Taken Positions

EUR/USD: long at 1.1345, target 1.1550, stop-loss 1.1285, risk factor *

GBP/USD: (Full Content - VIP Subscription Only)

USD/CHF: (Full Content - VIP Subscription Only)

USD/CAD: short at 1.3020, target 1.2850, stop-loss 1.3130, risk factor **

AUD/USD: (Full Content - VIP Subscription Only)

EUR/GBP: (Full Content - VIP Subscription Only)

EUR/CHF: (Full Content - VIP Subscription Only)

AUD/JPY: long at 86.80, target 89.80, stop-loss at 86.10, risk factor **

AUD/NZD: (Full Content - VIP Subscription Only)

Pending Orders:

EUR/JPY: (Full Content - VIP Subscription Only)

EUR/CAD: (Full Content - VIP Subscription Only)

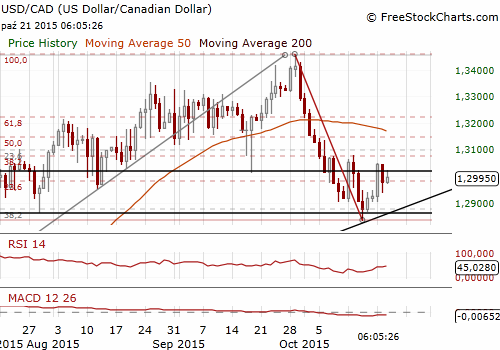

USD/CAD: BoC May Support The Loonie Today

(short at 1.3020)

- We expect the Bank of Canada to remain on hold today, leaving the overnight rate unchanged at its current level of 0.50%. The central bank’s statement is also likely to reaffirm the message it outlined at its 9 September meeting. The BoC is likely to say that the current stance of its monetary policy is appropriate and Inflation is evolving in line with the scenario described in the July policy report.

- The CAD has recovered substantially since the end of September, but we do not think that the BoC will see this move as strong enough to trigger a substantial change in its foreign exchange rhetoric as, even after the recent bounce, the currency remains much weaker than it was at the start of the year.

- Positive surprises, if any, may come from the new set of economic forecasts, given the likelihood that the BoC may signal slightly better trends than those outlined in its July Monetary Policy Report that projected Canadian growth just over 1% in 2015 and about 2.5% in 2016 and 2017.

- Data from Statistics Canada showed on Tuesday that the value of Canadian wholesale trade unexpectedly fell 0.1% in August as sales declined in sectors including machinery and motor vehicles. The machinery, equipment and supplies sector dropped 2.4% to its lowest level since April 2014, and the motor vehicle and parts sector fell 1.2%.

- In our opinion the outcome of the BoC’s meeting may support the loonie. We went short at 1.3020, in line with our trading strategy announced yesterday. The USD/CAD is close to the 10-day exponential moving average now. Breaking below this indicator, may open the way to stronger falls. The nearest strong support level is 1.2831 low on October 15. We have placed the target of our short slightly above this level, at 1.2850.

Significant technical analysis' levels:

Resistance: 1.3046 (high Oct 20), 1.3071 (38.2% fibo of 1.3457-1.2832), 1.3080 (high Oct 13)

Support: 1.2900 (psychological level), 1.2852 (low Oct 16), 1.2831 (low Oct 15)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

AUD/USD turns south toward 0.6400 after mixed Australian jobs data

AUD/USD has come under renewed selling pressure and turned south toward 0.6400 after Australian employment data pointed to loosening labor market conditions, fanning RBA rate cut expectations and weighing on the Aussie Dollar.

USD/JPY remains below 154.50 amid weaker US Dollar

USD/JPY keeps losses for the second successive session, trading below 154.50 in Asian trading on Thursday. The pair is undermined by the latest US Dollar pullback, Japan's FX intervention risks and a softer risk tone.

Gold price finds buyers again near $2,355 as USD licks its wounds

Gold price is attempting a tepid bounce in the Asian session, having found fresh demand near $2,355 once again. Gold price capitalizes on a softer risk tone and an extended weakness in the US Treasury bond yields, despite the recent hawkish Fed commentary.

OMNI post nearly 50% loss after airdrop and exchange listing

Omni network lost nearly 50% of its value on Wednesday after investors dumped the token following its listing on top crypto exchanges. A potential reason for the crash may be due to the wider crypto market slump.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.