Analysis for February 19th, 2016

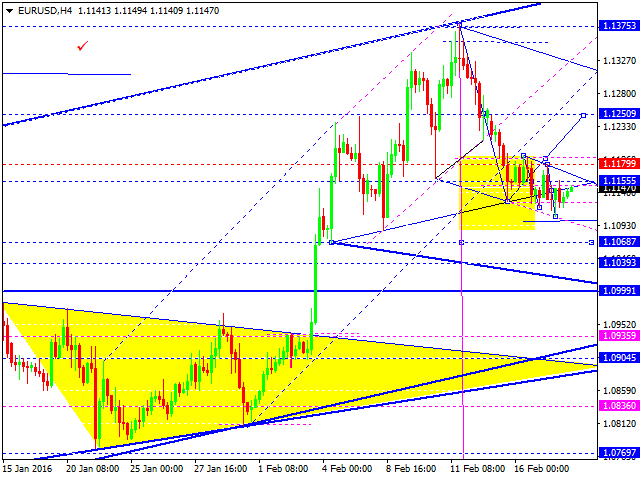

EUR USD, “Euro vs US Dollar”

At the H4 chart, Eurodollar has fallen to reach its target and broken the descending channel; the pair has almost reached the closest target of the correction. Possibly, today the price may fall towards 1.1000 and then start another correction with the target at 1.1250.

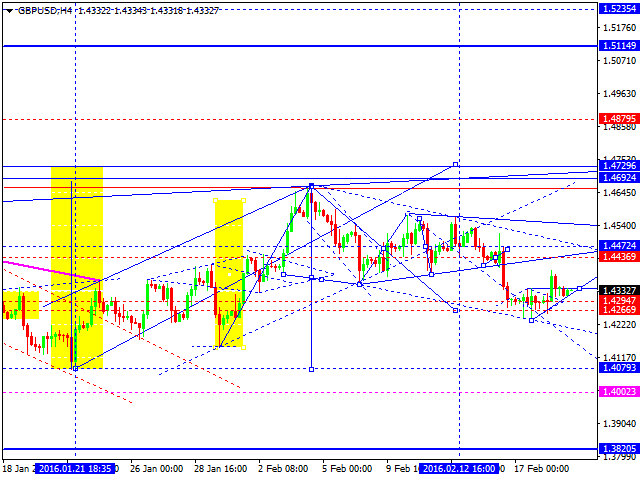

GBP USD, “Great Britain Pound vs US Dollar”

Pound has expanded its consolidation channel upwards. We think, today the price may continue growing towards 1.4440 and then fall to reach 1.4300.

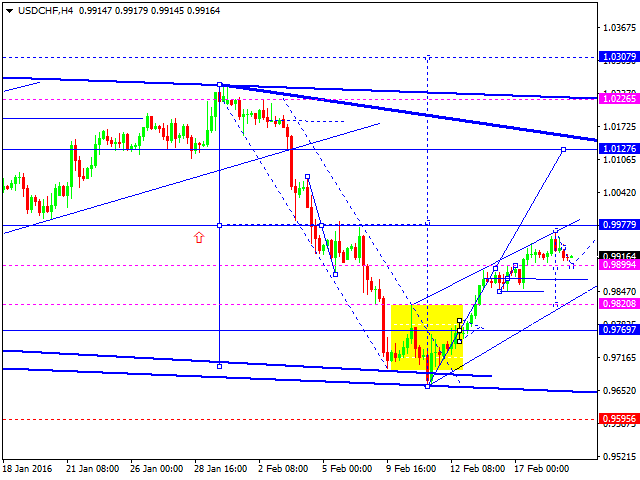

USD CHF, “US Dollar vs Swiss Franc”

Franc continues moving upwards. We think, today the price may reach 0.9980 and then grow towards 1.0127. Later, in our opinion, the market may start another correction towards 0.9820.

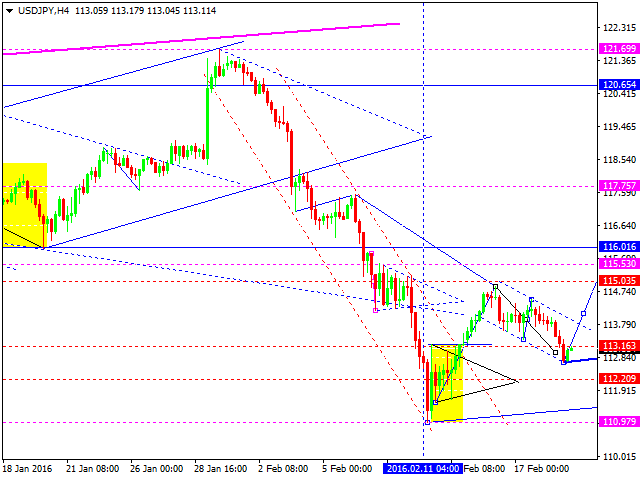

USD JPY, “US Dollar vs Japanese Yen”

Yen has completed its descending structure as a correction. We think, today the price may grow towards 115.50 and then fall to return to 113.00.

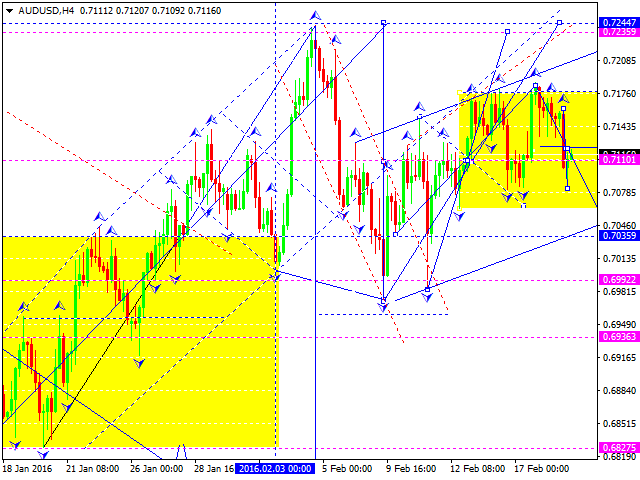

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is still consolidating and falling towards 0.7050. After reaching it, the market return to 0.7150. If the channel is broken upwards, the price may reach 0.7250; if downwards - the downtrend may continue towards 0.6660.

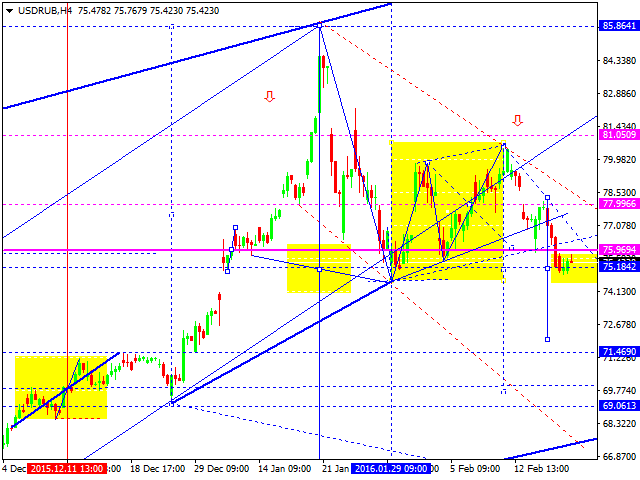

USD RUB, “US Dollar vs Russian Ruble”

Russian Ruble is still consolidating near 76. We think, today the price may continue falling the third wave inside the downtrend with the target at 69.

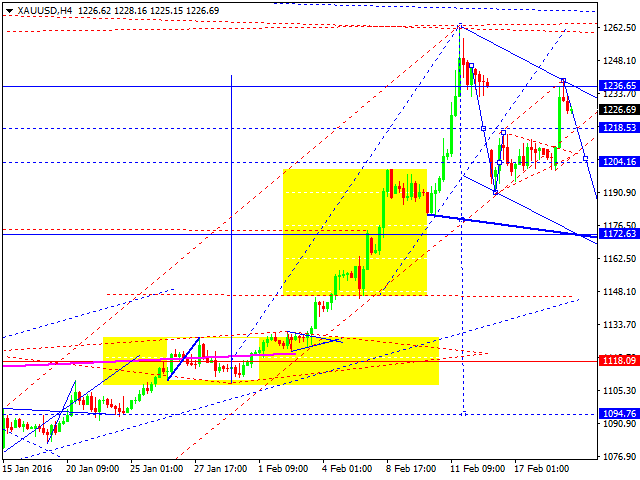

XAU USD, “Gold vs US Dollar”

Gold has expanded its consolidation channel upwards and almost reached the target of the correction. We think, today the price may fall to reach the target at 1172.60.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.