EURUSD – Euro/dollar weakens and forms bearish pin bar

The weekly chart of the EURUSD below shows us a clear indication that this currency pair may want to move lower this week. Notice the large pin bar reversal signal that formed last week as price made a false-break above 1.1450 key resistance. This keeps price contained within the trading range between about 1.1450 – 1.0800 and we can look to be sellers this week on a 1 hour, 4 hour or daily chart sell signal should price retrace slightly higher, in anticipation of price falling further, perhaps down to re-test support near 1.0800.

GBPUSD – Sterling/dollar false-break of key resistance

The GBPUSD also created a false break of resistance last week, and that false break was followed by a powerful move lower. Notice that price ended the week right at key support near 1.5330; if price closes under that 1.5330 level we will become more bearish and will look for selling opportunities. However, there is a small chance price may rally from this support near 1.5330, so if that happens we will remain neutral and wait for an obvious signal either long or short to set up.

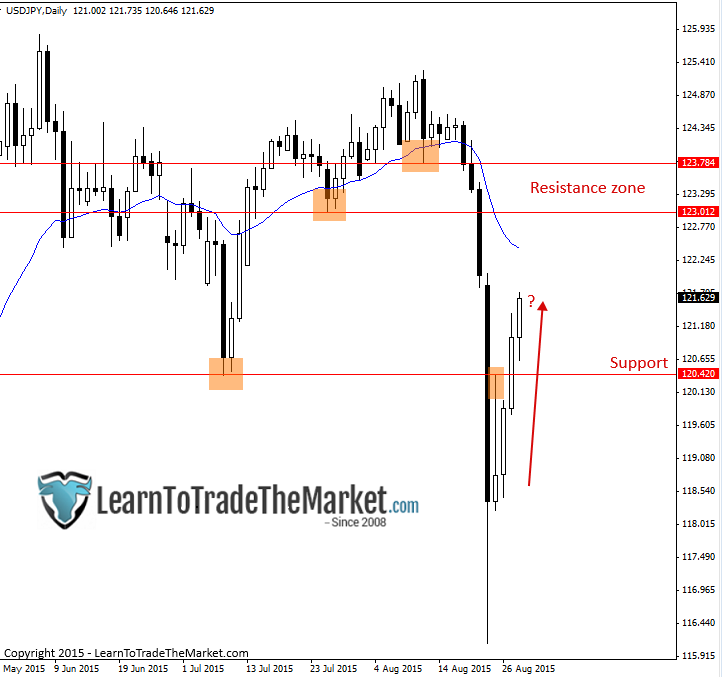

USDJPY – Dollar/yen recovers after sell-off

The USDJPY recovered quite aggressively last week following Monday’s powerful sell-off. I expect price to try and continue pushing higher from here, however, we still have a lot of resistance overhead, so be careful. Price could easily move lower again before building enough bullish momentum to resume the longer-term uptrend.

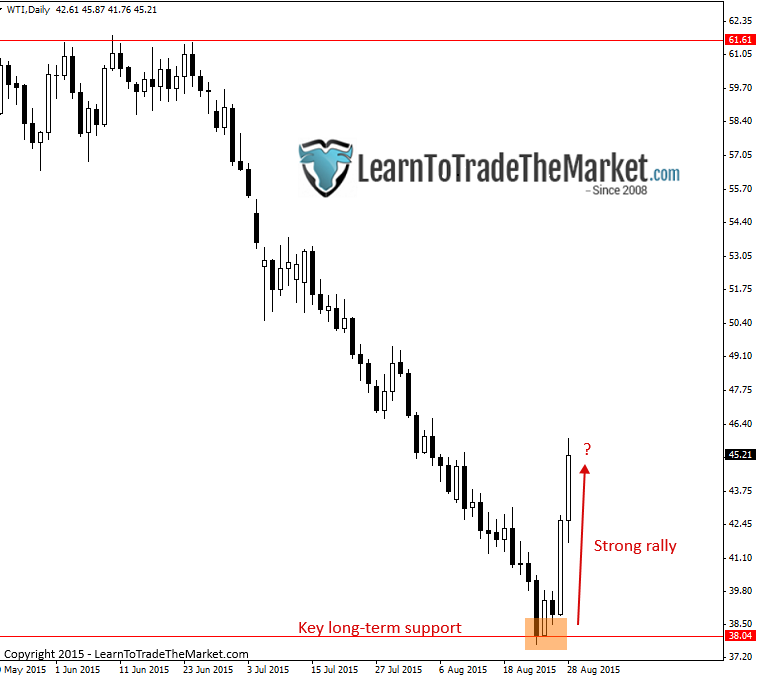

Crude Oil – Crude oil rallies significantly higher after hitting key support

Crude Oil has rallied aggressively higher after hitting key long-term support down near 38.00 last week. We are moving to a more neutral stance on this market for the time being, but if an obvious buy signal forms following a small retrace lower whilst above that 38.00 level, we will consider a long entry.

Copyright 2015 LearnToTradeTheMarket.com

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.