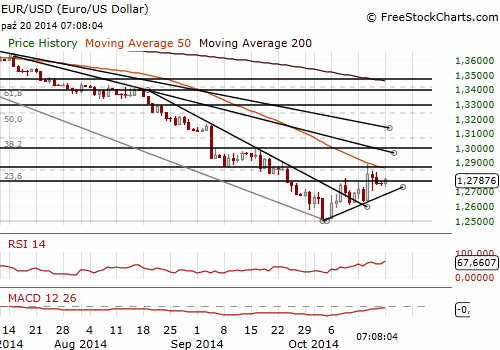

EUR/USD: Outlook still uncertain

(we keep our short position, but have lowered the stop-loss level)

Fed’ chair Janet Yellen did not comment on the economic outlook after investors reappraised the Fed's likely policy path. Yellen did not comment on the volatility of financial markets or on monetary policy. Instead, she was speaking on widening economic inequality in the United States.

Boston Fed President Eric Rosengren (dovish, does not have a rotating vote on Fed policy until 2016) said the recent volatility in financial markets reinforces the need for the Federal Reserve to be patient with its policy stimulus and to clearly tie an eventual interest-rate rise to improving economic conditions. Rosengren backs ending quantitative easing this month unless something dramatic happens. His comments reflect the dovish point of view and show there is no support from the doves for extending QE.

The current account balance in the Euro zone amounted in August to EUR 18.9 bn (seasonally adjusted) vs. EUR 21.6 bn in July, mainly due to lower foreign trade surplus.

The run of better U.S. data at the end of last week (industrial production, higher consumer sentiment reading and better-than-expected housing numbers) left the fundamental picture in favour of the USD. However, further dovish comments from the Fed officials may strengthen the EUR/USD.

We keep the target of our short EUR/USD position at 1.2710, but have lowered the stop-loss level to 1.2810, just to save our small profit. We do not see potential for a strong decline of the EUR/USD in the short term, but in our opinion the target is achievable.

Significant technical analysis' levels:

Resistance: 1.2779 (hourly high Oct 20), 1.2845 (high Oct 16), 1.2887 (high Oct 15)

Support: 1.2730 (10-dma), 1.2714 (21-dma), 1.2705 (session low Oct 16)

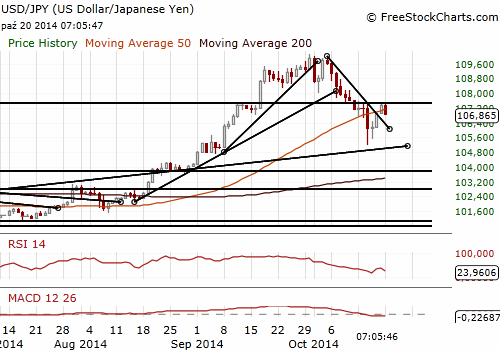

USD/JPY: Strong stocks despite political turmoil

(we keep our long position, key resistance at 107.63)

The junior partner in Japanese Prime Minister Shinzo Abe's coalition government called for steps to stimulate an economy hit by April's sales tax rise and to soften the pain of rising costs caused by a weak yen. Keiichi Ishii, policy chief of the Komeito party, said the government needs to craft an extra budget given the economy's current weakness regardless of Abe's decision on whether to go ahead with a second tax hike in 2015.

Japan's trade and justice ministers resigned after accusations they misused campaign funds.

Bank of Japan Governor Haruhiko Kuroda said on Monday the country's economy continues to recover moderately as a trend, although there are some weaknesses mainly in output. His speech was the same as what the recent policy meeting statement said.

The head of the central bank's Osaka branch Atsushi Miyanoya said the JPY's decline has boosted profits at big manufacturers in the Kinki region of western Japan as well as companies in the leisure industry as it lured more foreign tourists. Toru Umemori, the BOJ's Nagoya branch manager, said many companies in the Tokai central Japan region feel that rapid exchange-rate moves are undesirable.

Japan’s stocks traded higher on Monday despite resignations of prominent ministers from the Abe cabinet. The USD/JPY saw an early rally near 107.30 on news that Government Pension Investment Fund (GPIF) was looking to up its domestic equity allocation from 12% now to 25%. The USD/JPY fell back a bit to slightly below 107.00 later.

The currency bears are under pressure after recent strong recovery moves. We have raised the target of our long USD/JPY position to 108.30 from 107.50 previously. An important resistance level is situated at 107.63 (kijun line and daily high October 13). Breaking above that level will open the way for the currency bulls. We have moved also our stop-loss level to 106.50, to save our profit.

Significant technical analysis' levels:

Resistance: 107.49 (high Oct 15), 107.64 (high Oct 13), 108.15 (high Oct 10)

Support: 106.95 (session low Oct 20), 106.14 (low Oct 17), 105.51 (low Oct 16)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

AUD/USD recovers to near 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to near 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY bounces back toward 154.50 amid risk-recovery

USD/JPY bounces back toward 154.50 in Asian trading on Thursday, having tested 154.00 on the latest US Dollar pullback and Japan's FX intervention risks. A recovery in risk appetite is aiding the rebound in the pair.

Gold rebounds on market caution, aims to reach $2,400

Gold price recovers its recent losses, trading around $2,370 per troy ounce during the Asian session on Thursday. The safe-haven yellow metal gains ground as traders exercise caution amidst heightened geopolitical tensions in the Middle East.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.