GROWTHACES.COM Forex Trading Strategies

Pending Orders:

EUR/USD: buy at 1.0950, target 1.1200, stop-loss 1.0850, risk factor **

GBP/USD: (Full Access - VIP Subscription Only)

USD/JPY: (Full Access - VIP Subscription Only)

USD/CHF: (Full Access - VIP Subscription Only)

USD/CAD: sell at 1.3340, target 1.2850, stop-loss 1.3460, risk factor **

AUD/USD: buy at 0.7025, target 0.7300, stop-loss 0.6935, risk factor **

NZD/USD: buy at 0.6550, target 0.7100, stop-loss 0.6450, risk factor **

EUR/GBP: (Full Access - VIP Subscription Only)

EUR/CHF: (Full Access - VIP Subscription Only)

AUD/NZD: (Full Access - VIP Subscription Only)

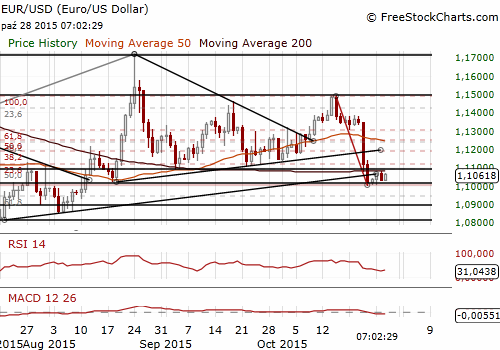

EUR/USD: We Expect Limited Changes To FOMC Wording Today

(buy at 1.0950)

The Commerce Department said on Tuesday non-defense capital goods orders excluding aircraft, a closely watched proxy for business spending plans, slipped 0.3% last month after a downwardly revised 1.6% decline in August. Manufacturing has been hobbled by a strong dollar and spending cuts in the energy sector. Manufacturing, which accounts for about 12% of the economy, has also been hit by efforts by businesses to reduce an inventory bulge and by slowing global demand. The downbeat report added to weak trade, retail sales and industrial production data that have suggested the economy lost significant momentum in the third quarter.

Shipments of core capital goods, which are used to calculate equipment spending in the government's gross domestic product measurement, rose 0.5% last month after a downwardly revised 0.8% drop in August. Core capital goods shipments were previously reported to have dropped 0.4% in August. The US government will publish its advance third-quarter GDP estimate on Thursday. Our forecast is 1.3% qoq annualized, below the market consensus.

US October consumer confidence index fell to 97.6 from 102.6 in September (revised from 103.0)

The Fed is widely expected to keep rates unchanged today (18:00 GMT). The policy statement, however, will be widely scrutinized for clues regarding how close or far the Fed may be to starting its lift off campaign of eventually raising interest rates. The statement is the only evidence Fed-watchers will have to review Wednesday because this meeting does not include a news conference by Chair Janet Yellen or an update of the central bank's economic forecasts.

Yellen and some other Fed officials have said a rate hike is still likely by the end of this year. But many market participants point to a string of weaker-than-expected economic reports in recent weeks that they think will lead the Fed to delay any rate increase until 2016.

What is changed is a global economic slowdown, led by China, that's inflicted wide-ranging consequences. US job growth has flagged. Wages and inflation are subpar. Consumer spending is sluggish and manufacturing is being hurt by a stronger USD, which has made US goods pricier overseas.

A Fed rate hike would boost the USD value and thereby squeeze US exporters of farm products and factory goods by making them costlier overseas. Compounding the situation, central banks from the Eurozone and China are easing policy, keeping upward pressure on the USD.

Most Fed policymakers have said they expect to raise rates in 2015, but two broke ranks with Yellen this month, questioning her view that labor market tightness will fuel inflation and overheat the economy. Fed Governors Lael Brainard and Daniel Tarullo urged caution, arguing slower growth abroad could sap U.S. economic strength and keep inflation too low. With Chicago Fed President Charles Evans, that puts three members of the rate-setting FOMC opting for no hike this year.

We anticipate very limited changes to the wording today. However, the statement will probably leave the open door to a hike in interest rates in December. Janet Yellen's scheduled public appearances in December, which will come after hiring data for October is released, could offer a better idea as to whether a hike will come at the December 15-16 policy meeting, the last of the year.

Last week, European Central Bank chief Mario Draghi said falling inflation expectations, driven in part by lower-than-expected demand for oil, have led the central bank to consider a wide variety of possible measures, including a deposit rate cut. European Central Bank Executive Board member Benoit Coeure saidif euro zone inflation rises back to target more slowly than previous expected, the ECB may need to cut its deposit rate further, although this is still an open discussion. Ardo Hansson, a member of the ECB Governing Council and head of Estonia's central bank, said he saw no need to ease policy further in December, contradicting an unexpectedly dovish message last week from ECB President Mario Draghi.

The USD has appreciated strongly since the ECB meeting. Some correction over the coming days seems likely to us in light of an expected deceleration in US GDP growth tomorrow. We are looking to buy the EUR/USD at 1.0950.

Significant technical analysis' levels:

Resistance: 1.1080 (high Oct 27), 1.1115 (200-dma), 1.1139 (high Oct 23)

Support: 1.0989 (low Oct 26), 1.0960 (low Aug 11), 1.0926 (low Aug 10)

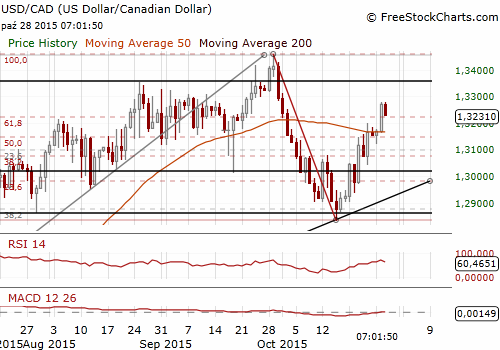

USD/CAD: Loonie Weakens As Oil Falls

(sell at 1.3340)

Deputy Governor of the Bank of Canada Timothy Lane said that while global experience had shown that quantitative easing and other central bank tools can be effective, the Bank of Canada was assuming they would not be necessary domestically at present.

The Bank of Canada outlined also possible alternative measures of inflation to help guide it in setting interest rates. However, Lane said it would not make any big changes to inflation-targeting framework unless necessary.

The official target is to keep overall inflation to 2%, but operationally the bank uses as its guide a core measure of inflation, that excludes eight volatile components and the effect of indirect tax changes. That ran at 2.1% in September, but Lane reiterated the bank's new emphasis on what it calls underlying inflation, which it sees at 1.5 to 1.7%, because it excludes exchange rate effects and one-off factors.

Lane also said that while exports have picked up recently, previous strength in the CAD had meant the disappearance of a number of exporters, and new firms might be needed for major surges in exports.

The CAD weakened against the USD on Tuesday, hitting its lowest level in more than three weeks as the commodity-sensitive currency was stung by a further fall in oil prices. Some weak US economic data, including a drop in the gauge of business plans, also took some steam out of the loonie. The United States is Canada's biggest trading partner by far and policymakers are looking for a pickup south of the border to help support Canada's economy.

Today’s Fed statement will play key role for the USD/CAD. Our trading strategy is to sell the USD/CAD at 1.3340.

Significant technical analysis' levels:

Resistance: 1.1080 (high Oct 27), 1.1115 (200-dma), 1.1139 (high Oct 23)

Support: 1.0989 (low Oct 26), 1.0960 (low Aug 11), 1.0926 (low Aug 10)

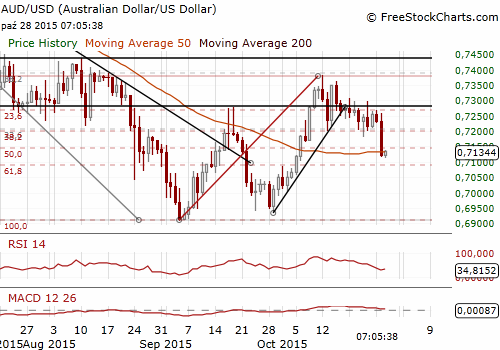

AUD/USD: Low Inflation Adds To Easing Risk

(buy at 0.7025)

Australian inflation amounted to 0.5% and 1.5% yoy in the third quarter, unchanged from the previous quarter. The reading was below the market forecast of 1.7% yoy. The annual pace of core inflation slowed to 2.2% from 2.4% in the second quarter. That was less than what the Reserve Bank of Australia had been projecting and almost at the floor of its long-run target band of 2% to 3%.

Investors immediately reacted by ramping up wagers on a cut in rates at the central bank's November 3 policy meeting. Interbank futures jumped to imply a 50-50 chance of an easing in the 2% cash rate next week, up from one-in-five before the data. December implied an 82% probability and a move to 1.75% was fully factored in by February.

In our opinion a probability of further rate cuts is very low and we are pretty sure that the RBA will not cut in November. The AUD/USD slid to a three-week low on Wednesday. We are looking to use lower AUD/USD levels to get long. We have placed our bid at 0.7025.

Significant technical analysis' levels:

Resistance: 0.7249 (10-dma), 0.7258 (high Oct 27), 0.7297 (high Oct 23)

Support: 0.7112 (session low Oct 28), 0.7100 (psychological level), 0.7071 (low Oct 6)

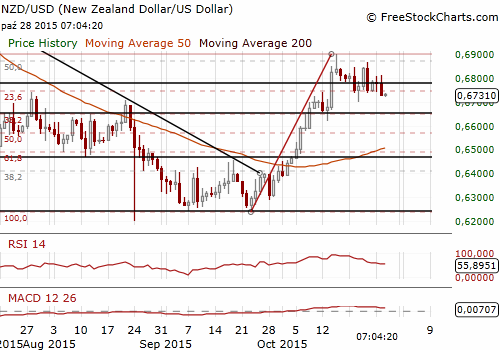

NZD/USD: Stronger Kiwi Poses Some Risks Ahead Of RBNZ Decision

(buy at 0.6550)

The Reserve Bank of New Zealand, having already delivered three rate cuts, is expected to leave interest rates unchanged today (20:00 GMT).

Appearing to lay the groundwork for a possible pause, Governor Graeme Wheeler said recent economic indicators have been "more encouraging" even as he reiterated that "some further easing" seemed likely.

Global dairy prices rebounded by around 60% from 13-year lows set back in August, while a survey found the services sector grew at its fastest pace in nearly eight years last month. Consumer inflation has largely unfolded as expected by the RBNZ. The latest report showed annual inflation running at 0.4% in the third quarter, slightly above the RBNZ's own forecast of 0.2%.

The strengthening of the NZD poses some risks ahead of the Reserve Bank of New Zealand meeting. Sustained currency strength is the last thing the economy needs. If the RBNZ steps up its FX rhetoric today, this would be negative for the NZD, probably driving the NZD/USD significantly below 0.6700.

We do not expect a cut today, but the statement may be dovish, which would be a good opportunity for investors to take profit on recent NZD/USD long positions. A rate cut is still possible in December. The RBNZ will release its quarterly Monetary Policy Statement at its December 10 review that contains a more comprehensive economic assessment, as opposed to a one-page statement that will accompany this month's rate review.

Our NZD/USD trading strategy is to buy at 0.6550.

Significant technical analysis' levels:

Resistance: 0.6717 (high Oct 28), 0.6813 (high Oct 27), 0.6865 (high Oct 23)

Support: 0.6703 (low Oct 22), 0.6699 (low Oct 21), 0.6622 (low Oct 14)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.