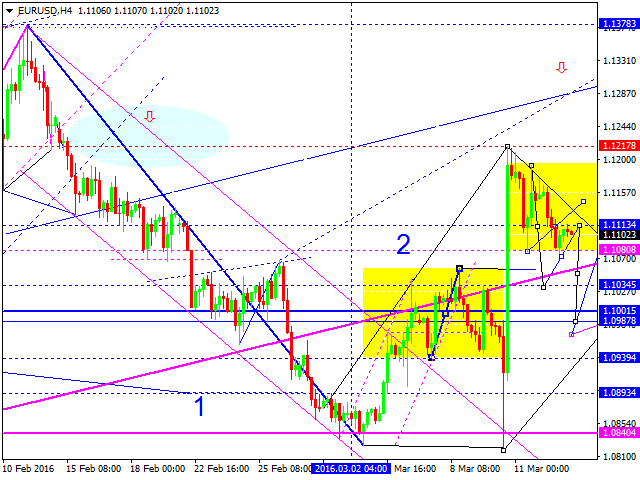

Analysis for March 15th, 2016

EUR USD, “Euro vs US Dollar” After rebounding from 1.1110, Eurodollar continues forming its descending wave with the target at 1.1035. After that, the pair may consolidate. After breaking the minimums, the market may continue falling towards 1.0900.

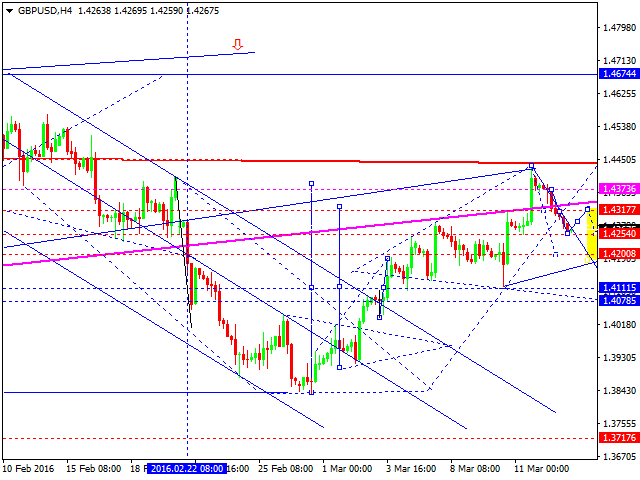

GBP USD, “Great Britain Pound vs US Dollar”

Pound has broken its descending channel; the market is forming the fifth descending wave with the target at 1.3720. We think, today the price may form the first wave with the target at 1.4079.

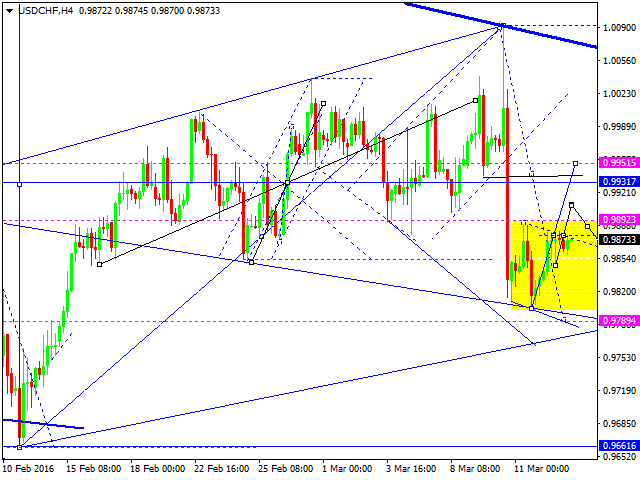

USD CHF, “US Dollar vs Swiss Franc”

Franc is growing towards the upper border of its consolidation channel. Earlier, the market already rebounded from this structure. We think, today the price may expend the channel upwards to reach 0.9950.

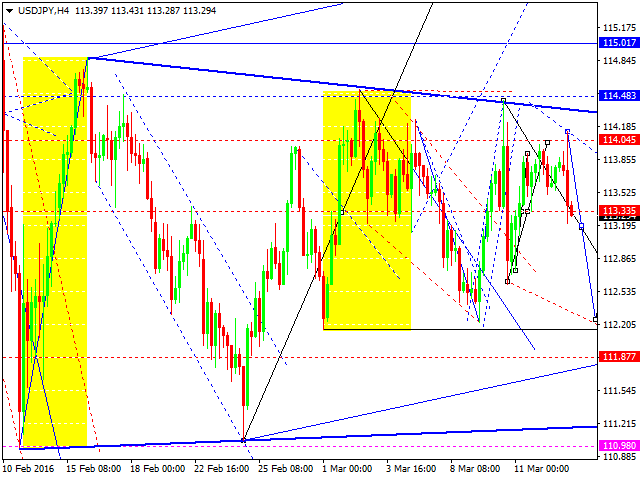

USD JPY, “US Dollar vs Japanese Yen”

Yen has reached the target of its ascending stricture and right now is rebounding from 114.05. After that, the pair may fall to reach 111.88 and then grow to return to 113.35.

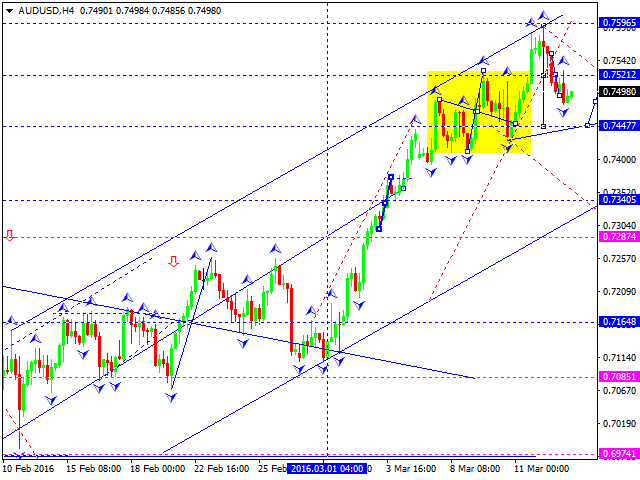

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is forming another descending wave with the target at 0.7440. After that, the pair may test 0.7522 from below and then start another descending wave towards 0.7340.

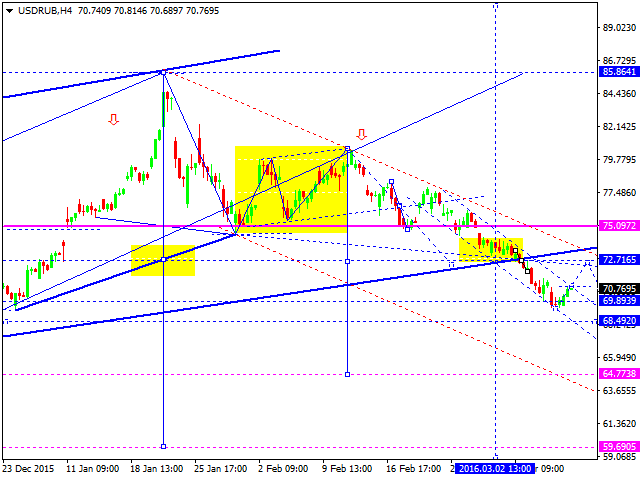

USD RUB, “US Dollar vs Russian Ruble”

Russian Ruble is still moving inside a narrow channel towards 65. An alternative scenario implies that the market may be corrected towards 72. Later, in our opinion, the market may continue falling inside the downtrend to reach 65.

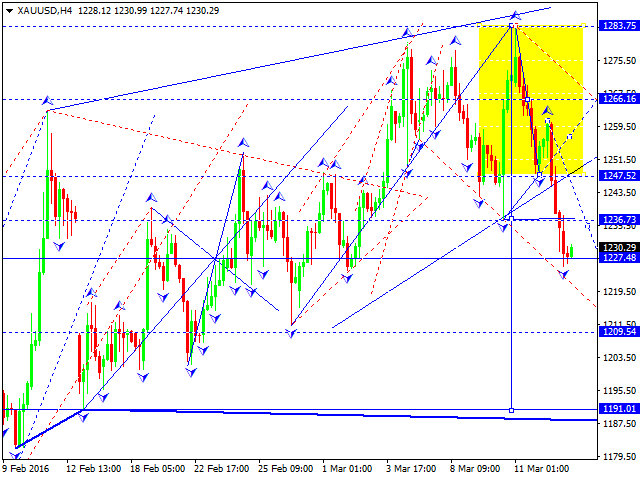

XAU USD, “Gold vs US Dollar”

Gold is still falling towards 1209. Later, in our opinion, the market may be corrected to reach 1236 and then continue moving downwards with the target at 1191.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.