In our opinion, the following forex trading positions are justified - summary:

EUR/USD: none

GBP/USD: none

USD/JPY: none

USD/CAD: none

USD/CHF: none

AUD/USD: none

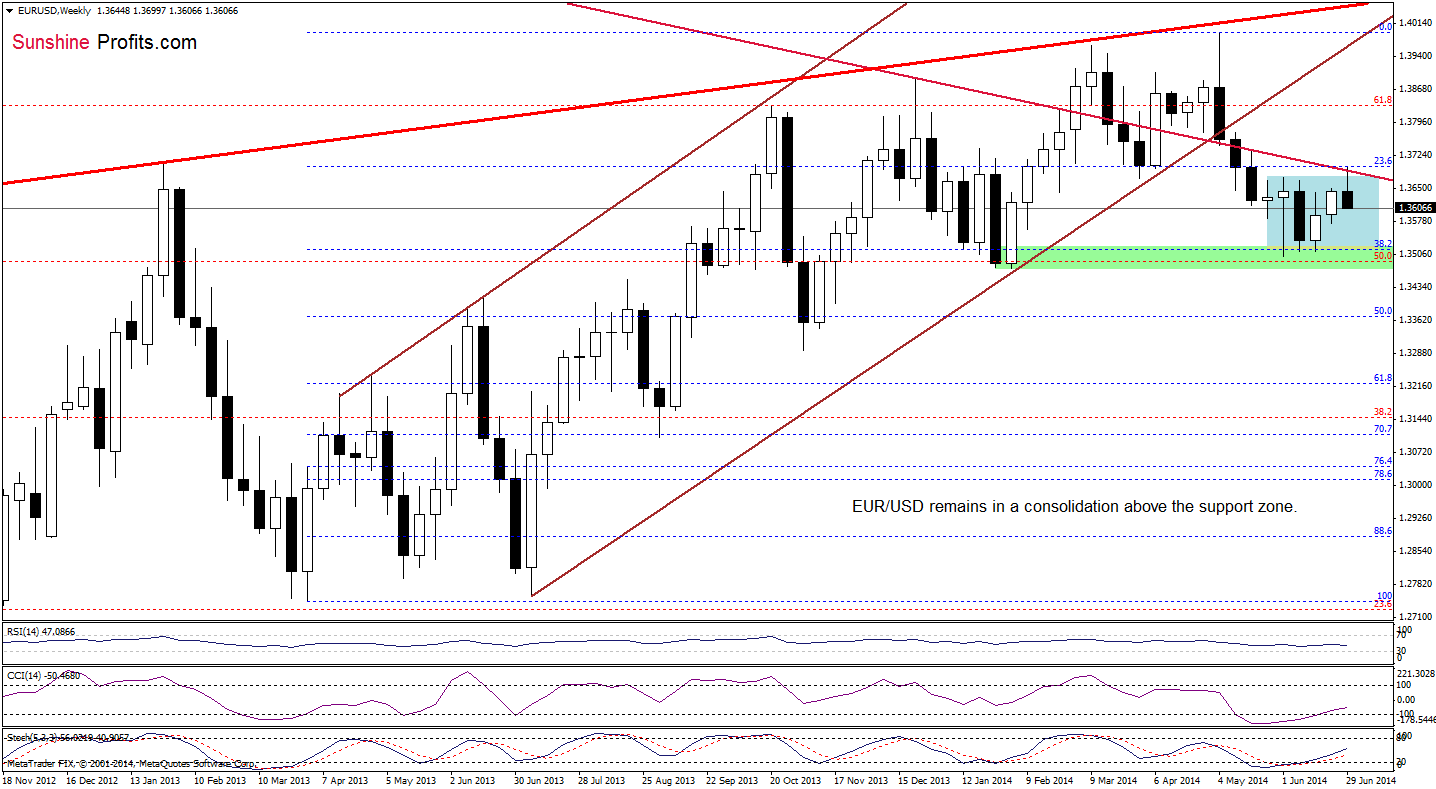

EUR/USD

The situation in the medium term has deteriorated as EUR/USD extended losses below the previously-broken upper line of the consolidation and the long-term resistance line. From this perspective, it seems that the next downside target for forex traders will be last week’s low of 1.3574.

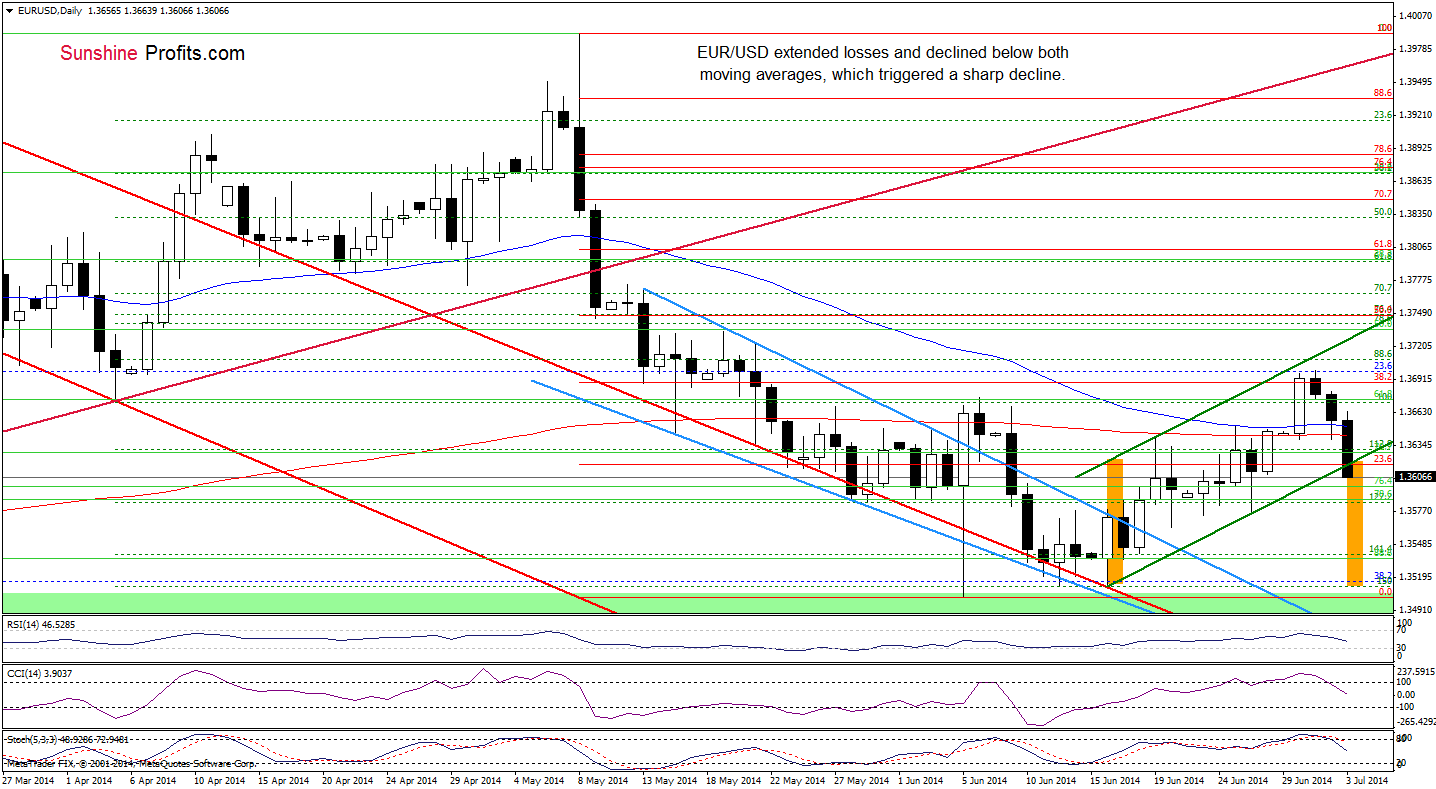

What can we infer from the daily chart?

Quoting our last commentary:

(…) taking into account the current position of the indicators and combining it with the medium-term picture, it seems to us that we’ll see further deterioration in the coming days. If this is the case, the next downside target will be around 1.3564-1.3575, where the bottom of the previous correction is.

On the daily chart, we see that EUR/USD declined below the support zone created by the 50- and 200-day moving averages, which triggered a sharp decline that took the pair below the very short-term green support line. As you see on the above chart, this is also the lower border of the rising trend channel. Therefore, today’s breakdown below this line is a strong negative signal and we think that the exchange rate will extend current correction and we’ll realization of the above-mentioned bearish scenario. At this point, it’s worth noting that if the nearest support area doesn’t hold, we’ll see further deterioration and the next target will be around 1.3520, where the size of the downswing will correspond to the height of the trend channel. Please not that the current position of the indicators also favors currency bears as sell signals remain in place.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: bearish

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective at the moment.

USD/JPY

The situation in the medium term hasn’t changed much as USD/JPY remains between the medium-term support/resistance and the May low of 100.81. Today, we’ll take a closer look at the very short-term picture.

Yesterday, we wrote the following:

(…) the RSI rebounded, while the CCI and Stochastic Oscillator generated buy signals, which suggests that we will also see a breakout above the lower border of the consolidation. If this is the case, the next upside target will be around 102.12, where the upper line of the formation is.

From this perspective, we see that USD/JPY moved higher, in line with our yesterday’s assumptions, and reached the above-mentioned upside target. Taking this fact into account and combining it with the current position of the indicators, we think that we’ll see further improvement in the coming day (or days) and the next target for currency bulls will be around 102.48, where the lower green resistance line is.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective at the moment.

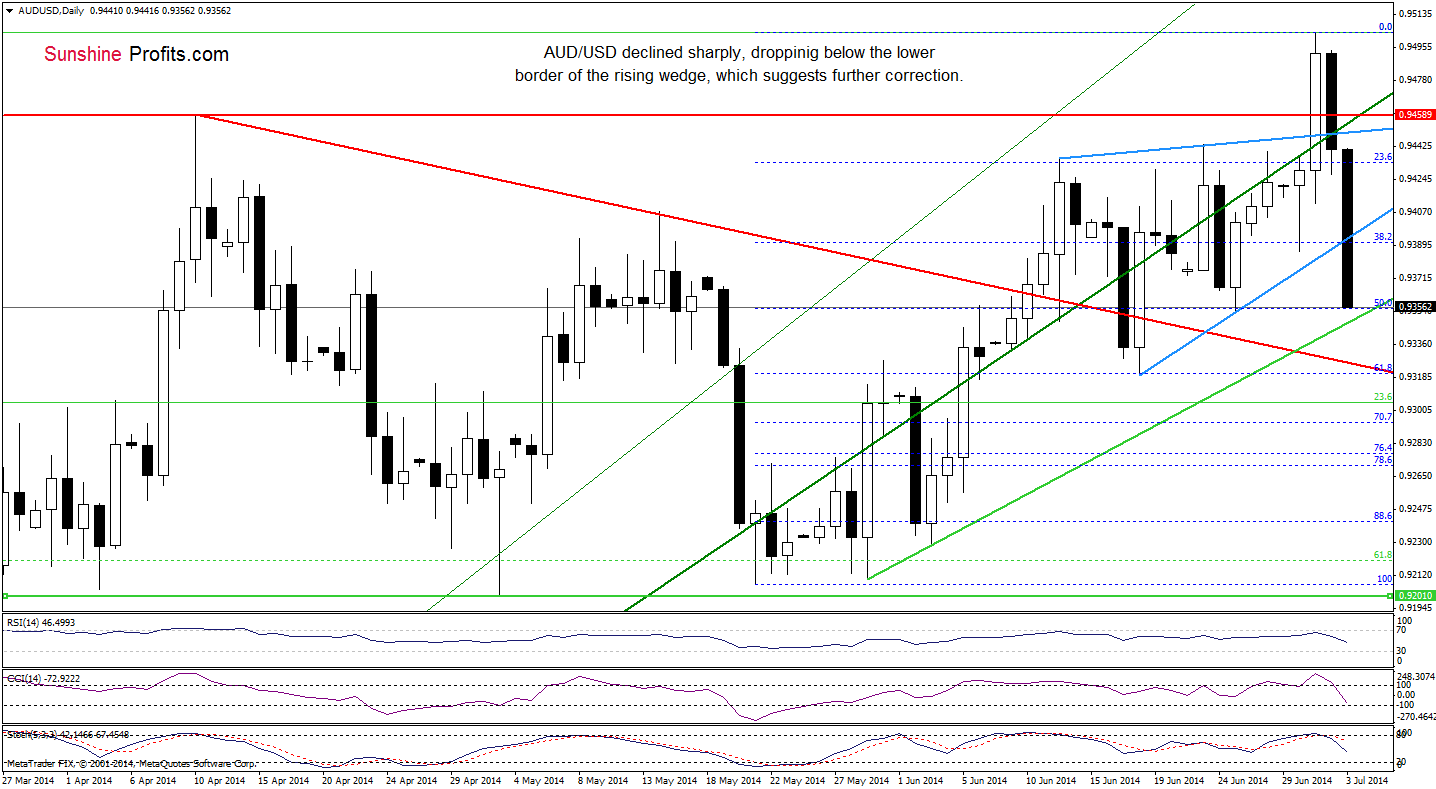

AUD/USD

Today, we’ll focus on the very short-term changes.

Quoting our previous Forex Trading Alert:

(…) although AUD/USD (…) broke above the strong resistance zone (created by the previous 2014 high and the upper line of the rising wedge), the pair reversed, invalidating earlier breakout (a strong negative sign). With this downward move, the exchange rate also dropped below the medium-term green support line, which is an additional bearish signal. On top of that, the Stochastic Oscillator generated a sell signal, while the CCI is close to doing it, which suggests that further deterioration is more likely than not. If this is the case, and the pair extends losses, the initial downside target will be the short-term green line or even the lower border of the rising wedge.

Looking at the above chart, we see that currency bears not only realized the above-mentioned scenario, but also managed to push the pair lower. As a result, AUD/USD declined below the lower border of the rising wedge, reaching the 50% Fibonacci retracement (based on the May-July rally) and approaching the short-term support line based on the May and June lows. If this support area holds, we’ll see a corrective upswing and the initial upside target will be the blue resistance line. However, if it is broken, the next downside target will be around 0.9321-0.9327, where the support zone (created by the red declining support line and the 61.8% Fibonacci retracement) is. Please note, that the current position of the indicators still supports the bearish scenario.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: bearish

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective at the moment.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.