Earlier today, the U.S. Department of Labor reported that the number of initial jobless claims in the week ending December 4 rose by 13,000 to 282,000, missing analysts’ forecasts. As a result, the USD Index moved slightly lower, but did it change anything in the short-term picture of the euro?

In our opinion, the following forex trading positions are justified – summary:

EUR/USD: none

GBP/USD: none

USD/JPY: none

USD/CAD: none

USD/CHF: none

AUD/USD: none

EUR/USD

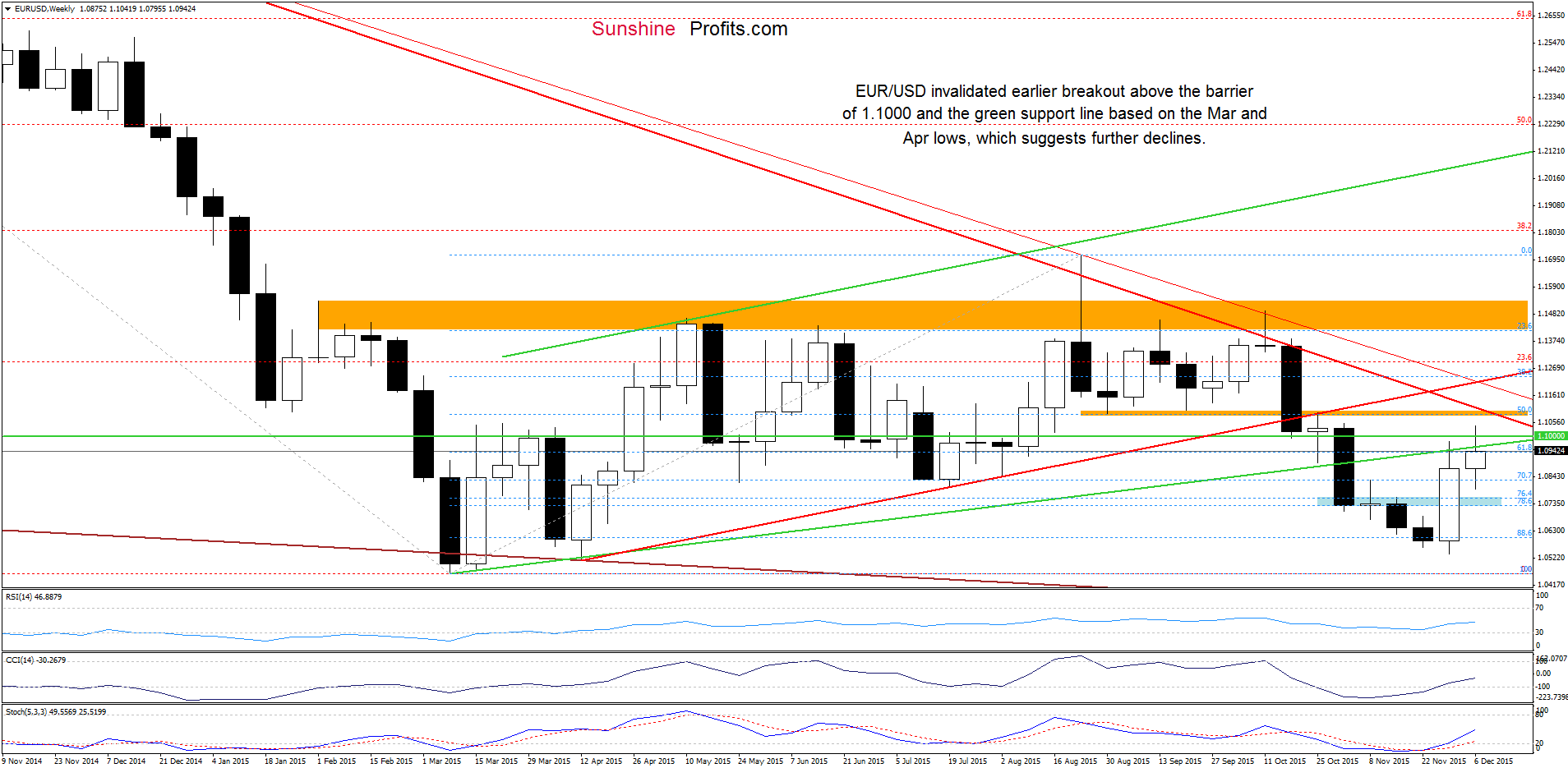

Looking at the weekly chart, we see that EUR/USD invalidated breakout above the barrier of 1.1000 and the green line based on the Mar and Apr lows, which suggests further declines.

How did this move affect the very short-term picture? Let’s check.

Quoting our previous commentary:

(…) the exchange rate extended gains, which resulted in a climb to our yesterday’s upside target. If the pair moves higher from here, we’ll see a test of the strength of the previously-broken green resistance line (based on the Mar and Apr lows and marked on the weekly chart) in the coming day(s). If it is broken, currency bulls will likely push EUR/USD to the last week’s high.

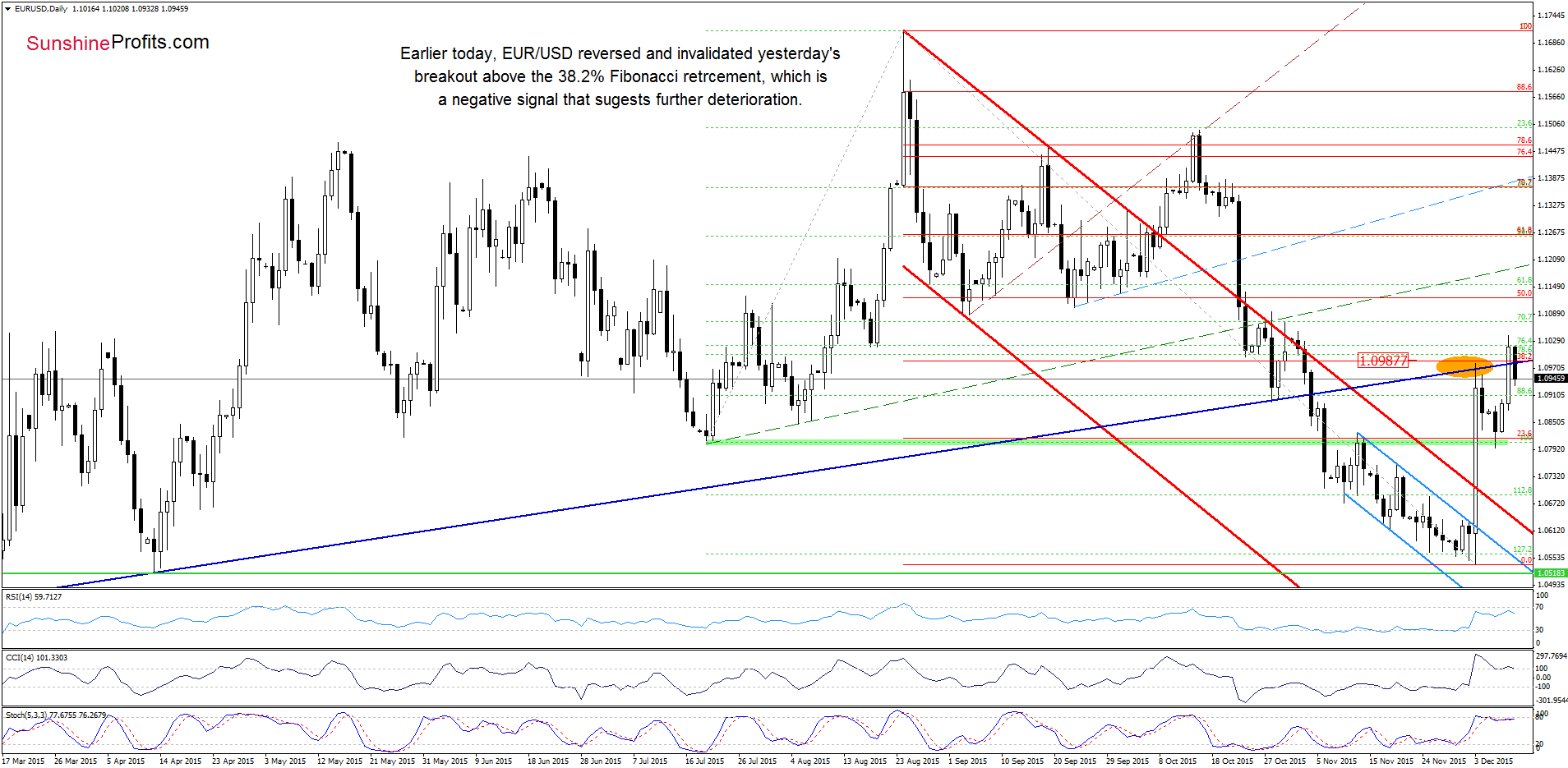

As you see on the daily chart, currency bulls not only took the pair to our upside target, but also pushed it above the 38.2% Fibonacci retracement. Despite this improvement, they didn’t manage to hold gained levels, which resulted in a reversal earlier today. With this downswing, the exchange rate invalidated yesterday’s breakouts, which is a negative signal that suggests further declines and a test of the Wednesday’s low.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment.

USD/CAD

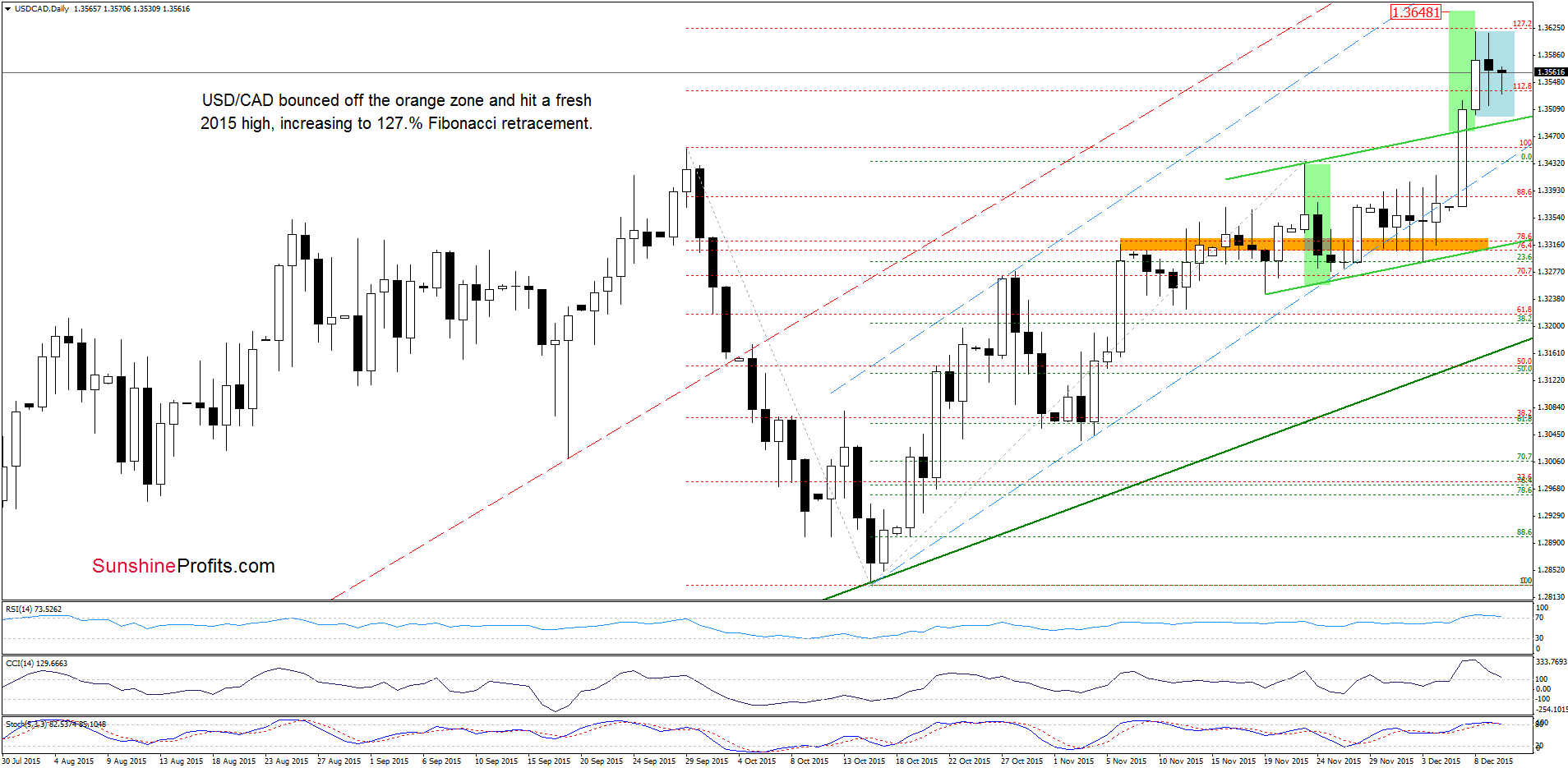

On the daily chart, we see that USD/CAD bounced off the orange zone and the lower border of the green rising trend channel, which resulted not only in a rally to a fresh 2015 high, but also in a breakout above the upper border of the channel. This positive signal triggered further improvement and an increase to the 127.2% Fibonacci extension. As you see this resistance level pushed the pair little lower, but USD/CAD remains in the blue consolidation. Although the current position of the indicators suggests further declines, we think that earlier breakouts and the current situation in crude oil (if you want to have a more complete picture of the commodity and the oil sector we encourage you to sign up for Oil Trading Alerts or the Fundamental Package that includes it) will encourage currency bulls to act – especially when we factor in the long-term picture.

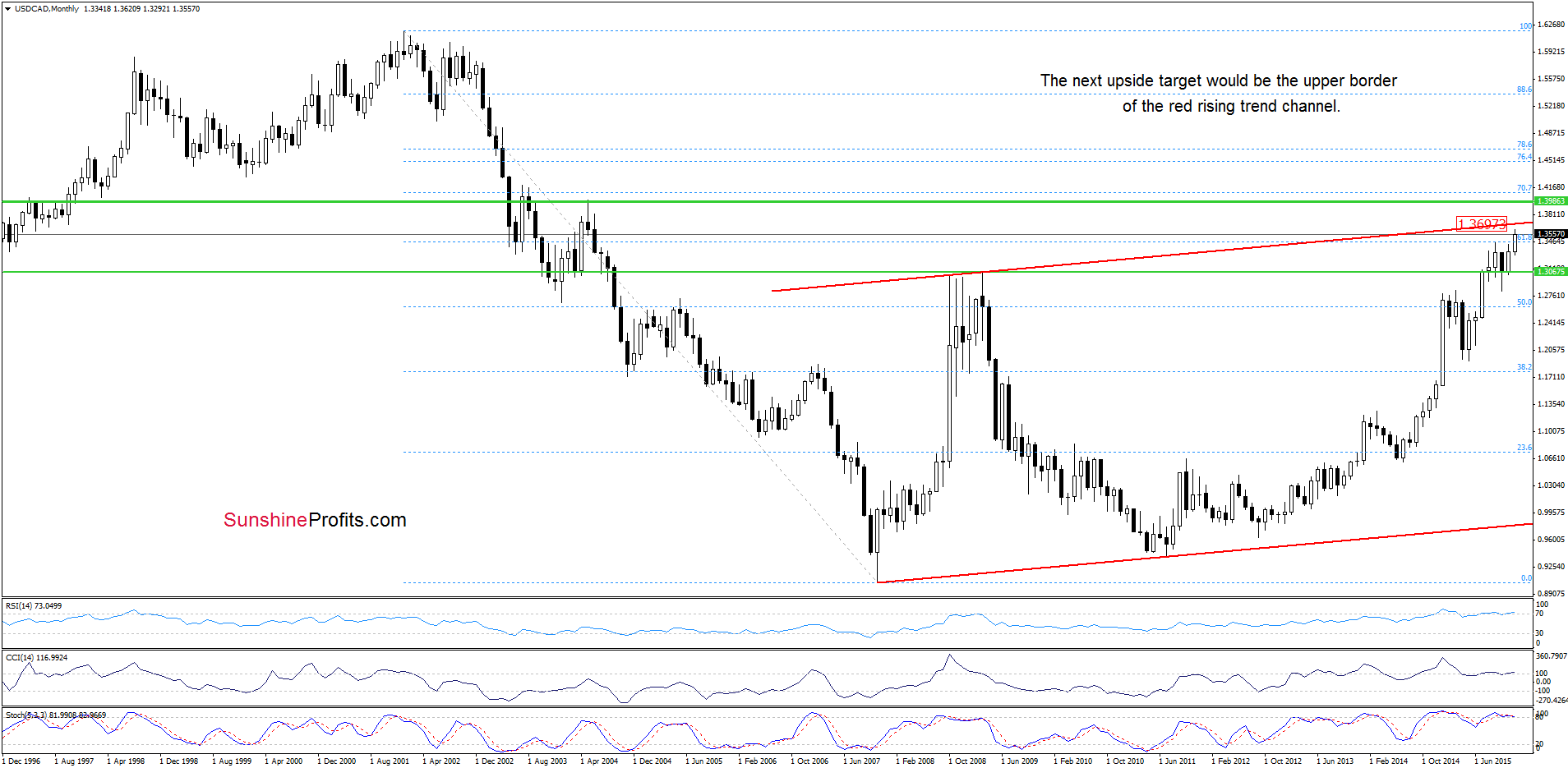

From this perspective, we see that the next upside target for currency bulls would be around 1.3700, where the upper border of the red rising trend channel is.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment.

AUD/USD

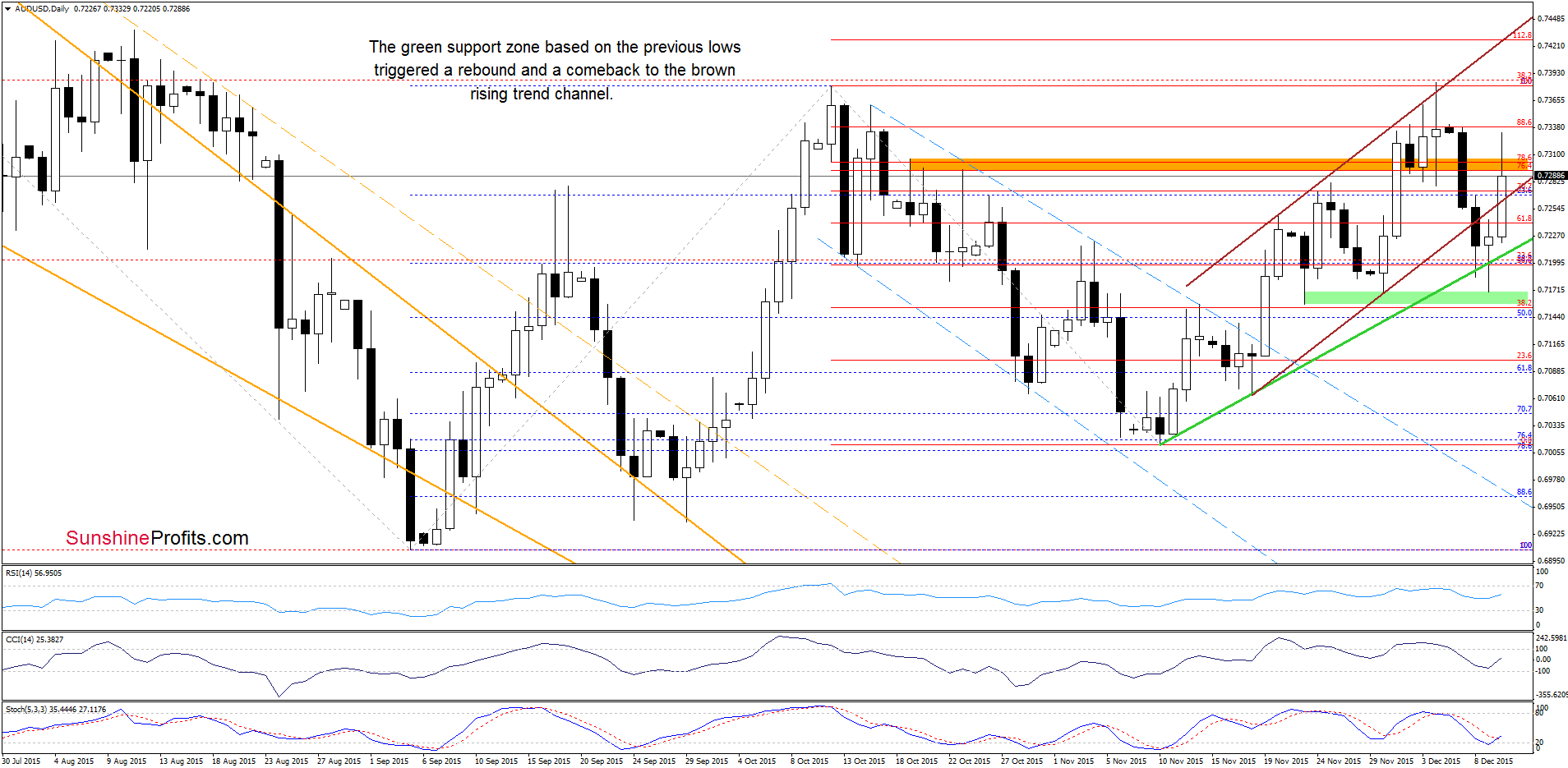

The proximity to the previously-broken orange line and the green support zone stopped currency bears, which resulted in a rebound.

What impact did this move have on the daily chart? Let’s check.

Looking at the daily chart we see that the breakdown under the lower border of the brown trend channel triggered a decline to the green support zone based on the previous lows. This area, in combination with the medium-term supports triggered a sharp rebound, which took the pair to the trend channel. In this way, AUD/USD invalidated earlier breakdowns, which is a positive signal that suggests further improvement – especially when we factor in the current position of the indicators. Therefore, if the pair closes the day above the orange resistance zone, we may see not only a test of the recent high, but also a climb to the upper border of the short-term trend channel (currently around 0.7418) in the coming days.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold clings to strong daily gains above $2,380

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.