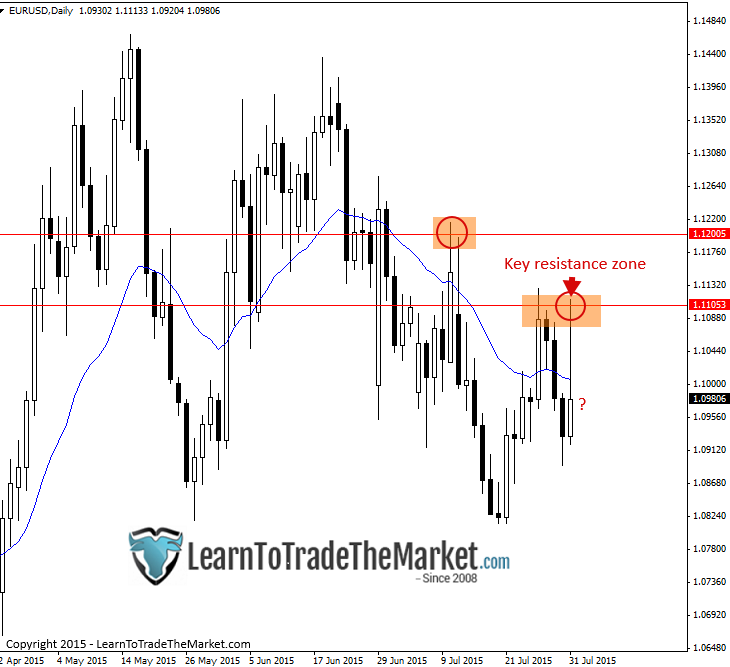

The EURUSD tried to test resistance up between 1.1100 – 1.1200 on Friday, but bears stepped in and quickly pushed the market back lower. Price formed a pin bar signal after reversing from the bottom edge of the resistance zone between1.1100 – 1.1200. This week, traders can look to sell this market perhaps up near the 50% level of Friday’s pin bar or they may wait for an intraday (1 hour or 4hour chart) sell signal from up closer to 1.1100 area. We will remain bearish whilst price is contained under 1.1200 key resistance.

GBPUSD – Sterling/dollar remains buoyant

GBPUSD has remained buoyant recently, despite the weakness in the other major USD pairs. We are looking to be buyers of this market perhaps on a rotation down to near-term support at 1.5500 or slightly above, with a price action confirmation signal. We will remain bullish biased on this market whilst price is trading above 1.5330 key support.

AUDUSD – Aussie/dollar trading just above key support

Last week, the AUDUSD consolidated just above the key support level at 0.7250 and price is still trading just above that level currently. We don’t want to sell here, as we don’t want to sell right into that key long-term support, but the trend is still down and we are bearish on this market so we will wait and look for price action sell signals from higher prices. Traders can watch 0.7450 for price action selling opportunities this week if price retraces higher. A decisive break and close down under 0.7250 would also be a cause to look for sell signals on intraday charts or the daily chart.

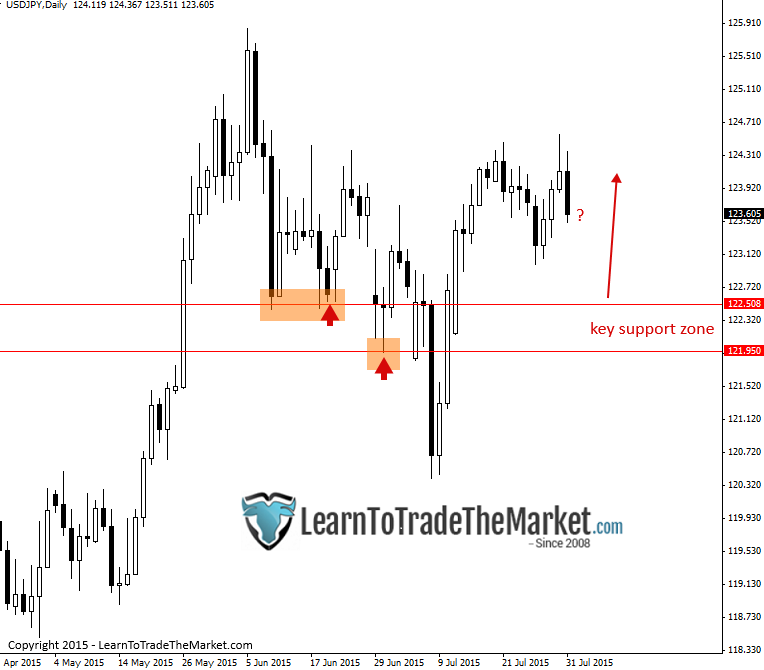

USDJPY – Dollar/yen remains buoyant

The USDJPY remains a potential buy from key support down near 1.2250 – 1.2200 or just above on a 1 hour, 4 hour or daily chart buy signal.

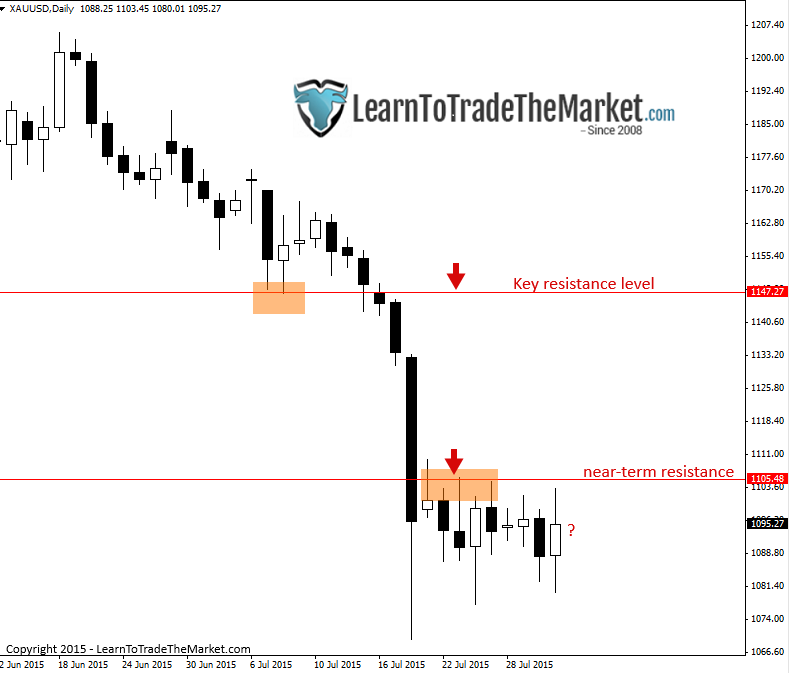

Gold – Spot Gold weakness continues

The spot Gold market continues to remain very weak and we are still watching 1105.00 near-term resistance for 1 hr, 4hr or daily chart sell signals to get short and re-join the downtrend. If price rallies decisively above that level however, we will wait for it to potentially move back up to the key level near1140.00 – 1150.00 and look to sell from there.

Post by Nial Fuller, founder of learntotradethemarket.com

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.