ECONOMIC CALENDAR

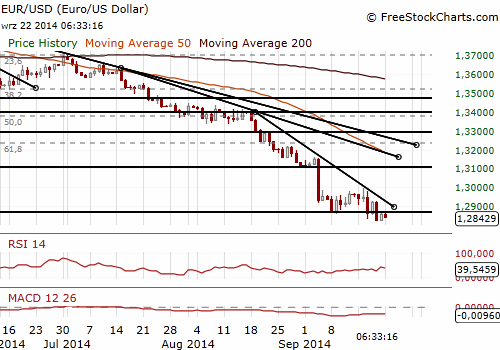

EUR/USD: ECB’s Draghi in the limelight today

(stop-loss reached; low chance of further fall)

The ECB Executive Board member Benoit Coeure said on Sunday: “We're all aware that the room has become very limited to further stimulate demand through macroeconomic policies. Central banks in advanced economies, including the ECB, are already pursuing very accommodative monetary policies. As regards to fiscal policies, we must all aim at putting our public debt on a downward path, on a sustainable path."

Top of the agenda for the EUR/USD is European Central Bank President Mario Draghi's appearance in the European parliament.

The USD made strong gains on Friday and the EUR/USD has reached our stop-loss at 1.2830. The rate opened today’s Asia session below 1.2830 but recovered then. The nearest strong support levels are 61.8% of 1.2042-1.3995 at 1.2788 and 1.2755 (low Jul 9, 2013). In the opinion of Growth Aces without fresh reasons to sell EUR/USD these levels are safe (the ECB has used almost all the weapons). We still expect a rise of the EUR/USD in the medium term.

Significant technical analysis' levels:

Resistance: 1.2931 (high Sep 18), 1.2982 (high Sep 17), 1.2995 (high Sep 16)

Support: 1.2828 (low Sep 19), 1.2800 (psychological level), 1.2788 (61.8% of 1.2042-1.3995)

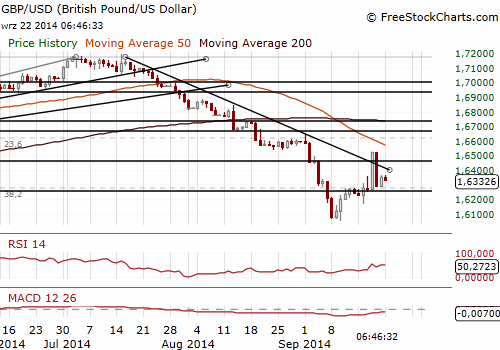

GBP/USD: Back to fundamentals after Scottish storm

(GrowthAces.com is long again on the GBP/USD)

After the referendum on Scotland’s independence British politicians are preparing to the May 2015 vote. Former prime minister Gordon Brown urged British leaders on Saturday to keep their promise to grant further powers to Scotland after it voted to remain in the United Kingdom. All the three biggest parties had promised to rapidly expand Scotland's autonomy just days before Thursday's referendum. During the campaign Britain's Conservative Prime Minister David Cameron, Labour opposition leader Ed Miliband and Liberal Democrat leader Nick Clegg for their part all promised to guarantee Scotland high levels of state funding and greater control over healthcare spending.

Britain's opposition Labour party promised on Sunday to raise the national minimum wage by more than 25% within five years if it wins next year's national election, a pledge designed to win over voters hit by rising living costs. In response, Cameron's Conservatives said they were already implementing an above-inflation rise in the minimum wage.

The GBP/USD rose on Friday to a high at 1.6525 but then reversed below 1.6300. The GBP/USD is calmer today after Friday’s volatile session. The GBP is firming as focus turned to rate outlook. Futures tipped to the UK leading the rates move higher with a hike in the first quarter 2015 and the USA is expected to hike in the second half next year. In line with our Friday’s scenario we’ve got long on the GBP/USD at 1.6320, our target is at 1.6540 and stop-loss is at 1.6210.

Significant technical analysis' levels:

Resistance: 1.6461 (30-dma), 1.6525 (high Sep 19), 1.6615 (high Sep 2)

Support: 1.6284 (low Sep 19), 1.6267 (10-dma), 1.6162 (low Sep 16)

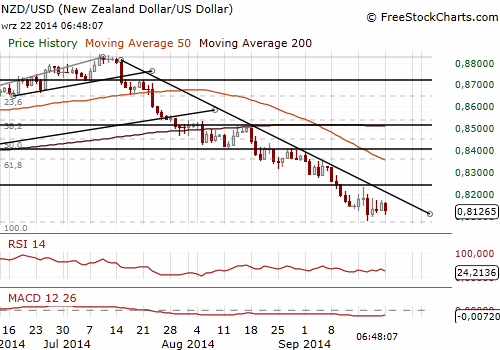

NZD/USD supported by the election’s results.

(NZD/USD in downward trend, but we see a chance of recovery)

The dominant center-right National Party had won 48% of the vote, the strongest result for a single party since New Zealand adopted a proportional election system in 1996. The result gives the National Party 61 of the 121 seats in Parliament, enough to govern alone. Financial markets cheered the results in early Monday trade.

The Westpac-McDermott Miller consumer confidence index fell in the third quarter to 116.7 from 121.2 in the previous quarter.

The NZD/USD opened the week at 0.8140 and rallied to 0.8170 on the result of the National Party. Weak consumer confidence reading was neutral for the NZD/USD. However, the AUD/USD losses pushed the NZD/UZD down towards 0.8100. The downward trend on the NZD/USD is strong. However, GrowthAces.com sees a chance of recovery. Doji weekly candle at 61.8% last week suggests that sellers are losing conviction.

Significant technical analysis' levels:

Resistance: 0.8179 (high Sep 19), 0.8205 (high Sep 17), 0.8221 (high Sep 11)

Support: 0.8081 (low Sep 18), 0.8078 (low Sep 17), 0.8052 (low Feb 4)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.