EURUSD – Euro/dollar weakens and forms bearish pin bar

The weekly chart of the EURUSD below shows us a clear indication that this currency pair may want to move lower this week. Notice the large pin bar reversal signal that formed last week as price made a false-break above 1.1450 key resistance. This keeps price contained within the trading range between about 1.1450 – 1.0800 and we can look to be sellers this week on a 1 hour, 4 hour or daily chart sell signal should price retrace slightly higher, in anticipation of price falling further, perhaps down to re-test support near 1.0800.

GBPUSD – Sterling/dollar false-break of key resistance

The GBPUSD also created a false break of resistance last week, and that false break was followed by a powerful move lower. Notice that price ended the week right at key support near 1.5330; if price closes under that 1.5330 level we will become more bearish and will look for selling opportunities. However, there is a small chance price may rally from this support near 1.5330, so if that happens we will remain neutral and wait for an obvious signal either long or short to set up.

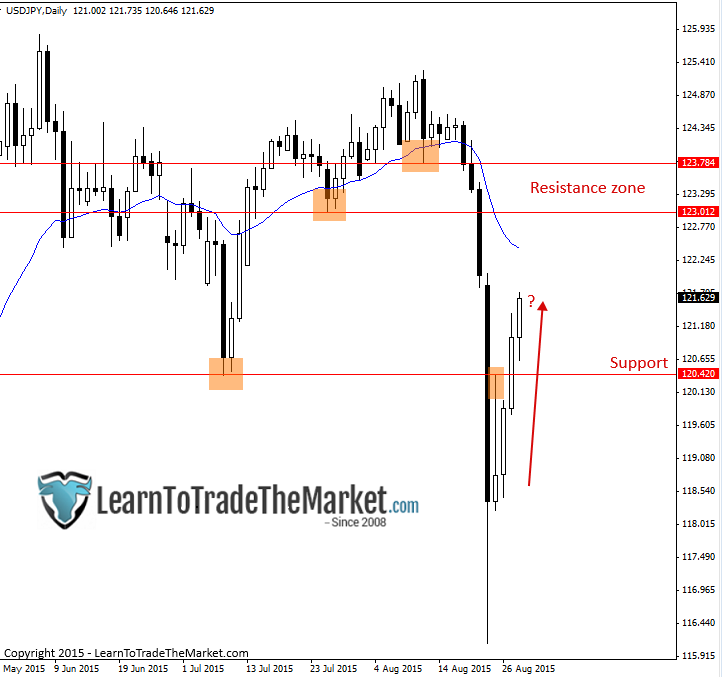

USDJPY – Dollar/yen recovers after sell-off

The USDJPY recovered quite aggressively last week following Monday’s powerful sell-off. I expect price to try and continue pushing higher from here, however, we still have a lot of resistance overhead, so be careful. Price could easily move lower again before building enough bullish momentum to resume the longer-term uptrend.

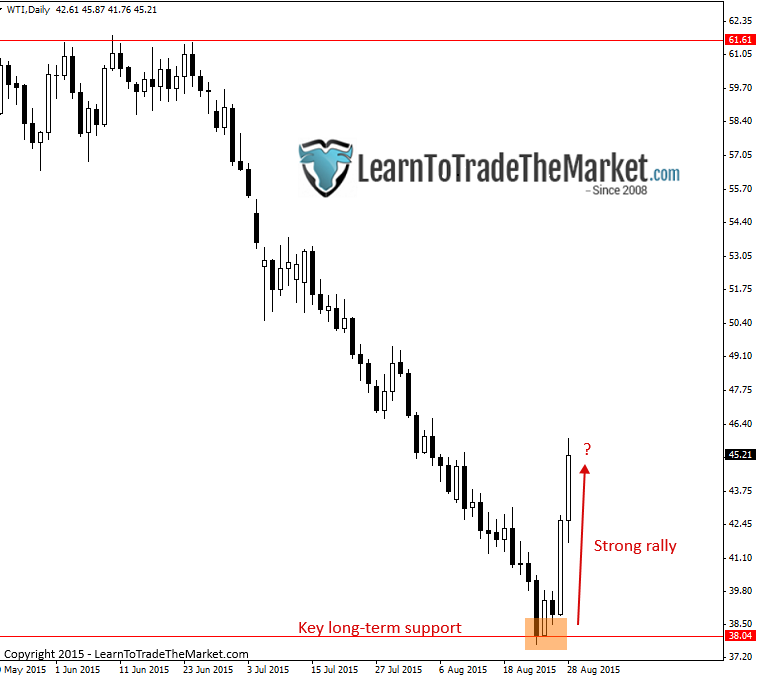

Crude Oil – Crude oil rallies significantly higher after hitting key support

Crude Oil has rallied aggressively higher after hitting key long-term support down near 38.00 last week. We are moving to a more neutral stance on this market for the time being, but if an obvious buy signal forms following a small retrace lower whilst above that 38.00 level, we will consider a long entry.

Copyright 2015 LearnToTradeTheMarket.com

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish. 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.