Analysis for July 6th, 2015

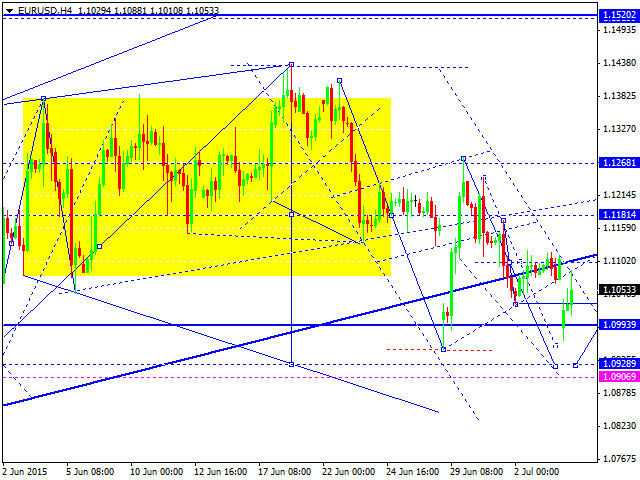

EUR USD, “Euro vs US Dollar”

The market was opened with a gap down. We think, today, the price may try to eliminate the gap and then continue falling to reach a new low. The target is at level of 1.0930. After that, the pair may return to level of 1.1182.

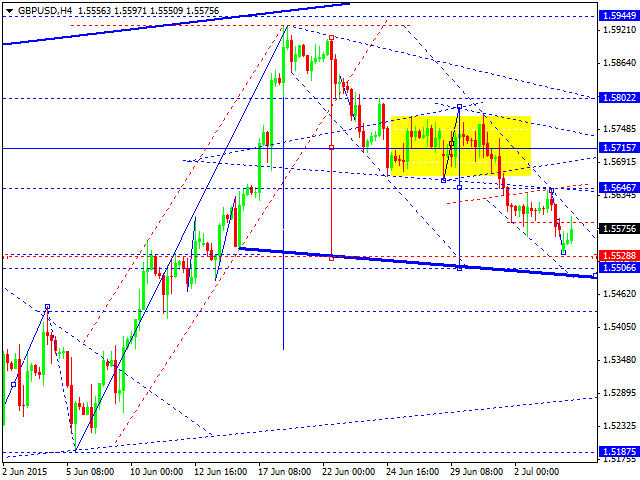

GBP USD, “Great Britain Pound vs US Dollar”

Pound’s reaction to the Greek referendum was a gap down. We think, today, the price may extend this wave with the target at level of 1.5500 and then grow to return to level of 1.5717 or even 1.5940. Later, in our opinion, the market may continue falling inside the downtrend.

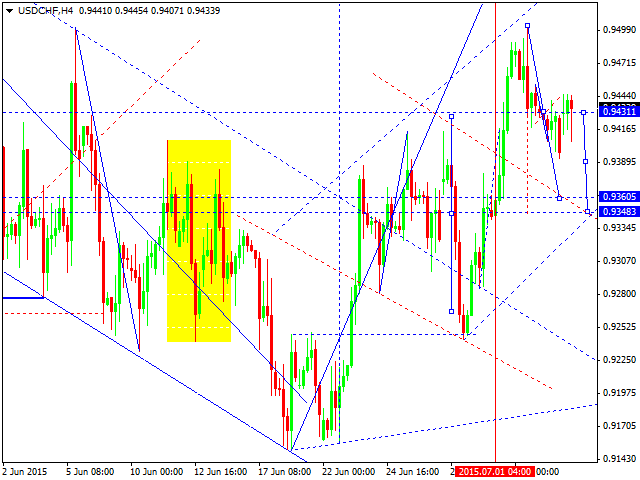

USD CHF, “US Dollar vs Swiss Franc”

The market was opened with a slight gap up; Franc is still consolidating. Possibly, the price may fall towards level of 0.9360 and then may grow to reach level of 0.9545. Later, in our opinion, the market may continue falling inside the downtrend.

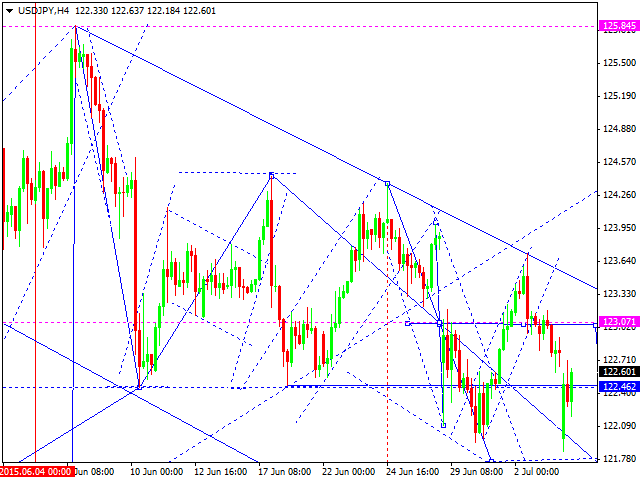

USD JPY, “US Dollar vs Japanese Yen”

The market was opened with a gap down. We think, today, the price may eliminate the gap at level of 123.07 and then continue falling towards level of 121.66. Later, in our opinion, the market may grow to return to level of 123.00 and then start another descending movement. The predicted target is at level of 120.20.

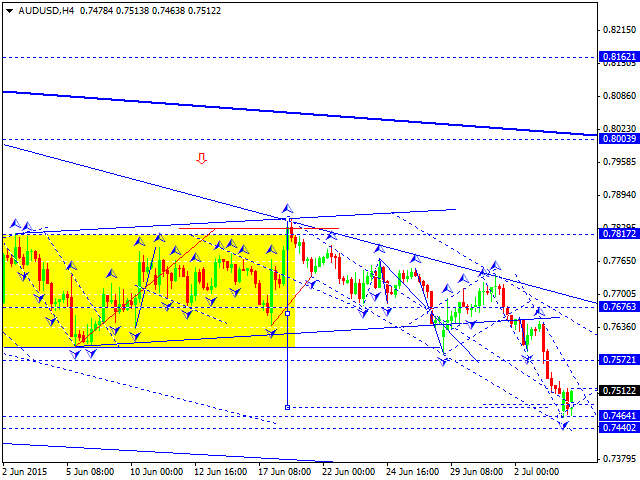

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar has reached its downside target; the market has formed an ascending impulse and corrected it. We think, today, the price may form another ascending impulse. After breaking the maximum of the first impulse, the pair is expected to form a wave to return to level of 0.7676.

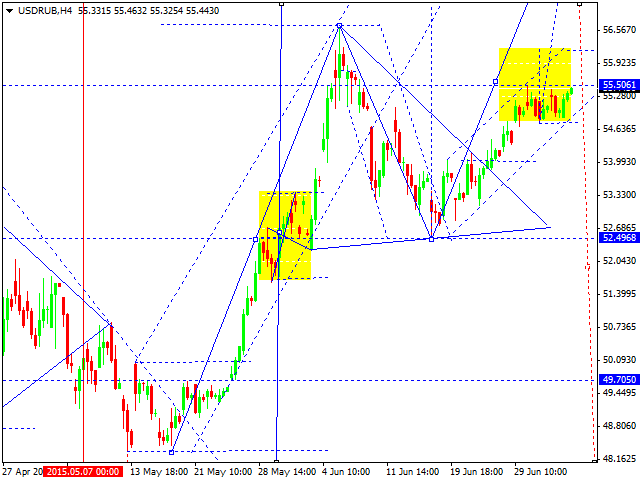

USD RUB, “US Dollar vs Russian Ruble”

The market was opened with a gap up. We think, today, the price may consolidate above level of 55.50 and test it from above. After that, the pair may continue growing to reach level of 58.50.

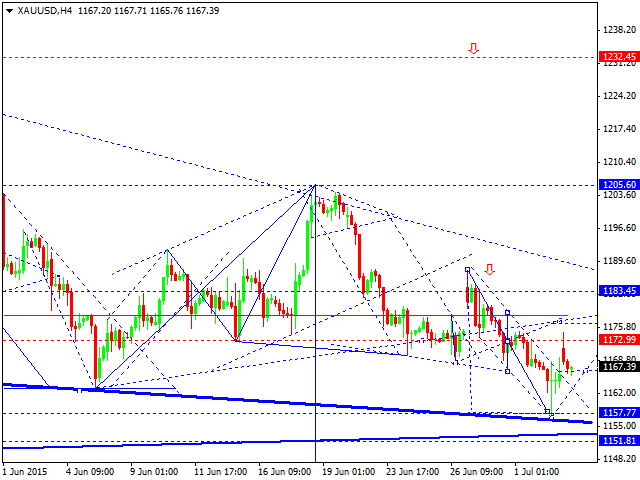

XAU USD, “Gold vs US Dollar”

Gold has reached its minimum upside target and returned to the broken channel. We think, today, the price may grow to reach level of 1178 and then continue falling inside the downtrend towards level of 1140.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.