GROWTHACES.COM Forex Trading Strategies

Taken Positions:

GBP/USD: (Full Access - VIP Subscription Only)

USD/CHF: (Full Access - VIP Subscription Only)

USD/CAD: short at 1.3195, target 1.2850, profit locked in at 1.3120, risk factor **

AUD/USD: long at 0.7105, target 0.7300, profit locked in at 0.7145, risk factor **

Pending Orders:

EUR/USD: (Full Access - VIP Subscription Only)

NZD/USD: (Full Access - VIP Subscription Only)

EUR/GBP: (Full Access - VIP Subscription Only)

EUR/CHF: (Full Access - VIP Subscription Only)

EUR/CAD: (Full Access - VIP Subscription Only)

CHF/JPY: (Full Access - VIP Subscription Only)

AUD/NZD: buy at 1.0690, target 1.0990, stop-loss 1.0570, risk factor **

AUD/JPY: buy at 86.00, target 88.00, stop-loss 85.00, risk factor ***

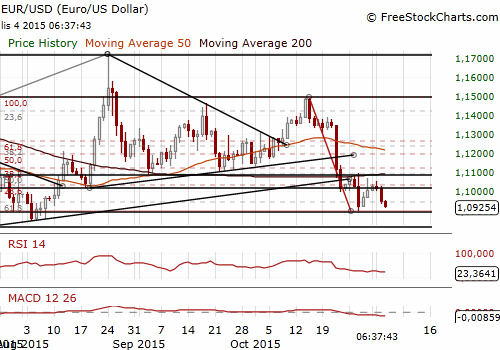

EUR/USD: Draghi Sticks To His Target Of Weaker EUR

European Central Bank’s President Mario Draghi said: “Even though domestic demand remains resilient, concerns over growth prospects in emerging markets and other external factors are creating downside risks to the outlook for growth and inflation.” He reiterated that the degree of monetary policy accommodation would need to be re-examined at the Governing Council's December meeting. He said: “The Governing Council is willing and able to act by using all the instruments available within its mandate if warranted in order to maintain an appropriate degree of monetary accommodation.”

We see that Draghi’s target is a weaker EURand he will do anything to get the EUR lower. Weaker EUR was the target of his dovish statement on October 22, when he goaded markets into pricing in easing expectations for December 3. Over the past week or so we have highlighted several key ECB board members that were all quoted well after the October 22 ECB saying much more data would need to be seen before deciding on any extensions to ECB QE or further negative rates. Comments from other ECB policymakers suggest that we may be quite far from additional easing. However, Mario Draghi has not changed his rhetoric despite hawkish shift by the Fed. He is still playing a dangerous game in terms of credibility with the markets.

Final October Eurozone composite PMI came in at 53.9, weaker than an earlier estimate of 54.0 but above September's four-month low of 53.6. The survey suggests that the Eurozone quarterly growth rate remains constrained at around 0.4%.

The Commerce Department said yesterday US new orders for manufactured goods declined 1.0% mom after a downwardly revised 2.1% mom drop in August. The manufacturing sector continues to struggle under the weight of a strong USD and deep spending cuts by energy companies. Factory activity is also being constrained by efforts by businesses to reduce an inventory overhang and tepid global demand. But the worst could be over for the sector after a report on Monday showed new orders rose in October for the first time since July.

The Commerce Department also said orders for non-defense capital goods excluding aircraft, seen as a measure of business confidence and spending plans, slipped 0.1% instead of the 0.3% drop reported last month. This also supports the view that the worst of the manufacturing slump might be over. Shipments of these so-called core capital goods, which are used to calculate business equipment spending in the gross domestic product report, increased 0.5% mom in September as reported last month. Inventories of factory goods fell 0.4% mom after a similar drop in August, also an encouraging sign for the sector. That left the inventories-to-shipments ratio unchanged at a still lofty 1.35.

The ADP employment report today (13:15 GMT) will be closely watched ahead of Friday's nonfarm payrolls for clues on whether the US is ready for its first hike in nearly a decade.

(Full Access - VIP Subscription Only)

Significant technical analysis' levels:

Resistance: 1.1006 (10-dma), 1.1073 (high Oct 30), 1.1097 (high Oct 28)

Support: 1.0896 (low Oct 28), 1.0855 (low Aug 7), 1.0847 (low Aug 5)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.