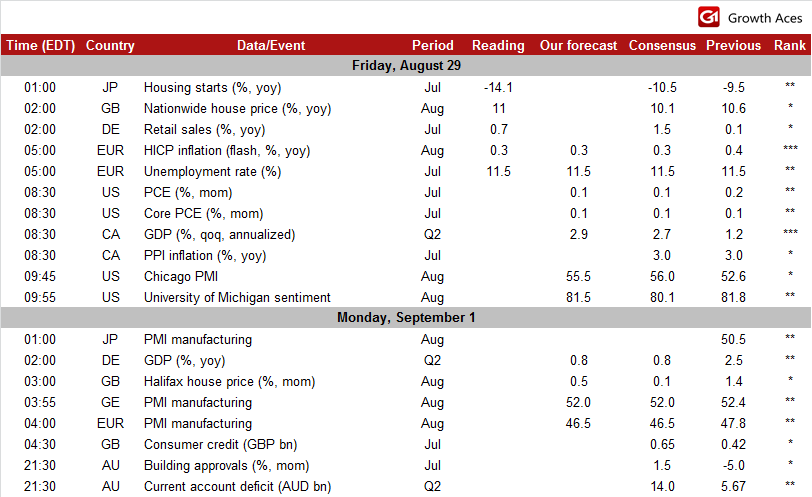

ECONOMIC CALENDAR

EUR/USD: EZ inflation eased, as expected.

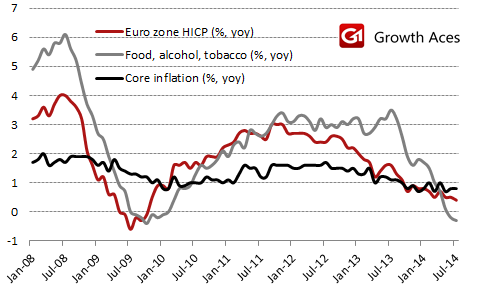

Euro zone inflation has eased slightly to 0.3% yoy, as expected, and down from 0.4% yoy in July. The reading was in line with the consensus forecast and left inflation at its lowest rate since October 2009.

Annual energy inflation fell from -1.0% to -2.0%. Meanwhile, food, alcohol and tobacco inflation remained at -0.3%. HICP excluding energy, food, alcohol and tobacco rose to 0.9% yoy from 0.8% yoy in the previous month.

- Unemployment rate amounted in July to 11.5%. The rise by 4,000in the number of unemployed was the first increase since September 2013. This is the sign that the labour market recovery is fading and will not generate pressure on wages and prices in the near future. Any immediate action coming at the ECB's policy meeting scheduled for September 4 is not considered likely.

- German July retail sales have come in much worse than expected at -1.4% mom and 0.7% yoy from 0.4% yoy in the previous month and the consensus forecast of 0.1% mom.

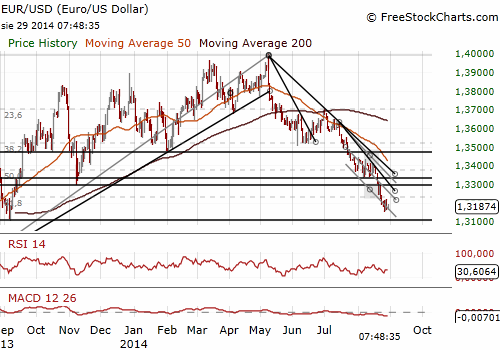

- The EUR/USD rose to a day’s high of 1.3195 soon after the inflation data. The investors are focused on the ECB’s meeting next week. We do not expect extraordinary dovish tone from M. Draghi. On the other hand, geopolitical situation and poor macroeconomic data from the Euro-zone will keep the EUR weak. We stay flat on the EUR/USD.

Significant technical analysis' levels:

Resistance: 1.3222 (hourly high Aug 28), 1.3297 (high Aug 22), 1.3324 (high Aug 20)

Support: 1.3151 (low Aug 27), 1.3105 (low Sep 6), 1.3089 (low Jul 19)

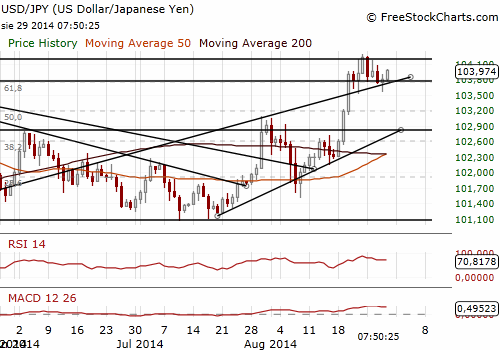

USD/JPY: Weaker Japan’s macroeconomic data supported USD/JPY.

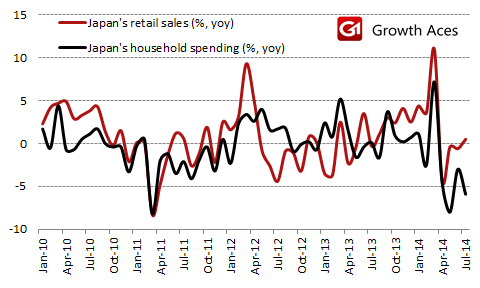

The Ministry of Economy, Industry and Tradeannounced that industrial output rose 0.2% mom, much less median forecast of 1.0% mom. Manufacturers expect output to rise 1.3% in August and 3.5% in September. But the ministry said there was uncertainty on whether production will rise as companies had continued to overestimate their outlook plans.

Household spending fell 5.9% yoy in July. The reading was much weaker than forecast. Poor data were the result of higher sales tax and bad weather that kept consumers at home instead of going out shopping. On the other hand, Japanese retail sales rose 0.5% yoy in July. The data beat expectations of 0.1% yoy.

Japanese Finance Minister Taro Aso said that the impact of April's sales tax hike on the economy is gradually easing but it needs close monitoring from now on. Japanese Economics Minister Akira Amari said on Friday there is no need to be so pessimistic about household spending, after data showed it had fallen more than expected in July.

Japan's July consumer prices were up 3.4% yoy, in line with expectations. The central bank of Japan estimates that the sales tax hike carried out in April has pushed the inflation rate up by about 2 pps. The bank aims at lifting the rate to 2% in fiscal 2015, without the effect of the tax hike. The core consumer price index, which includes oil products but excludes fresh food prices, amounted to 3.3% yoy. The so-called core-core inflation index, which excludes food and energy prices and is similar to the core index used in the United States, rose 2.3% yoy in July.

Japan’s unemployment rate went up to 3.8% in July vs. the median forecast of 3.7% and the reading of 3.7% in the previous month.

Japan’s housing starts fell by 14.1% yoy in July. The reading was weaker than the median forecast (a fall by 10.5% yoy). Housing starts declined by 9.5% yoy in June. Starts totaled 72k and this was the fifth consecutive fall in yoy terms. Construction orders rose 24.4% yoy vs. a rise of 9.3% yoy in June.

In line with the scenario of GrowthAces.com weaker Japanese macroeconomic data pushed the USD/JPY up. The rate is going to test the level of 104.00. The break above the level will open the way to 104.49 (August high). Technical situation supports further gains of the USD/JPY (tenkan and kijun lines are positively aligned). We maintain our long position. Geopolitical situation is still the main risk for our strategy.

Significant technical analysis' levels:

Resistance: 104.16 (high Aug 27), 104.49 (high Aug 25), 104.84 (high Jan 23)

Support: 103.66 (session low Aug 29), 103.50 (low Aug 22), 103.35 (38.2% of 101.51-104.49)

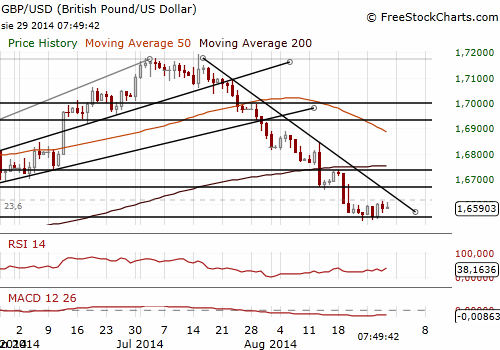

GBP/USD higher after better UK macro data.

British house prices rose in August at a faster monthly pace than expected. Mortgage lender Nationwide said house prices rose 0.8% mom and 11.0% yoy in August compared with a 0.2% mom and 10.6% yoy rise in July. The reading was higher than expected (0.2% mom, 10.1% yoy).

Polling company GfK said its monthly consumer confidence index rose to +1 in August from -2 in July.

The GBP strengthened after strong macroeconomic data. The USD/GBP broke above 1.6600, which gives us more faith to our long position opened yesterday. We still see the target at 1.6690, near 200-dma.

Significant technical analysis' levels:

Resistance: 1.6615 (hourly high Aug 28), 1.6680 (high Aug 20), 1.6690 (200-dma)

Support: 1.6568 (hourly low Aug 28), 1.6537 (low Aug 27), 1.6501 (low Aug 25)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0650 ahead of Eurozone PMI data

EUR/USD remains on the back foot near 1.0650 in European trading on Tuesday. Resurgent US Dollar demand amid a cautious risk tone weighs on the pair. Investors stay wary ahead of the preliminary Eurozone and US business PMI data.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold could see a rebound before resuming the correction

Gold price sees a fresh leg down in Asia on Tuesday even as risk flows dissipate. Receding fears over Middle East escalation offset subdued US Dollar and Treasury bond yields. Gold remains heavily oversold on the 4H chart, rebound appears in the offing.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.