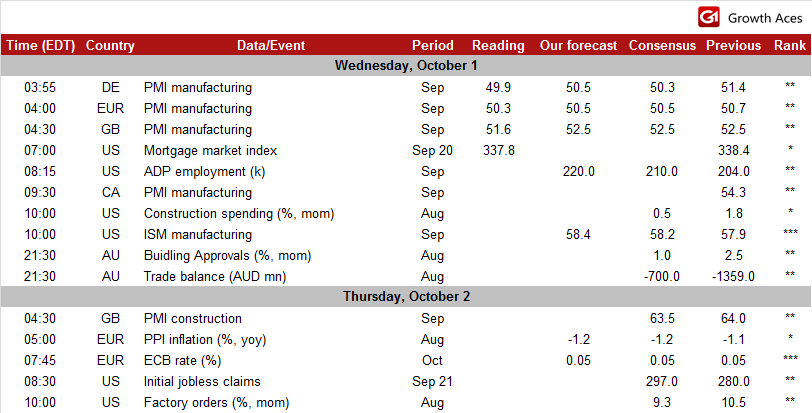

ECONOMIC CALENDAR

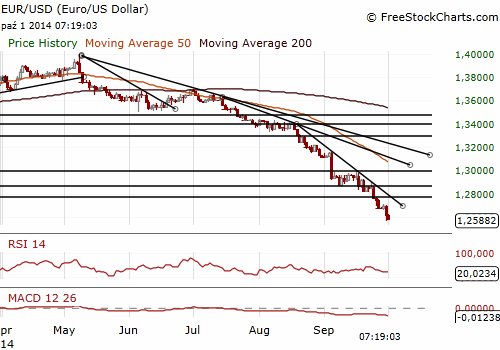

EUR/USD: No mercy for the EUR after PMIs

(looking to get short, next target 1.2502)

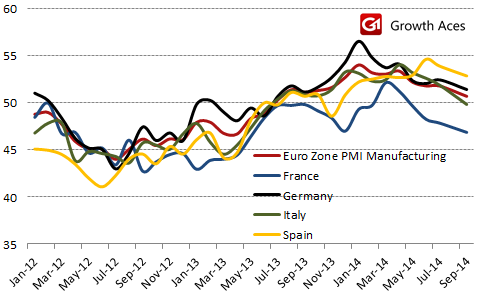

September manufacturing PMI came in at 50.3, the lowest since July last year and below both August's 50.7 and an earlier flash estimate of 50.5. New orders contracted for the first time in over a year on dwindling demand at home and from abroad suggesting output could start to fall as we move into the final quarter of the year. Factories also cut prices last month for the first time since April.

The German manufacturing sector was broadly stagnant in September, with the German PMI posting a shade below the 50.0 dividing line for the first time since June 2013. Output growth slowed to a 15-month low, while new orders fell for the first time since June last year and at the quickest pace in almost two years.

The weakening manufacturing sector will intensify pressure on the ECB to do more to revive the economy and no doubt strengthen calls for full-scale quantitative easing. In our opinion any additional action at tomorrow’s meeting is unlikely. However, the full-blown quantitative easing (adding government bonds to the ECB's shopping list) cannot be excluded around the turn of the year (after assessment of the second round of TLTROs).

Bear trend shows no signs of relenting. Key support is at 1.2502 (76.4% of 1.2042-1.3995), which in our opinion is the short-term target for the currency bears. We are looking to get short.

Significant technical analysis' levels:

Resistance: 1.2635 (hourly high Sep 3), 1.2664 (low Sep 29), 1.2715 (high Sep 29)

Support: 1.2571 (low Sep 30), 1.2561 (low Sep 6, 2012), 1.2502 (76.4% of 1.2042-1.3995)

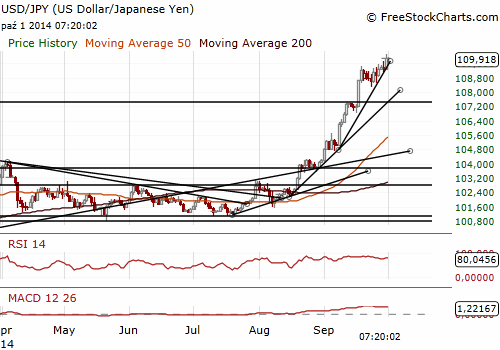

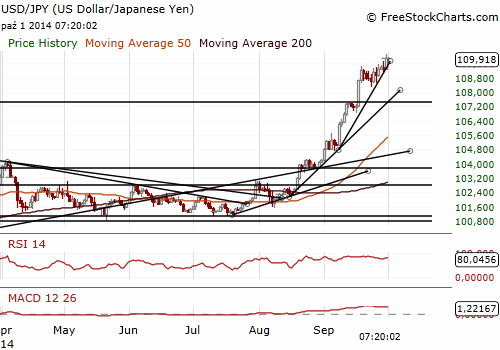

USD/JPY broke above 110.00 after Tankan survey

(still long)

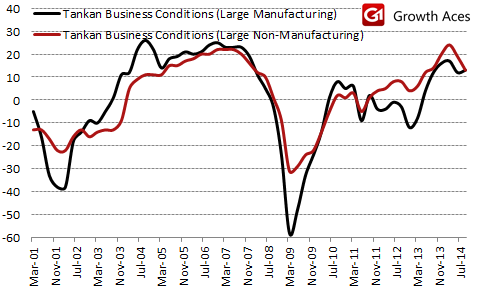

The results of Tankan survey was the most important Japanese reading for JPY traders this week. The headline index of business conditions for large manufacturers in the Q3 Tankan survey edged up from 12 to 13, above the median forecast of 10. However, this reading was overshadowed by a significant deterioration in business conditions in the non-manufacturing sector. The index for large firms fell to +13 from +19 (vs. the median forecast of +17), the sharpest decline since the second quarter of 2011.

Large manufacturers expect conditions to remain unchanged this quarter, while large non-manufacturers predict a small improvement of 1 point. The consensus expected a more upbeat outlook.

Today's survey suggests that the labour market continues to tighten. The employment index fell to -14, the lowest level since early 90s. Tight labour market does not, however, reflect in inflation pressure. The index for output prices was unchanged in the third quarter and suggests that price pressure may be not enough to meet the BoJ’s target.

A Japanese government spokesman Katsunobu Kato said that the Bank of Japan's Tankan survey of business sentiment showed that the pullback in demand following the sales tax hike is easing and the economy is continuing moderate growth. He added the country needs to monitor the JPY’s weakening carefully because of its impact on prices in addition to the positive effect it can have on the economy.

Japan's Cabinet Office issued estimates showing heavy rains and unusually cool weather this summer have shaved anywhere from 0.2 to 0.6 pp. from Q3 GDP. Economics Minister Akira Amari said heavy rain has probably pushed the GDP down by 1.6 pps. on an annualised basis in July-September.

Bank of Japan Governor Haruhiko Kuroda said that the central bank would make policy adjustment without hesitation if judged necessary to achieve its price target. The central bank expects continuation of moderate recovery trend and that effects of decline in demand following sales tax hike will wane gradually.

The USD/JPY broke above the level of 110.00 and hit the day’s high at 110.09 after the Tankan but then went back near 109.75 on profit taking. We see USD/JPY at higher levels soon and maintain our long position with the target of 110.50. In our opinion the likelihood of further easing from the BoJ is rising after another series of weak macroeconomic data. We have gone long also on the EUR/JPY. The EUR/JPY went up to 138.80 after the Tankan but fell again during European session after weaker Euro zone PMI releases.

Significant technical analysis' levels:

Resistance: 109.97 (hourly high Oct 1), 110.09 (high Oct 1), 110.33 (high Aug 19)

Support: 109.56 (session low Oct 1), 109.19 (low Sep 30), 109.15 (10-dma)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.