Analysis for February 23rd, 2016

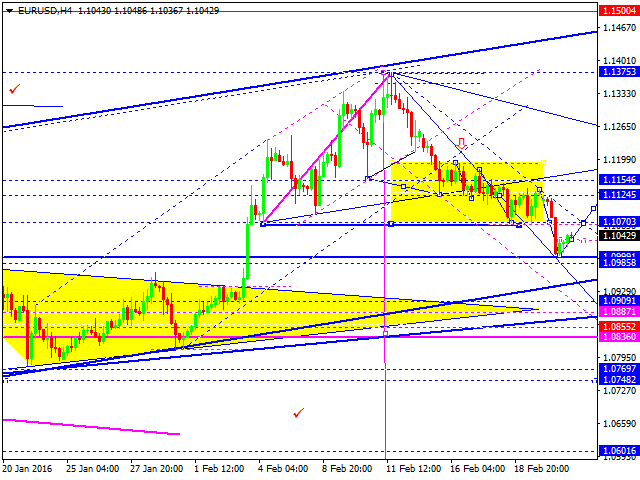

EUR USD, “Euro vs US Dollar”

The euro dollar currency pair is trading in the structure of a declining wave to the refinement of the level of 1.0900. The market has once again expanded the range of consolidation down. Today, we consider the test level of 1.1070 (as a minimum). As a maximum, a correction to the level of 1.1125 is possible. Furthermore – continuation in the trend down to the testing of the specified target.

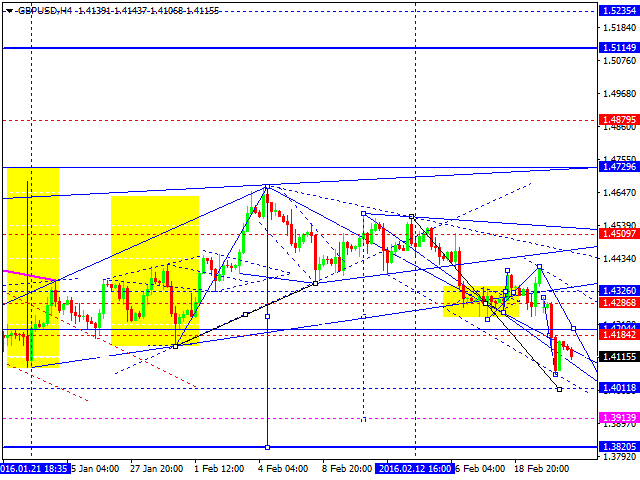

GBP USD, “Great Britain Pound vs US Dollar”

The pound against US dollar currency pair is trading under pressure to decline. The consolidation range broken down. The market reversed the fifth wave of growth and continues to decline to the target of 1.3850. Today we consider the refinement of the level of the local target at 1.4000. Next - a correction to the level of 1.4285. Then - a decline of testing the primary target.

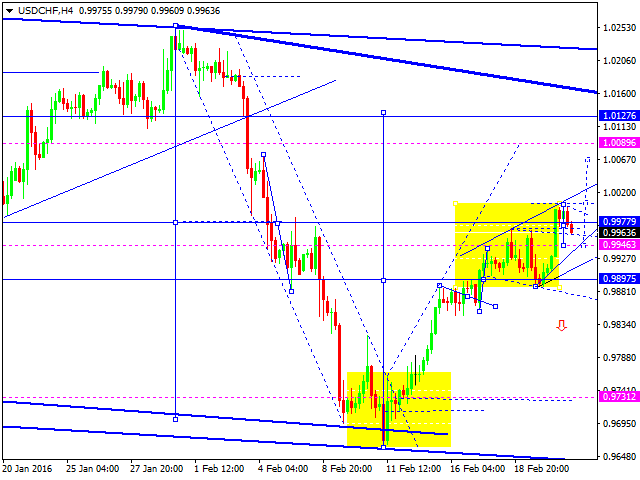

USD CHF, “US Dollar vs Swiss Franc”

The USD CHF currency pair broke through the consolidation up. The potential for growth to testing of the main target at the level of 1.0127 is almost open. Today we consider the possibility of a correction to 0.9946 (as a minimum). As a maximum, and we do not exclude the reduction to the level of 0.9898, the test above. Furthermore - continued growth to testing of the main target.

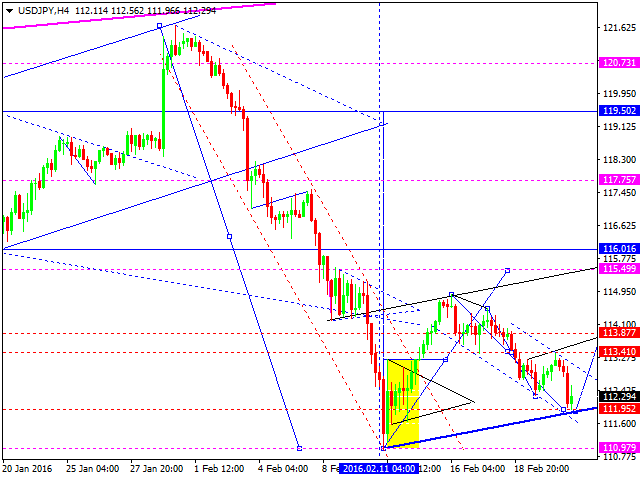

USD JPY, “US Dollar vs Japanese Yen”

The dollar yen currency pair almost fulfilled the correction in the fifth wave. Today we consider the overlap at the level of 111.95, and the completion of the correction. The next consider an increase to the refinement of the level of 115.50. Next - a return to the level of 113.00.

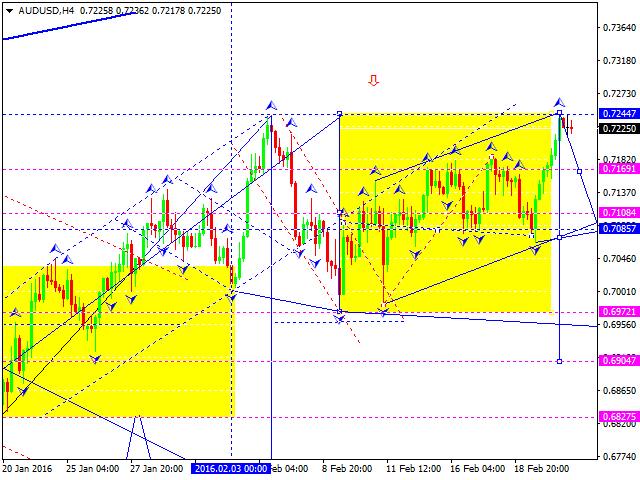

AUD USD, “Australian Dollar vs US Dollar”

The Australian dollar against the US dollar has fulfilled the target of the fifth wave of growth. Today we consider the possibility a reduction to the level of 0.7086. Next - a correction to 0.7170. Then, we consider the continued reduction to the refinement of the level of 0.6660.

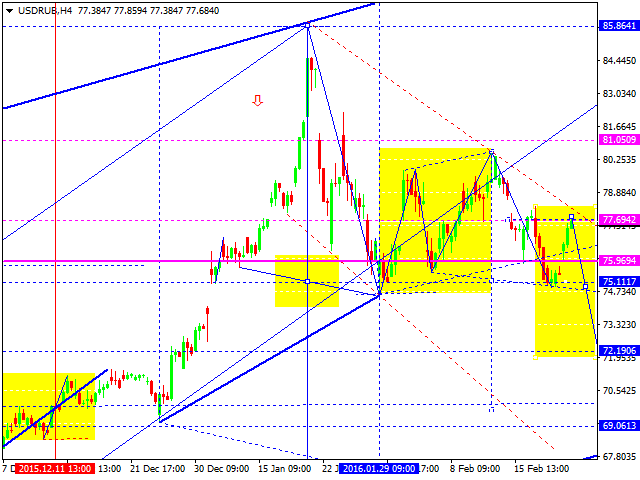

USD RUB, “US Dollar vs Russian Ruble”

The Russian ruble will not be trading today. The market is closed due to the Defender of the Fatherland day.

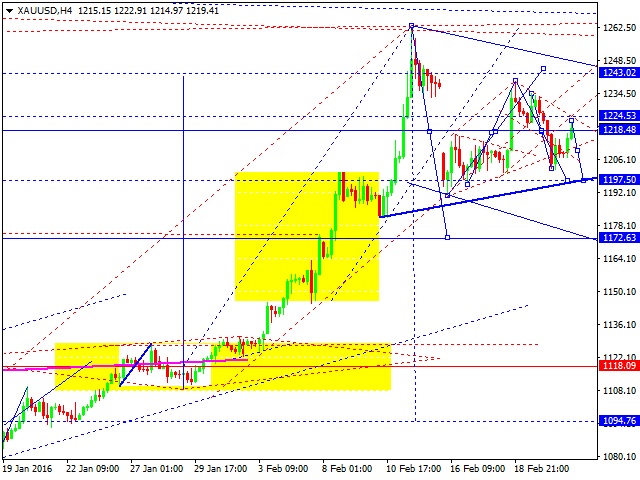

XAU USD, “Gold vs US Dollar”

Gold is trading in the structure of a "Triangle". Today, we consider the refinement of the level of the upper limit of 1226. Next, we consider the possibility of a rebound down with a reduction to the level of 1186.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.