner than in the second half of December after the Fed decision. In our opinion the statement after the Fed decision in December may be relatively dovish, as the Fed would like to take a gradual approach to further hikes. This could be a surprise for the market, as hawkish Fed may fuel market expectations for consectutive hikes in the near term.

Significant technical analysis' levels:

Resistance: 1.0973 (10-dma), 1.1073 (high Oct 30), 1.1097 (high Oct 28)

Support: 1.0834 (hourly low Nov 5), 1.0808 (low Jul 20), 1.0785 (low Apr 24)

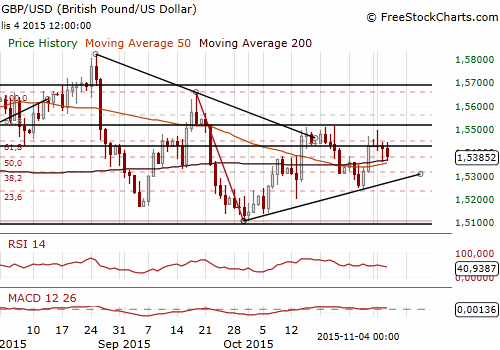

GBP/USD: The Sooner Fed Hikes The Sooner BOE Will Follow

(stay sideways)

Today the Bank of England publishes its quarterly Inflation Report alongside its policy decision and the minutes of its meeting (at 12:00 GMT). We expect no change in the Bank Rate, with Ian McCafferty remaining isolated in his call for a 25 bp increase.

However, after recent good data from the UK and hawkish shift by the Fed there is a risk that one or two members (Martin Weale and/or Kristin Forbes) join McCafferty in voting for an immediate rate increase. Even without any further dissent, the inflation report will probably be “less dovish” than the market expects, as the stimulus from the lower yield curve is likely to more than offset the downside news from China and other emerging markets.

Nevertheless, we can expect some downward revision to the near-term growth and inflation forecasts. Those downward revisions to near-term growth and inflation are pretty mechanical. Rather, the focus of attention will be on revisions to the policy-relevant 2-3 year horizon, and here we expect the risks to be skewed to the upside. That’s largely because of the stimulus from the lower yield curve, as well as gradually firming wage growth as the labor market tightens.

Financial markets have pushed out their expectation for the first rate hike to the first quarter of 2017, around 10 months later than was priced in only three months ago. In our opinion financial markets have gone too far in pushing rate hikes out further into the future. We expect the Fed to hike rates in December and the BoE to follow not too long after, at the beginning of next year. We expect market expectations to converge to our forecast soon, which should support the GBP.

We stay sideways on the GBP/USD after taking profit on our long position yesterday, but we expect the GBP to strengthen against other major currencies. We will be looking to use any dovish surprises in today’s BoE releases to get long on the GBP/JPY and to get short on the EUR/GBP.

Significant technical analysis' levels:

Resistance: 1.5446 (high Nov 4), 1.5498 (high Nov 2), 1.5510 (high Oct 22)

Support: 1.5359 (low Nov 3), 1.5358 (10-dma), 1.5308 (low Oct 30)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.