GROWTHACES.COM Trading Positions

USD/JPY: long at 117.50, target 119.80, stop-loss 116.60

USD/CHF: long at 0.9560, target 0.9760, stop-loss 0.9610

EUR/CHF: long at 1.2025, target 1.2095, stop-loss 1.1995

EUR/GBP: short at 0.7990, target 0.7840, stop-loss 0.7980

AUD/JPY: long at 101.20, target 102.80, stop-loss 100.50

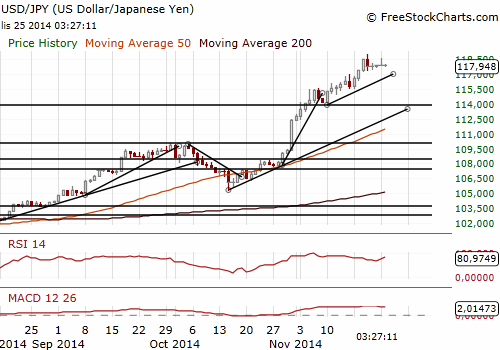

USD/JPY: BOJ’s Minutes Triggered Profit-Taking On USD/JPY Longs

(we stay long, the target is 119.80)

The Bank of Japan released minutes of an October 31 meeting. The BOJ shocked investors at that meeting by expanding its quantitative easing, increasing annual government debt purchases to JPY 80 trillion from JPY 50 trillion.

The minutes showed that some Bank of Japan board members expressed concern that expanding the central bank's quantitative easing could increase the risk that it will be seen as financing the government deficit. On the other hand, many members pointed out that the decline in oil prices, weak developments in demand following the consumption tax hike, had been generating downward pressure on prices in the short-term. In the opinion of those members there was a significant risk that conversion of the deflationary mindset might be delayed. The minutes also showed that BOJ Governor Haruhiko Kuroda proposed expanding debt and risk asset purchases to maintain the central bank’s commitment to reaching its 2% inflation target next year.

Bank of Japan Governor Haruhiko Kuroda said today that while recent JPY depreciation is positive for exporters, it hurts households as well as small firms and non-manufacturers through increases in import costs. Bank of Japan Governor Haruhiko Kuroda said the central bank is ready to expand stimulus further to meet its price goal.

Bank of Japan Deputy Governor Hiroshi Nakaso said the BOJ's decision to expand its quantitative easing was intended to express its strong commitment to its price target. He added the central bank is buying government debt in a flexible manner to compress yields across the yield curve.

Japan's Government Pension Investment Fund (GPIF) said its holdings of domestic government bonds fell to 48.39% in September down from 51.91% at the end of June, highlighting how aggressively the fund is shifting to riskier assets. The GPIF on October 31 slashed its government bonds allocation target to 35% from 60%, while roughly doubling the targets for foreign and domestic shares to 25% each.

The Organisation for Economic Cooperation and Development said Japan’s government's decision to delay a sales tax increase scheduled for next year will help growth, but it also means the government will not meet its deficit reduction target for fiscal 2015. In the opinion of the OECD Japan needs a credible plan to reduce its debt to contain the risk that the Bank of Japan's quantitative easing could cause inflation expectations to spike.

The USD/JPY reached a day’s high at 118.59 but fell back below 118.00 soon after the release of the central bank’s minutes. The information about GPIF’s holdings supported the USD/JPY. The rate went back above 118.00 in the European session.

We stay USD/JPY long. Our target is 119.80. The nearest support is today’s session low at 117.69 and the resistance level is today’s session high at 118.59.

Significant technical analysis' levels:

Resistance: 118.59 (session high Nov 25), 118.98 (high Nov 20), 119.00 (psychological level)

Support: 117.69 (session low Nov 25), 117.58 (low Nov 24), 117.36 (session low Nov 21)

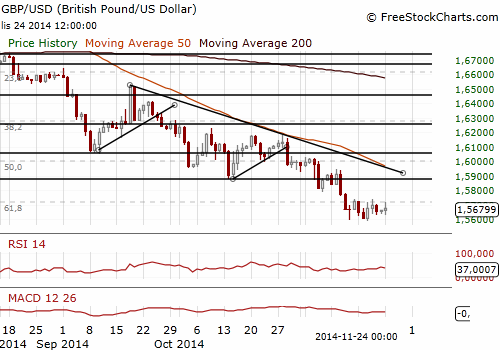

GBP/USD: BOE Hawks Are Getting Stronger

(sell at 1.5810)

Kristin Forbes who is among seven members of the nine-strong Monetary Policy Committee who voting to keep interest rates unchanged told lawmakers in Britain's parliament that some recent international economic data had been stronger than in the baseline forecast.

BoE Governor Mark Carney, speaking at the same session of parliament's Treasury Committee, said the global economic outlook had deteriorated and geopolitical risks had increased. Another member of the Monetary Policy Committee who has voted against a rate hike, Jon Cunliffe, said he was mostly worried about the risk of Britain's inflation rate falling further from a nearly five-year low in October. Ian McCafferty, one of the two MPC members who have voted for a rate hike since August, stuck to his view that inflation pressures could rise as the economy grows.

We see one additional BoE member is leaning toward the hawks. Kristin Forbes may join McCafferty and Weale early next year and vote to raise interest rates. There is a strong chance that the BoE MPC vote will go from 7-2 to 6-3.

The GBP/USD fell slightly after BOE testimony. The market focused mainly on hawkish comments from Forbes. In the opinion of GrowthAces.com the outlook for the GBP/USD is still bearish as the BOE is now seen lagging Fed in raising rates. However, the GBP is likely to strengthen against the EUR, which is supportive for our EUR/GBP short.

Significant technical analysis' levels:

Resistance: 1.5707 (hourly high Nov 25), 1.5715 (high Nov 24), 1.5737 (high Nov 20)

Support: 1.5630 (low Nov 24), 1.5626 (low Nov 21), 1.5590 (low Nov 19)

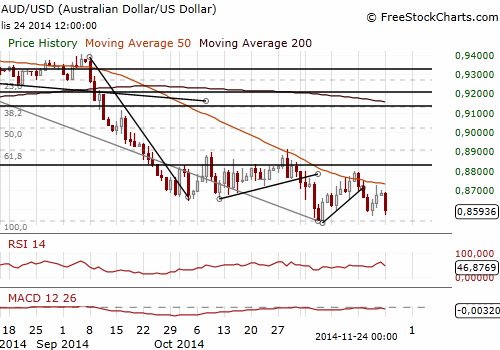

AUD/USD Fell Significantly After RBA Sharpened Its Rhetoric

(stay sideways)

Reserve Bank of Australia Deputy Governor Philip Lowe said a further drop in the AUD would help support economic growth. He said the lofty level of the AUD led to concerns that wages in Australia were too high to be competitive.

The AUD/USD fell to a four-year low of 0.8524 after Reserve Bank of Australia's Deputy Governor Philip Lowe said the currency was overvalued.

In the opinion of GrowthAces.com no positions on the AUD/USD are justified from the risk/reward perspective at the moment. We got long on the AUD/JPY at 101.20, in line with our strategy. The target is 102.80. We set the stop-loss at 100.50.

Significant technical analysis' levels:

Resistance: 118.59 (session high Nov 25), 118.98 (high Nov 20), 119.00 (psychological level)

Support: 117.69 (session low Nov 25), 117.58 (low Nov 24), 117.36 (session low Nov 21)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.