GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: long at 1.1345, target 1.1550, stop-loss 1.1285, risk factor *

GBP/USD: (Full Content - VIP Subscription Only)

USD/CHF: (Full Content - VIP Subscription Only)

EUR/GBP: (Full Content - VIP Subscription Only)

EUR/CHF: (Full Content - VIP Subscription Only)

AUD/NZD: (Full Content - VIP Subscription Only)

Pending Orders:

USD/CAD: sell at 1.3210, target 1.2830, stop-loss 1.3320, risk factor **

AUD/USD: (Full Content - VIP Subscription Only)

NZD/USD: (Full Content - VIP Subscription Only)

EUR/JPY: (Full Content - VIP Subscription Only)

AUD/JPY: (Full Content - VIP Subscription Only)

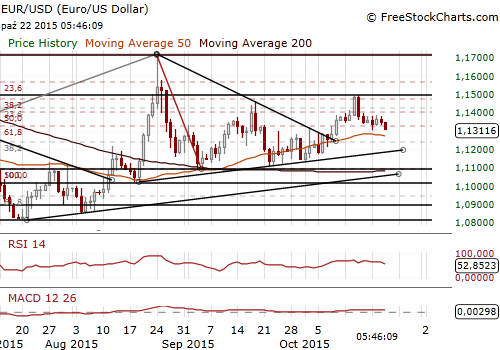

EUR/USD: Will Dovish Draghi Be Enough To Weaken The EUR?

(long at 1.1345)

The European Central Bank meeting will be the key event of today. The announcement of the decision is scheduled for 11:45 GMT and Draghi's press conference will be at 12:30 GMT. We expect no action and dovish rhetoric, mainly intended to stem the EUR appreciating trend. A dovish rhetoric is already priced in, but some investors expect also the announcement of an extension of QE already at this meeting. In our opinion the ECB President Mario Draghi is likely to talk down the currency today, but he is unlikely to deliver the extension of the QE programme or a further cut in the bank’s deposit rate. The ECB is still in wait-and-see mode, assessing incoming data for the possible materialization of downside risks.

Financial markets may be disappointed in case of no action from the ECB today and dovish rhetoric will be not enough to stop the EUR/USD rise. We do not change our trading strategy – we stay EUR/USD long.

Significant technical analysis' levels:

Resistance: 1.1387 (high Oct 20), 1.1420 (high Oct 16), 1.1495 (high Oct 15)

Support: 1.1300 (psychological level), 1.1268 (low Oct 9), 1.1233 (low Oct 8)

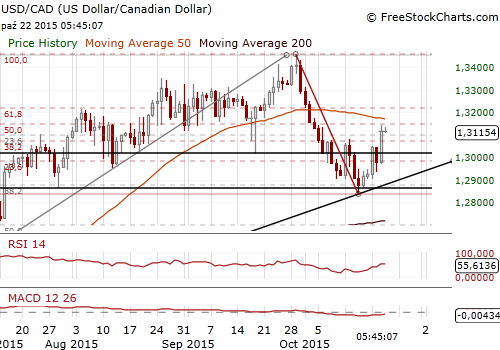

USD/CAD: Stop-loss Hit After BOC Trimmed Growth Outlook

(sell again at 1.3210)

The Bank of Canada maintained its target for the overnight rate at 0.5%.

Inflation has evolved in line with the outlook in the Bank's July Monetary Policy Report. Total CPI inflation remains near the bottom of the Bank's target range, owing to declines in consumer energy prices. Core inflation is close to 2% as the transitory effects of the past depreciation of the CAD are roughly offsetting disinflationary pressures from economic slack, which has increased this year.

Global economic growth has been a little weaker than expected this year, but the dynamics pointing to a pickup in 2016 and 2017 remain largely intact. However, lower prices for oil and other commodities were dampening business investment and exports in the resource sector. This prompted a cut in the growth forecast to 2.0% from 2.3% for 2016, and to 2.5% from 2.6% for 2017. It pushed back the time frame for when the economy will reach full capacity to mid-2017 from its July estimate of the first half of 2017, as economic slack has increased.

The Bank of Canada said that lower mortgage rates are contributing to strong growth in household borrowing. The lower cost of debt is also supporting other forms of consumer credit growth and spending, with consumption resilient despite the hit to incomes from lower commodity prices, the bank said. Canadians' debt-to-income ratio is at a record high. The bank expects the housing market and household indebtedness will stabilize over the next two years as the economy recovers momentum and as household borrowing rates start to normalize.

The CAD weakened more than 1% against the USD after the Bank of Canada lowered its growth forecasts for 2016 and 2017. Our USD/CAD short hit the stop-loss level at 1.3130. A rise in the USD/CAD was halted by 1.3144 – 50% retrace of 1.3457-1.2832.

The risks to our bullish view on the loonie have increased.However, the BoC signaled longer-lasting damage from lower oil prices, but this drag may be progressively absorbed in our view if oil prices recover as we expect over the medium term. Rather than signaling that it would be ready to cut rates soon, the BoC appears to be more supportive of the current neutral stance. Our trading strategy is to sell the USD/CAD again at higher levels. We have placed our sell order at 1.3210.

Significant technical analysis' levels:

Resistance: 1.3144 (session high Oct 22), 1.3175 (high Oct 5), 1.3200 (psychological level)

Support: 1.3000 (psychological level), 1.2969 (low Oct 21), 1.2935 (low Oct 20)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.