Analysis for February 22nd, 2016

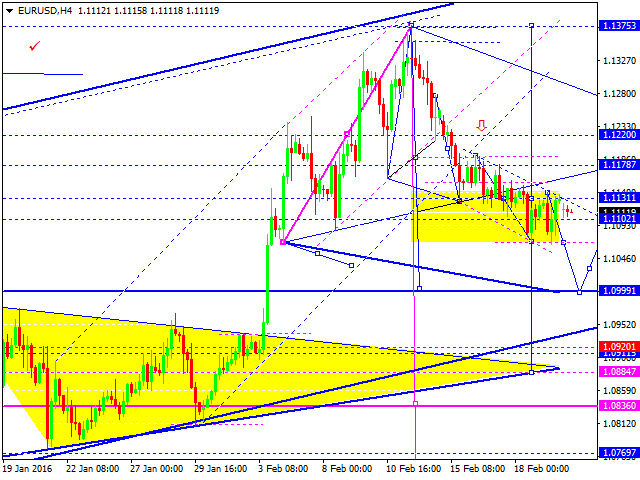

EUR USD, “Euro vs US Dollar”

The euro dollar currency pair is now under pressure to decline. With the breakdown of minimums, we consider the continued decline to the level of 1.1000. In practice, the market trades the first wave of reduction to the level of 1.0900. Now the whole structure is lined with lows updates through consolidation ranges. The market has not yet performed a correction to this decrease and at any time the pair can go to test below 1.1250. Then - again a continuation of the downtrend.

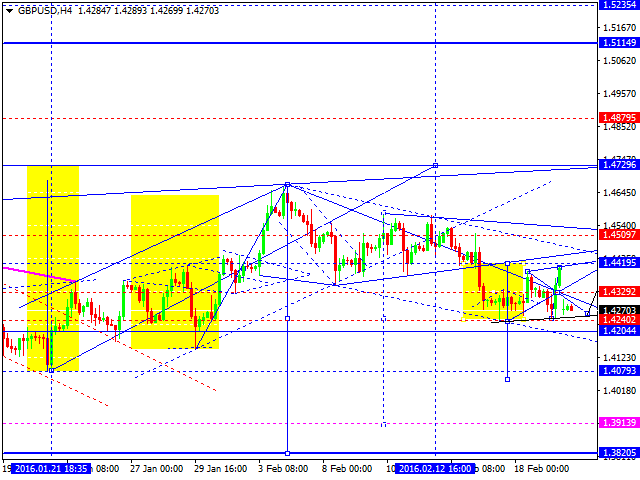

GBP USD, “Great Britain Pound vs US Dollar”

The pound to US dollar currency pair is trading under pressure to decline. The structure has a three wave character. We do not rule out the development of the fifth wave in the testing of the level of 1.4700. Then - with the trend, a decline to the level of refinement of 1.3850. But if the market will be able to update the lows in the current structure of the reduction, it immediately opens the potential for a continued downward trend with working the main target of decline.

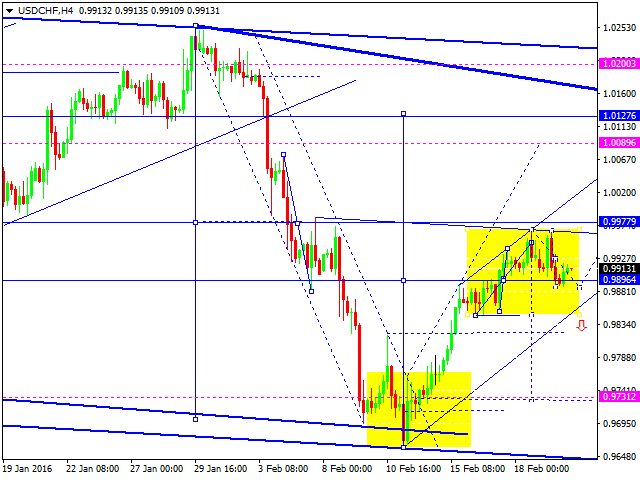

USD CHF, “US Dollar vs Swiss Franc”

The dollar franc currency pair performed almost a return to the centre of the consolidation range. With an upgrade of the maximum of the range, the testing of the potential level of 1.0127 will be opened. With the breakdown through the minimum, the market can go in a correction to the level of 0.9730.

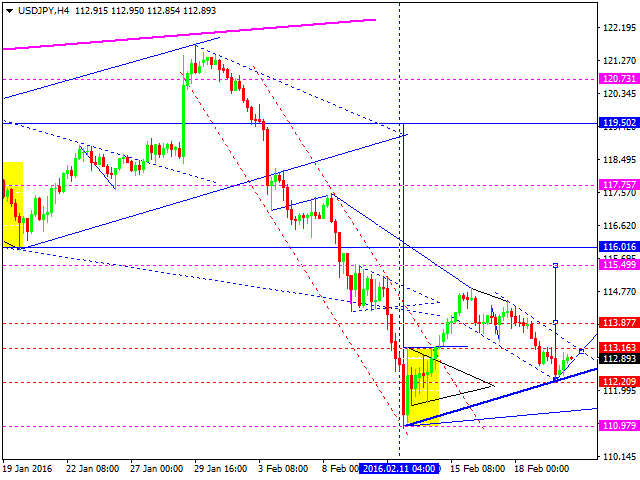

USD JPY, “US Dollar vs Japanese Yen”

The dollar yen currency pair stretched the structure of the correction. The next step - the fifth component of the growth to the level of 115.50. Then the wait for its termination. Next in line - reduction back to the level of 113.00. Therefore we expect the formation of a broad consolidation structure. With a break down we consider the continuation of the downward trend, with a break up - correction to the level of 120.70.

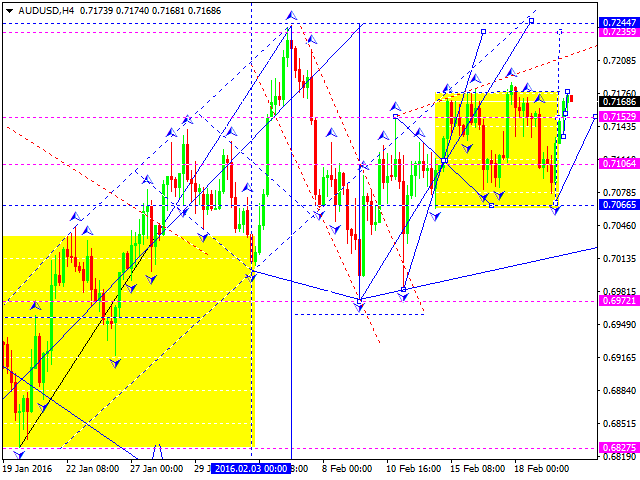

AUD USD, “Australian Dollar vs US Dollar”

Australian dollar against the US dollar was trading virtually within a consolidated range. Today we consider the possibility of expanding its upper limit to the level of 0.7236. Next - a return to the level of 0.7060. And we assume another maximum update. Here, the completion of the planned wave of growth. The next step - a continuation of the trend to decline to the level of 0.6660.

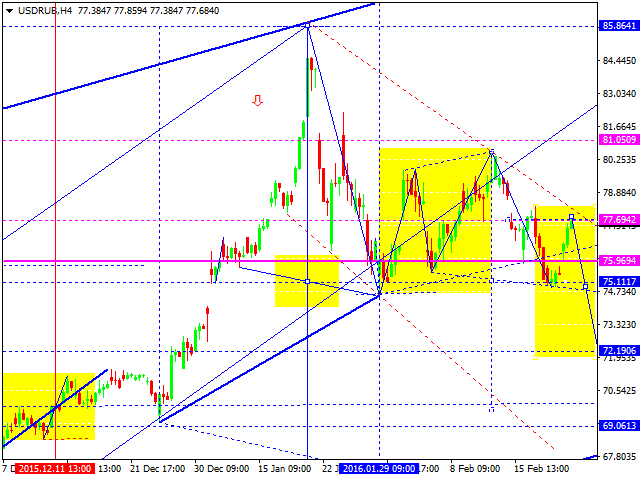

USD RUB, “US Dollar vs Russian Ruble”

Russian ruble will not be traded today and tomorrow. The market is closed on the occasion of the Defender of the Fatherland day.

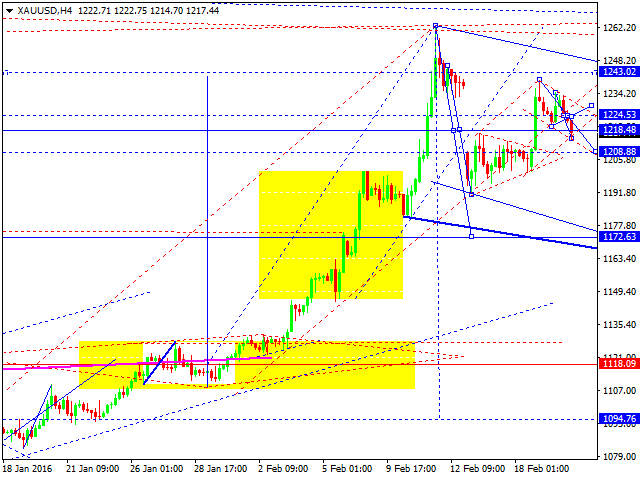

XAU USD, “Gold vs US Dollar”

Gold is now trading under pressure to decline. We do not exclude one more emission of the price to the level of 1243. Next in line - the main scenario for the continuation of the trend to decline to the level of 1117.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.