Analysis for July 31st, 2015

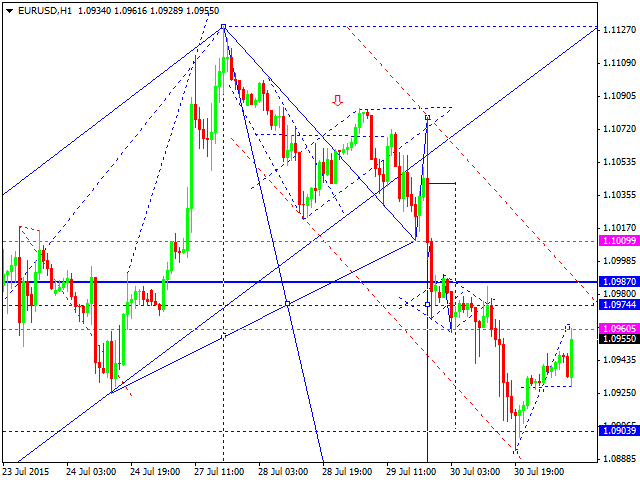

EURUSD, “Euro vs US Dollar”

Eurodollar is forming the third descending wave; the pair has already finished the correction. We think, today, the price may fall to reach the local target at 1.0870 and then form a new correction to return to 1.0974.

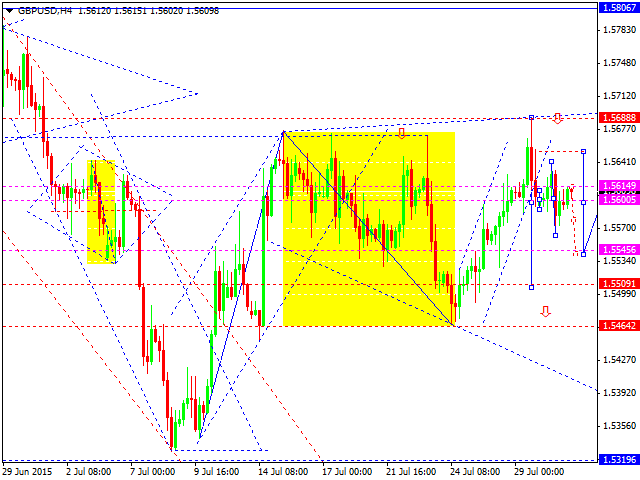

GBPUSD, “Great Britain Pound vs US Dollar”

Pound is forming a descending wave towards 1.5545 today. After that, the pair may return to 1.5600 and resume falling to reach 1.5509.

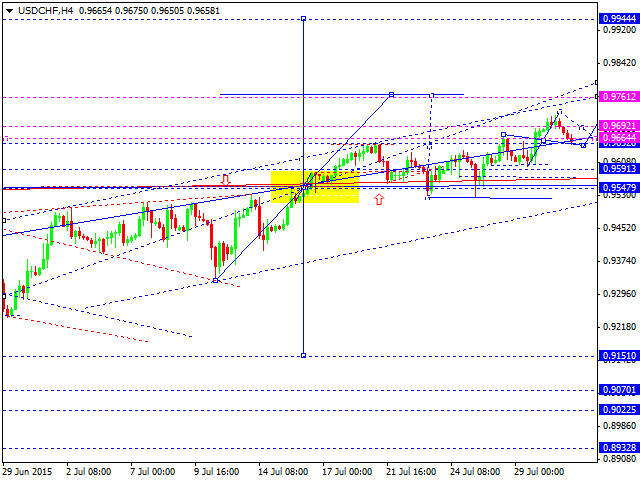

USDCHF, “US Dollar vs Swiss Franc”

Franc has completed the correction. We think, today, the price may grow towards 0.9761 and then form another correction to return to 0.9550.

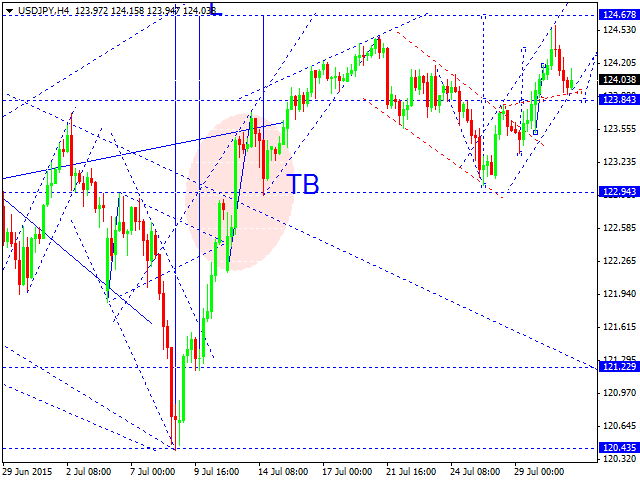

USDJPY, “US Dollar vs Japanese Yen”

Yen is forming an ascending wave to reach 124.67. After that, the pair may start a correction towards 122.94 and then another growth to reach 125.45.

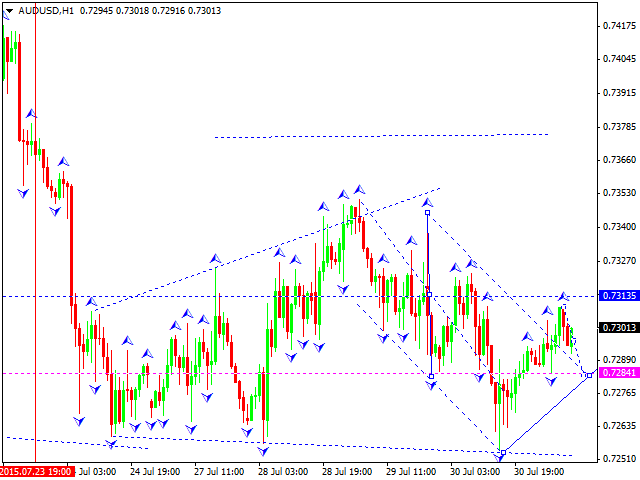

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar is moving downwards. After reaching 0.7281, the market may start forming another ascending wave towards 0.7315. Later, in our opinion, the market may fall to reach 0.7284.

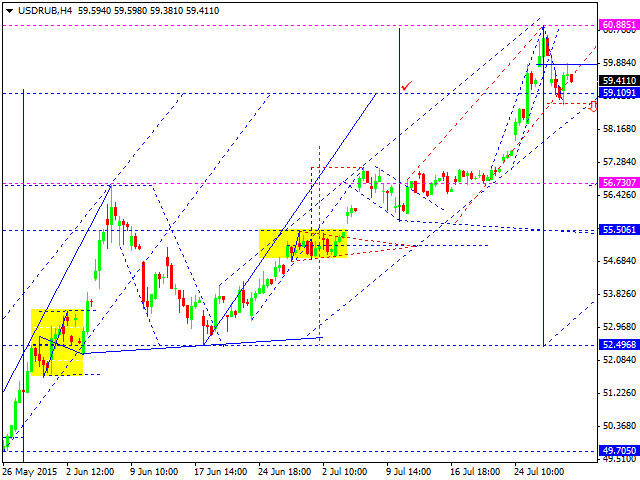

USDRUB, “US Dollar vs Russian Ruble”

Although the market was opened with a gap up, the main scenario still implies that the price may start falling and break the minimum of the first impulse and the ascending channel as well. The next target is at 52.50.

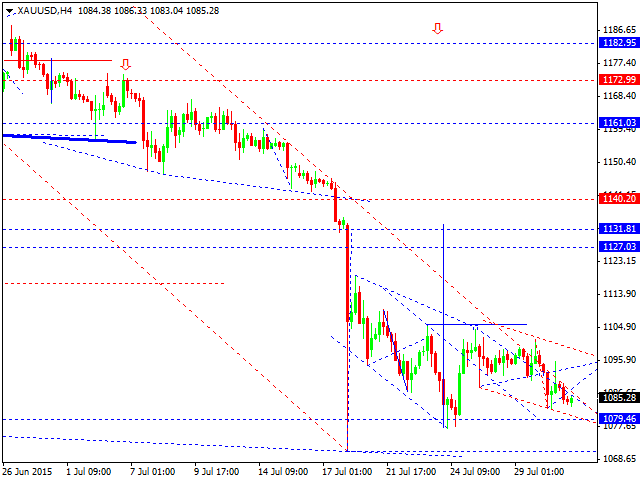

XAUUSD, “Gold vs US Dollar”

Gold is falling towards 1079.46. After that, the price may grow to reach 1100.00. After forming a continuation pattern, the market is expected to start a new ascending wave with the target at 1131.81.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.