Analysis for November 26th, 2015

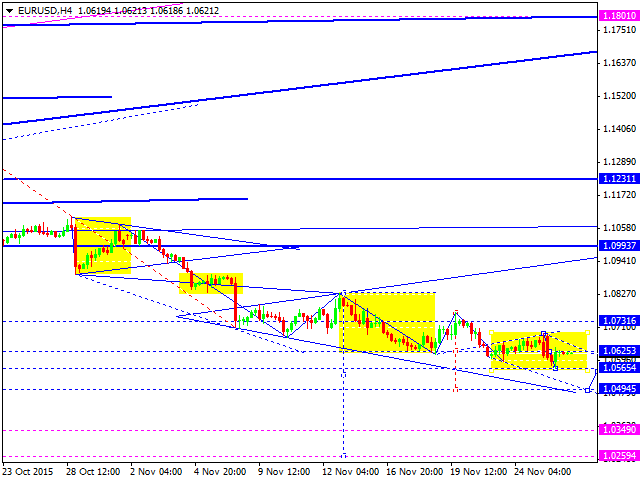

EUR USD, “Euro vs US Dollar”

Eurodollar has reached another new low and returned to the center of the pattern. We think, today, the price may rebound from the center and then continue falling towards 1.0500. After that, the instrument may test 1.0620 from below and then continue moving inside the downtrend to reach 1.0300.

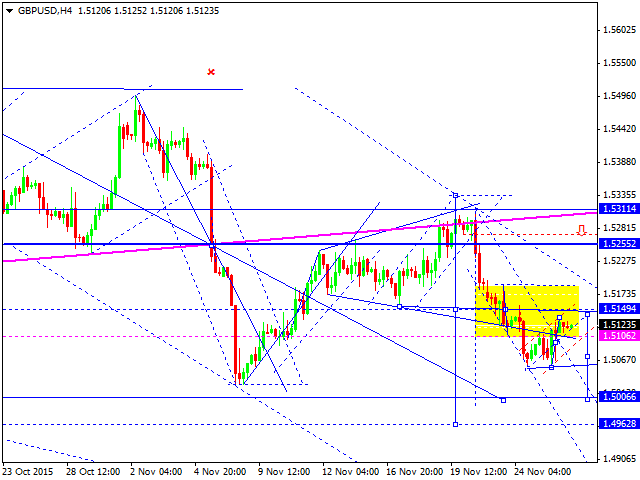

GBP USD, “Great Britain Pound vs US Dollar”

Pound is being corrected towards 1.5149 to test it from below. After that, the instrument may continue falling inside the downtrend to reach 1.5000. Later, in our opinion, the market may form another correction to return to 1.5150.

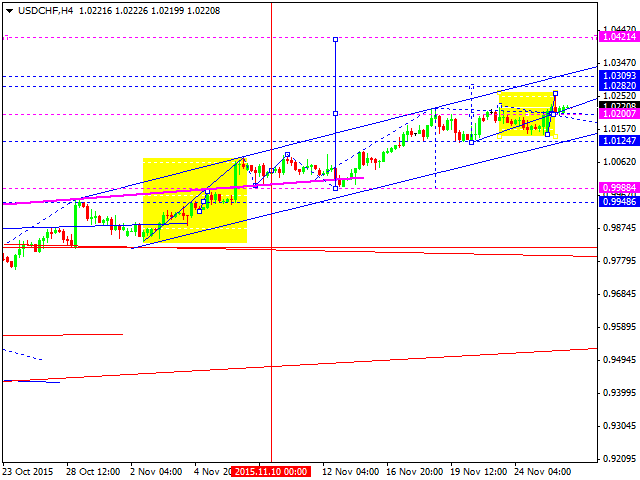

USD CHF, “US Dollar vs Swiss Franc”

Franc has reached a new high and returned to center of the pattern. We think, today, the price may continue growing towards 1.0282 and then return to 1.0200. After that, the instrument may continue growing inside the uptrend to reach 1.0420.

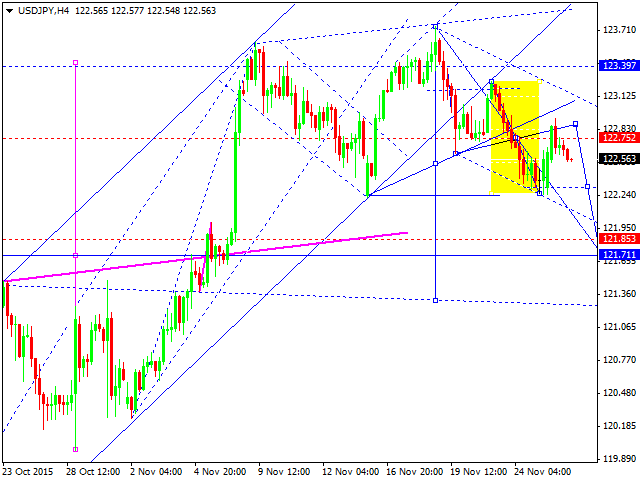

USD JPY, “US Dollar vs Japanese Yen”

Yen is moving inside its descending wave towards 121.85. After that, the instrument may continue growing as the fifth wave to reach 125.30.

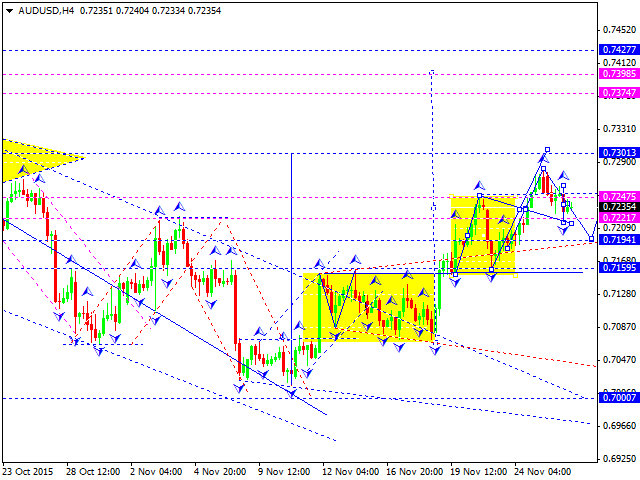

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is being corrected towards 0.7195. After that, the instrument may complete this ascending structure by growing to reach 0.7300. Later, in our opinion, the market may form another correction to return to 0.7150.

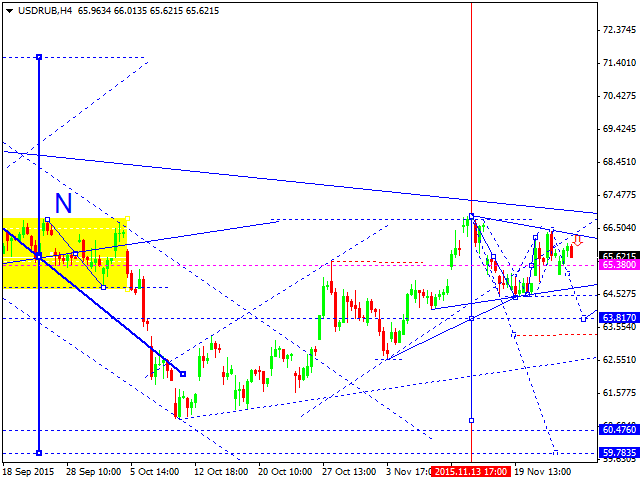

USD RUB, “US Dollar vs Russian Ruble”

Ruble is still moving inside triangle consolidation pattern. We think, today, the price may fall to break the lower border of the pattern and reach 63.82.

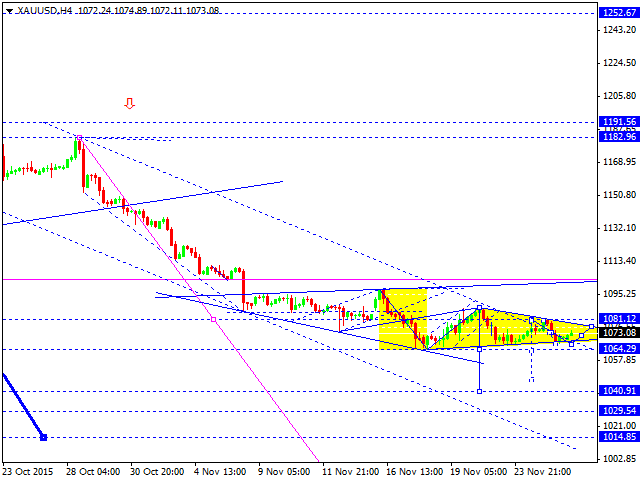

XAU USD, “Gold vs US Dollar”

Gold is consolidating; this trading range may be considered as triangle pattern. We think, today, the price may reach a new low and then form the fifth structure to return to 1075. After rebounding from the upper border, the instrument may continue falling inside the downtrend towards 1015.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.