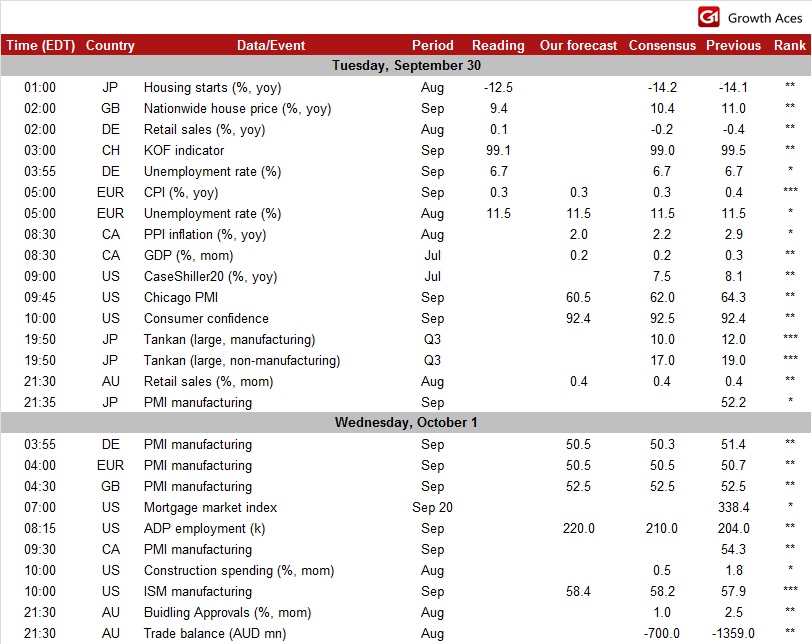

ECONOMIC CALENDAR

EUR/USD: One direction.

(bearish in the short term)

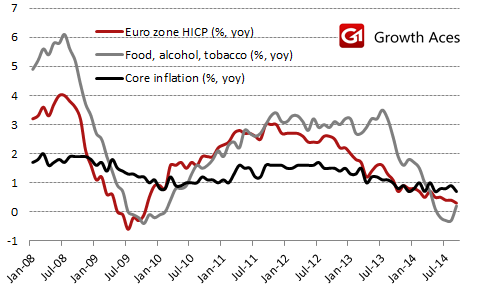

Euro zone inflation slowed further in September because of falling prices of unprocessed food and energy. CPI amounted to 0.3% yoy, slowing from 0.4% yoy increases in August and July. The reading was in line with expectations. Unprocessed food prices fell 0.9% yoy in September and energy was 2.4% cheaper. Core inflation - a measure stripping out these two volatile components – amounted to 0.7% yoy, slowing down from 0.9% yoy in August.

ECB governor Mario Draghi is expected to give further details of ECB plans of ABS purchases on Thursday. The ECB is unlikely to do more next week but deflation remains a serious threat and full-blown quantitative easing (adding government bonds to the ECB's shopping list) cannot be excluded around the turn of the year (after assessment of the second round of TLTROs). On the other hand, there is strong opposition against full QE in Germany.

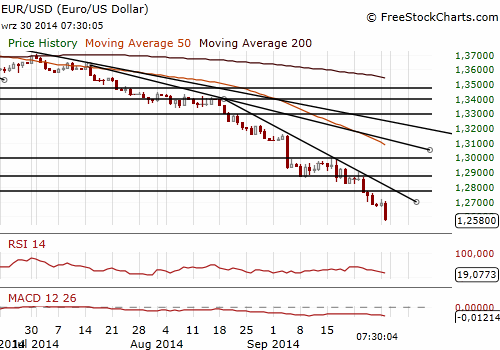

The EUR/USD broke below 1.2600 today after inflation data and there is only one direction on the EUR/USD chart now. We are looking for an opportunity to get short. Our sell offer is at 1.2655 now.

Significant technical analysis' levels:

Resistance: 1.2664 (low Sep 29), 1.2715 (high Sep 29), 1.2761 (high Sep 26)

Support: 1.2561 (low Sep 6, 2012), 1.2502 (76.4% of 1.2042-1.3995), 1.2493 (low Aug 31, 2012)

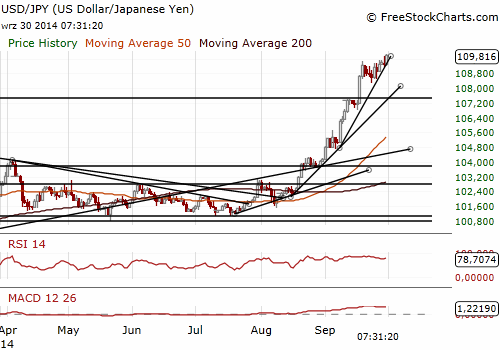

USD/JPY: Tankan in the spotlight after weak macro data.

(still long position, the target is 110.50)

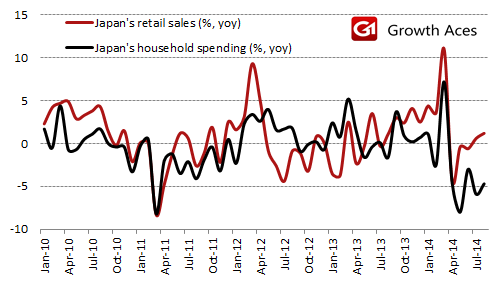

Japan’s factory output, consumer spending and real wages all fell in August. The one bright spot came in data showing the jobless rate fell in August and stronger-than-expected retail sales’ reading.

Household spending fell 4.7% yoy in August, the fifth-straight month of declines, and weaker than forecast drop of 3.8% yoy. Japanese retail sales rose 1.2% yoy in August from a year earlier. The rise was more than the median market forecast of 0.3%.

Real wages fell 2.6% yoy in August following a revised 1.7% yoy decline in July. The Bank of Japan will considers wage growth as crucial to achieve its 2% inflation goal sometime in the next fiscal year starting in April. Overtime pay, a barometer of strength in corporate activity, rose 1.8% yoy in August. That was slower than a revised 3.6% yoy in July. Total cash earnings rose 1.4% yoy vs. 2.4% yoy increase in the previous month.

The seasonally adjusted unemployment rate fell in Japan to 3.5% from July's 3.8%. The jobs-to-applicants ratio was 1.10 in August, unchanged from the previous month when the ratio climbed to its highest since June 1992

Japan’s industrial output fell 1.5% mom in August to the lowest level since June 2013. Manufacturers surveyed by the ministry expect output to rise 6.0% in September but decrease 0.2% in October.

Economy Minister Akira Amari said: “I have to admit that there has been some trouble in recovering from the decline in demand after the April sales tax hike. The economy has not developed as I had hoped (...) however, I still expect that the trend will point to economic recovery." Finance Minister Taro Aso said on Tuesday that Japan's economic fundamentals have held steady and that the economy is expected to start picking up from this month and next.

The BOJ's key tankan corporate survey (on Wednesday GMT) will be closely analyzed by central bankers ahead of a rate-setting meeting next week.

We maintain our long position on the USD/JPY, the target is 110.30. GrowthAces.com is also long on the EUR/JPY at the level of 138.55. The target is at 140.00 and stop-loss at 137.80.

Significant technical analysis' levels:

Resistance: 109.75 (high Sep 29), 109.94 (high Aug 26), 110.00 (psychological level)

Support: 109.13 (low Sep 29), 109.00 (psychological level), 108.98 (10-dma)

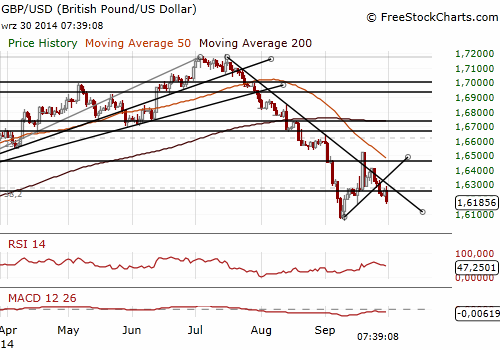

GBP/USD lower after Q2 C/A data

(our long position reached its stop-loss, we stay flat now)

Britain’s GDP grew 0.9% qoq and 3.2% yoy in the three months from April to June this year, a slight increase from earlier estimate of 0.8% qoq. Output in Britain's services industry expanded 1.1% in the second quarter, the fastest growth since the third quarter of 2011. Construction was revised up sharply to show 0.7% growth, compared with a previous estimate of no growth.

Business investment rose 3.3% qoq and 11.0% yoy during the second quarter. Household spending rose a quarterly 0.6% and real disposable income rose by 2.2% qoq. The savings ratio rose to 6.7% from 5.7% in the first three months of 2014.

Current account data for the second quarter showed that Britain's deficit widened to GBP 23.1 bn from GBP 20.5 bn in first three months of 2014. That was equivalent to 5.2% of GDP, up from 4.7% in the first quarter.

The GBP/USD hit a 2-week low against the USD after worse current account deficit data. Our long GBP/USD positions reached the stop-loss at 1.6210. We stay flat now.

Significant technical analysis' levels:

Resistance: 1.6290 (high 21-dma), 1.6304 (high 10-dma), 1.6333 (high Sep 26)

Support: 1.6162 (low Sep 16), 1.6052 (low Sep 10), 1.6003 (50% of 1.4814-1.7192)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.