GROWTHACES.COM Trading Positions

USD/JPY: long at 115.00, target 118.50, stop-loss 116.40

USD/CHF: long at 0.9560, target 0.9760, stop-loss 0.9530

EUR/CHF: long at 1.2025, target 1.2095, stop-loss 1.1995

EUR/GBP: short at 0.7990, target 0.7840, stop-loss 0.8060

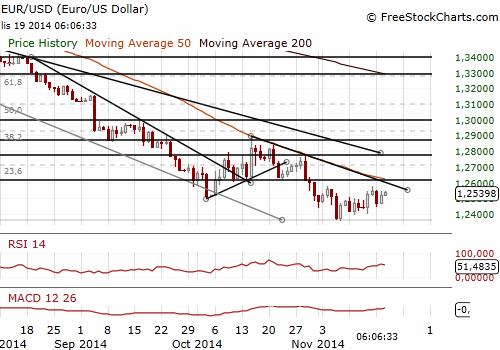

EUR/USD: Focus On The FOMC Minutes

(sell at 1.2580)

Minneapolis Federal Reserve President Narayana Kocherlakota (voter, dove) said yesterday the Federal Reserve is risking its credibility by not acting aggressively enough to bring inflation back up to its 2% target. Kocherlakota was the only Fed policymaker to dissent on the Fed's decision last month to end its bond-buying stimulus, repeated his view that inflation won't rise back to 2% until 2018. In his view a rate hike next year would be inappropriate unless inflation shows signs of heading back to 2% within a year or two.

Investors’ focus turns to the Federal Reserve which will release minutes of its latest policy review today. The Fed minutes are likely to sound relatively more hawkish which could give a boost to the USD.

Our trading strategy for today is to sell EUR/USD before the FOMC minutes. We placed our sell order at 1.2580. Our target will be 1.2400 near the lows from last Friday.

Significant technical analysis' levels:

Resistance: 1.2580 (high Nov 17), 1.2591 (hourly high Oct 31), 1.2617 (high Oct 31)

Support: 1.2470 (200-hma), 1.2467 (10-dma), 1.2442 (low Nov 18)

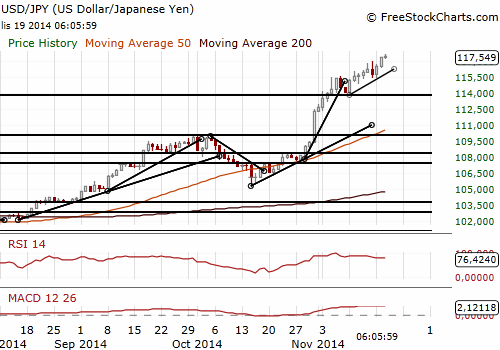

USD/JPY: Will The 117.95 Be Broken Today?

(we have raised the target to 118.50)

The Bank of Japan kept monetary settings and its upbeat economic view unchanged today. As widely expected, the central bank voted to continue its purchases of government bonds and risky assets, maintaining its pledge of increasing base money, or cash and deposits at the central bank, at an annual pace of JPY 80 bn. The BOJ said in a statement: “Japan's economy continues to recover moderately as a trend, although some weaknesses remain mainly in output.”

The BOJ voted 8-1 for steady policy against 5-4 vote for easing last month. Board member Takahide Kiuchi, a sceptic of the current quantitative easing programme, dissented to the policy decision in a show of his continued disapproval to last month's surprise monetary easing that was made by a closely split vote. The other three of the four dissenters of the October 31 easing voted for today's policy decision.

BOJ Governor Haruhiko Kuroda in reaction to sales tax postponement said: “I understand that whether to raise the sales tax is something the government and parliament decides, taking into account economic and other conditions. Speaking in general terms, it's important for Japan as a nation to maintain market trust in its finances.”

The USD/JPY and most JPY crosses rose in Asia. A larger majority of the BOJ supporting current monetary easing gave a boost to the USD/JPY. The market expects also an acceleration of monetary easing next year given determination of the authorities to achieve the inflation target of 2%.

The USD/JPY broke above the level of 117.00. The nearest support level is at today’s session low of 116.81. The strong resistance is at 117.95 – October 2007 high. In case of breaking above this level the USD/JPY is likely to go near 118.50 (levels not seen since August 2007).

We have raised the target of our long USD/JPY position to 118.50. We expect hawkish FOMC minutes, supportive for the USD bulls.

Significant technical analysis' levels:

Resistance: 117.95 (high Oct 15, 2007), 118.00 (psychological level), 118.52 (high Aug 14, 2007)

Support: 116.80 (session low Nov 19), 116.33 (low Nov 18, 116.00 (psychological level)

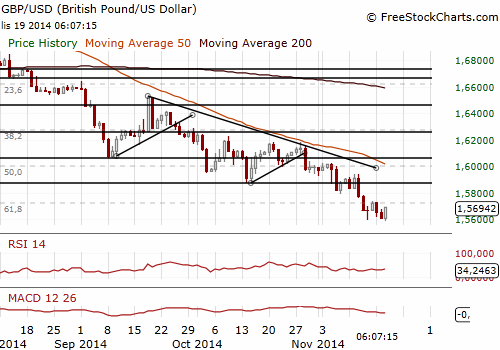

GBP/USD Firmer After BOE Minutes

(we stay sideways, outlook is bearish)

The Bank of England released minutes of the Monetary Policy Committee's November 5-6 meeting. Two BOE policymakers (Ian McCafferty and Martin Weale, who have voted for a rate hike since August) voted again for an increase in interest rates this month. They continued to point out that below target inflation was largely the result of a higher exchange rate and lower raw material prices.

The minutes said some members thought there was a risk that economic growth might soften further than anticipated and inflation might stay below target for longer. Let’s remind that last week, the BoE issued new forecasts that showed British inflation will likely fall below 1% in the next six months. Yesterday’s figures showed inflation edged up to 1.3% in October from 1.2% in September. BOE Governor Mark Carney suggested markets were right to rule out an interest rate hike any time soon.

The GBP/USD firmed after the release of the minutes. The median forecast for the minutes outcome was 7-2 vote, but there was quite high risk that one or both of the hawks supported the majority. The GBP/USD bulls were relieved to see an unchanged minutes outcome. The rate went up to 1.5676, near yesterday’s high.

We are looking to use upticks to get short on the GBP/USD. The next target for the currency bears could be near 1.5400.

Significant technical analysis' levels:

Resistance: 1.5737 (high Nov 17), 1.5751 (10-dma), 1.5780 (high Nov 13)

Support: 1.5593 (low Nov 13), 1.5563 (low Sep 6, 2013), 1.5556 (low Sep 4, 2013)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.