Analysis for September 3rd, 2015

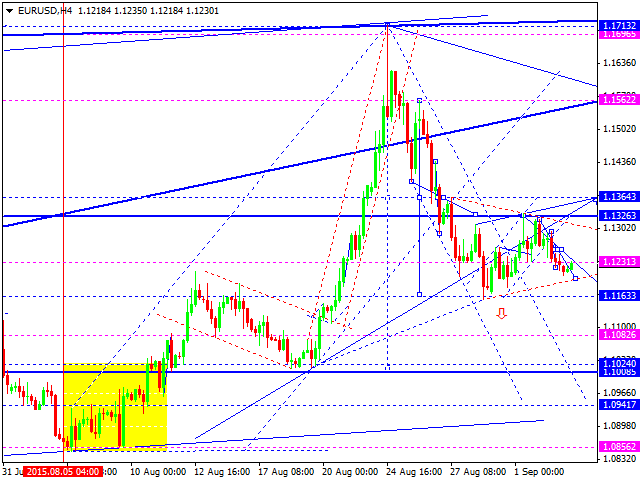

EUR USD, “Euro vs US Dollar”

Being under pressure, Eurodollar is still moving downwards. We think, today, the price may reach 1.1020. An alternative scenario suggests that the pair may grow towards 1.1364 and then continue falling inside the downtrend.

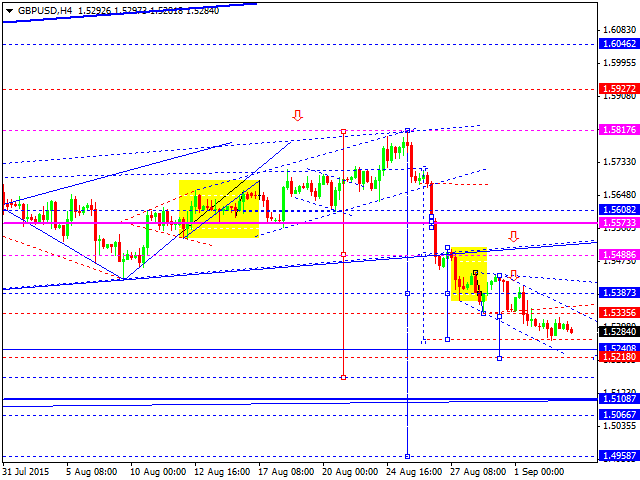

GBP USD, “Great Britain Pound vs US Dollar”

Being under pressure, Pound is falling. We think, today, the price may reach 1.5240 (at least). The possible target of the last descending structure is at 1.4960. This decline without any corrections may be considered as the trend wave with the target at 1.4400.

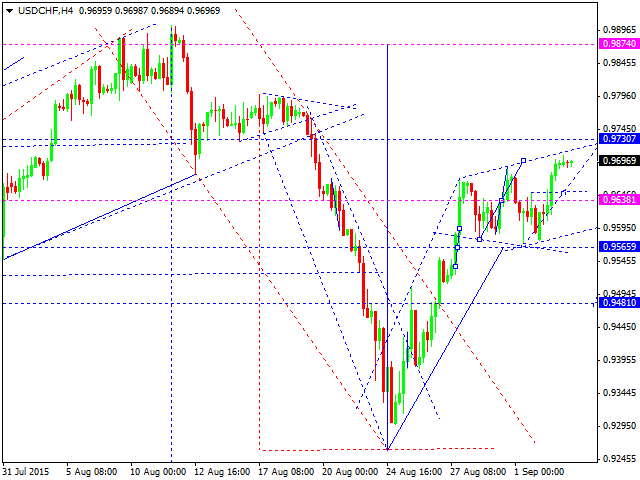

USD CHF, “US Dollar vs Swiss Franc”

Franc is still moving upwards. We think, today, the price may reach 0.9730 and then return to 0.9638 to test it from above. After that, the pair may start another growth with the target at 0.9870.

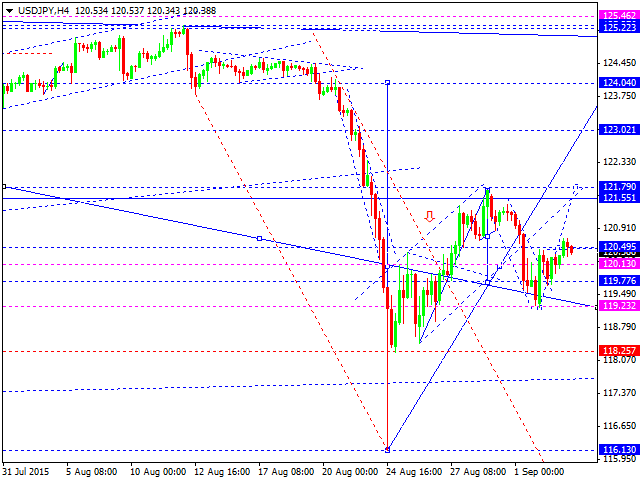

USD JPY, “US Dollar vs Japanese Yen”

Yen is forming an ascending structure. We think, today, the price may reach 121.80 and then return to 120.50 to test it from above. After that, the pair may start another growth with the target at 124.04.

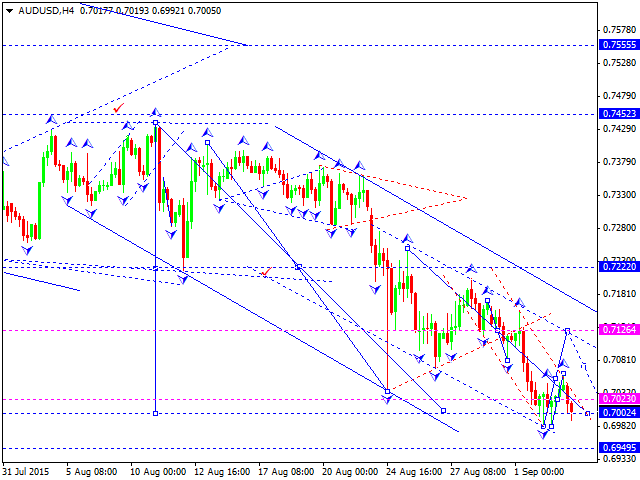

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar has formed two ascending impulses. We think, today, the price may form the third one to reach 0.7126 and then continue falling to reach 0.7020. After that, the pair may start another ascending wave with the target at 0.7222.

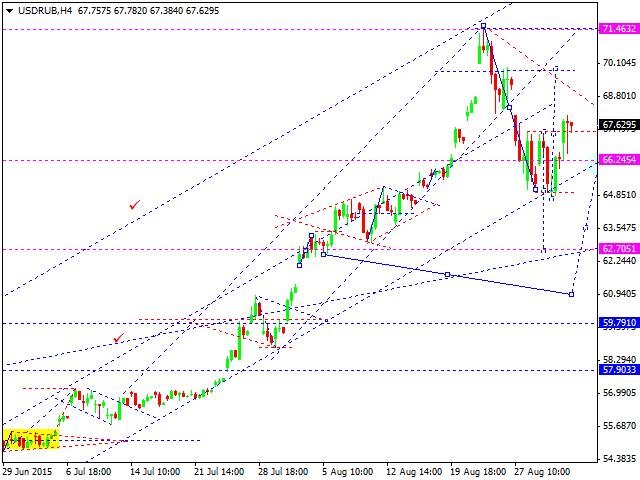

USD RUB, “US Dollar vs Russian Ruble”

Ruble has broken its consolidation channel upwards. We think, today, the price may grow towards 69.00. After that, the pair may form another descending wave to break minimums and then continue falling to reach 62.00.

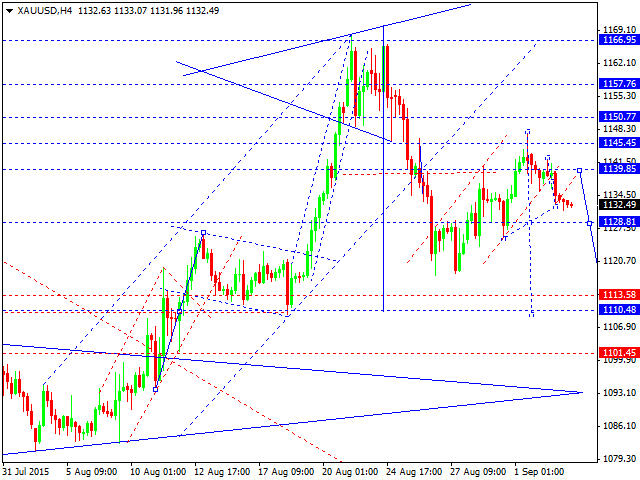

XAU USD, “Gold vs US Dollar”

Being under pressure, Gold is moving downwards. We think, today, the price may test 1139 from above and then continue falling to reach 1110, thus completing the correction. After that, the instrument is expected to start another ascending wave with the target at 1215.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD remains under pressure above 0.6400

AUD/USD managed to regain some composure and rebounded markedly from Tuesday’s YTD lows in the sub-0.6400 region ahead of the release of the Australian labour market report on Thursday.

EUR/USD holds above 1.0650 amid renewed selling pressure in US Dollar

The EUR/USD pair edges higher to 1.0672 on Thursday during the early Asian session. The recovery of that major pair is bolstered by renewed selling pressure in the US Dollar and a risk-friendly environment.

Gold retreats as lower US yields offset the impact of hawkish Powell speech

Gold prices retreated from close to weekly highs during the North American session on Wednesday amid an improvement in risk appetite. The bullish impulse arrived despite hawkish commentary by US Federal Reserve officials.

Bitcoin price uptrend to continue post-halving, Bernstein report says as traders remain in disarray

Bitcoin price is dropping amid elevated risk levels in the market. It comes as traders count hours to the much-anticipated halving event. Amid the market lull, experts say we may not see a rally until after the halving.

Australia unemployment rate expected to rise back to 3.9% in March as February boost fades

Australia will publish its monthly employment report first thing Thursday. The Australian Bureau of Statistics is expected to announce the country added measly 7.2K new positions in March after the outstanding 116.5K jobs created in February.